Cards

How much is the Casas Bahia card annuity?

If you're already a Casas Bahia customer, or if you still want to be one and want to acquire the card, but need more information about the annual fee, you've come to the right place! We'll show you how the Casas Bahia card annuity works and other information so you don't get lost!

Advertisement

See how card fees work

So, Casas Bahia is a well-known retail and real estate chain in Brazil, founded in 1952. Since then, it has been growing in the market, launching various products and services, including the Casas Bahia card. But, do you know the annual fee for the Casas Bahia card?

Today, we're going to answer your questions about the card's annual fee and other related useful information! Let's go!

How to apply for the Casas Bahia card

The Casas Bahia card offers you exclusive discounts, offers and installments. Want to know how to order it? So, read this post and check it out!

Does the Casas Bahia card have an annual fee?

So, the Casas Bahia card has an annuity charge, which is used to maintain the services and benefits of the credit card.

So you will be charged the rate of R$ 189.12 or 12x R$ 15.76.

How does the Casas Bahia Card annual fee work?

As we mentioned, the Casas Bahia card charges an annual fee of R$ 189.12, but this amount is charged monthly on the financial product bill. Therefore, you pay 12x of R$15.76.

What fees and charges are charged?

So, if you are the cardholder, you will pay an annuity of R$189.12 in 12 installments of R$15.76.

It is worth noting that there is a charge for withdrawals both nationally and internationally, of R$ 12.00 and R$ 16.00, respectively. In addition, you also have the cost of the emergency credit assessment in the amount of R$ 18.90.

In view of this, it is recommended that you make a comparison with other shopping cards on the market, to find out if it is the best alternative for you.

What are the benefits of the Casas Bahia card?

So, the Casas Bahia card has several advantages, the first of which is the fact that you can pay for purchases of selected products in up to 30 installments when they are made at Casas Bahia stores.

And, in addition, you can increase the card limit for purchases made in the store, as well as make withdrawals at Bradesco bank self-service machines.

Another super advantage is that you can shop at partner stores, as well as pay your card bill in installments.

In addition, the card offers Price Protection Insurance, 50% discount on the Cinemark network and the Casas Bahia application. Too much, isn't it?

Discover the Casas Bahia credit card

Do you already know the Casas Bahia credit card? It has exclusive offers and discounts, and even installments in 30x selected products. Check out!

How to cancel the Casas Bahia card annuity?

So, to cancel the card's annual fee, you can contact SAC Bradescard, which is available 24 hours a day at the following numbers:

- 4003 4033 (capitals and metropolitan regions);

- 0800 880 4033 (other locations).

Now that you know everything about the Casas Bahia card annuity, how about requesting yours? Read our recommended content and walk through the process step-by-step.

How to apply for the Casas Bahia card

The Casas Bahia card offers you exclusive discounts, offers and installments. Want to know how to order it? So, read this post and check it out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

7 main questions about Impact Bank card

Check out the main questions about the Impact Bank card and learn a little more about this international Mastercard card and app!

Keep Reading

Which bank gives the most credit?

Are you looking for a card to shop online with a high limit? So, check out in this article which bank gives the most credit!

Keep Reading

3 reliable self-employed loan options

If you are looking for a loan, how about knowing the best loan options for a reliable self-employed person? Read and check!

Keep ReadingYou may also like

Understand what is Ebitda

Want to invest in variable income and still don't know Ebitda? So stay with us and we'll show you its concept and how to calculate it.

Keep Reading

Discover the Daycoval loan

Are you in need of some extra cash? For this, we can count on several tools, and one of them is the payroll loan. So, get to know the Daycoval bank payroll loan option and stay on top of it!

Keep Reading

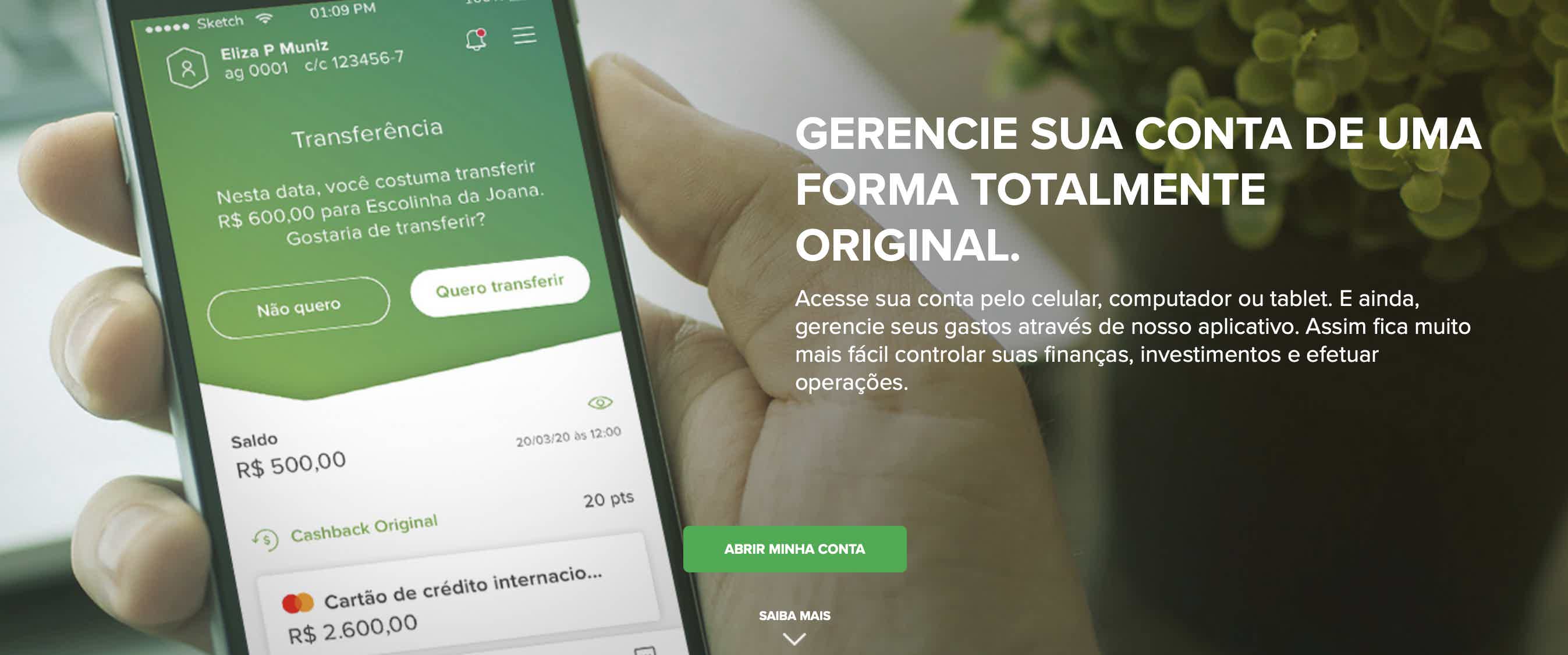

Know the original account

For those looking for more facilities in their routine and a safer way to manage their money, the Original account is certainly the best choice. Directly in the app, you have access to your current account, credit, personal credit, etc. All this without hidden fees and annual fees. Did you like it? So, learn more about it here.

Keep Reading