Mr Panda's recommendation for you is the Superdigital account

Superdigital Account – No bureaucracy and ideal for negatives

Advertisement

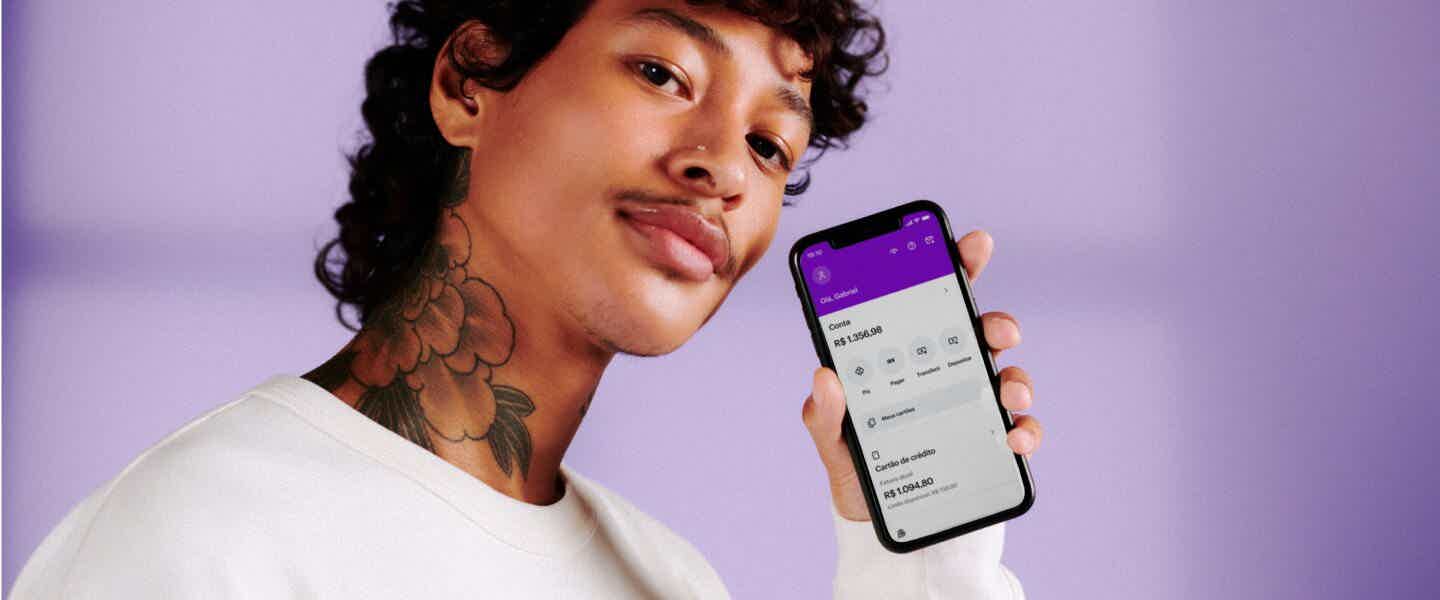

Today we are going to recommend the Superdigital account. It is one of Santander Bank's financial products and allows you to carry out various financial operations through the application. In addition to providing an international credit card and you can open it even if you are negative. Interested? So, read our content below.

Today we are going to recommend the Superdigital account. It is one of Santander Bank's financial products and allows you to carry out various financial operations through the application. In addition to providing an international credit card and you can open it even if you are negative. Interested? So, read our content below.

You will remain in the same website

Interested in the Superdigital account? So, let's get to know the numerous benefits offered below.

You will remain in the same website

Trending Topics

Nubank Ultraviolet Card or Nubank Platinum Card: which is better?

Decide between the Nubank Ultraviolet card or the Nubank Platinum card. Both are cards for people with higher incomes who love to travel. Check out!

Keep Reading

Hidden Camera Detector: how to detect hidden cameras with the app

Do you know what Hidden Camera Detector is? It is one of the best camera detector apps on Google Play!

Keep Reading

Discover the Caixa Gold card

With a Caixa Gold credit card, customers will benefit from the Vai de Visa Program and international coverage. Know more about him here.

Keep ReadingYou may also like

How to apply for the Classic Montepio card

Are you in Portugal and need a card with international coverage and a Visa logo? Then see how to apply for the Classic Montepio card.

Keep Reading

Online PagBank card: free and with a guaranteed limit

The online PagBank card is international with the Visa flag and has no annual fee. In addition, your investments in the account can be converted into a limit for the card. Thus, the more you invest, the better your credit score. Learn more below.

Keep Reading

Young man gets limit increase after changing address

Often, good payers cannot access credit and wonder what might have influenced the bank's decision. After the report of a student who managed to increase the limit just by changing his address, the answer may be clearer than we imagine. Know more!

Keep Reading