loans

Right Agreement Platform: how it works

Are financial issues keeping you up at night? So, learn how the Agreement Right platform works, which helps you negotiate your debts with up to 99% discount and installments that fit in your pocket.

Advertisement

Right Deal: Get out of debt safely

The Agreement Right platform was acquired by Boa Vista, a well-known credit negotiation company. Therefore, it offers negotiations in a few minutes through the website to more than 60 million indebted Brazilians.

So, how about learning more about how the Certo Agreement platform works? It is certainly a safe way out for debtors. In addition, the installments do not weigh on the pocket to get out of the red! So follow us on this post.

| Minimum Income | not informed |

| Interest rate | depends on the lender |

| Deadline to pay | Varies according to debt |

| release period | depends on the lender |

| Trading value | Varies according to debt |

| Do you accept negatives? | Yes |

| Benefits | Debt withdrawal in minutes Direct negotiation with partners Clear the name without further complications |

How to apply for the Right Agreement

Find out how to apply for the Certo Agreement quickly, safely and effectively. And get deals with up to 99% off debt.

Advantages Right Deal

Among the main advantages is the ease of accessing negotiations. As various debt repayment opportunities come up on the screen, it is beneficial to choose the one that fits your pocket.

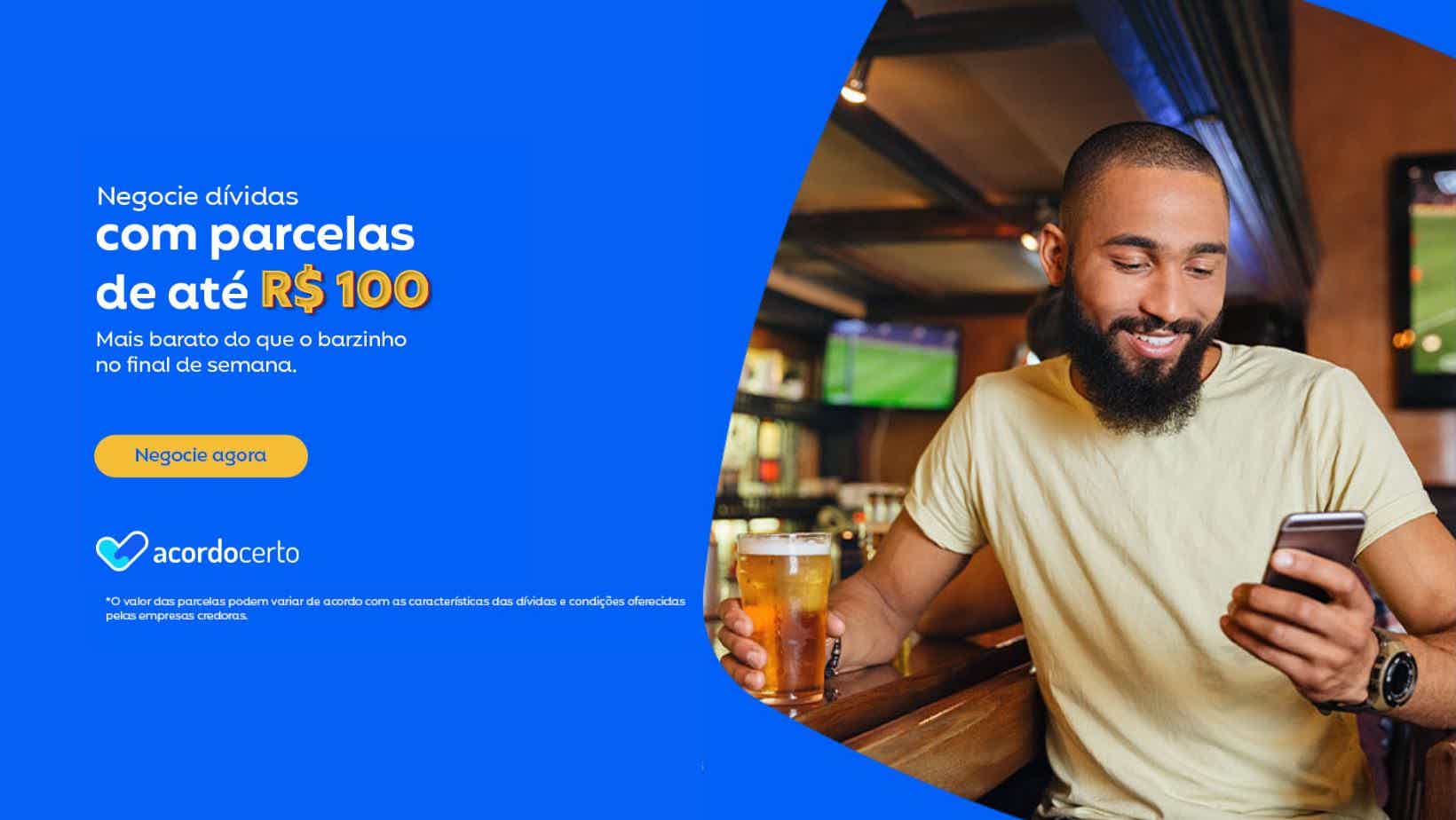

In addition, you get a discount of up to 99% on your debt, and you can pay installments of up to R$ 100.00. That is, it is a great opportunity to settle your financial debts and remove your name from credit protection bodies.

Main features of the Agreement Right platform

First, the withdrawal of debts is done through the platform's website. That is, it works as follows: register with your CPF. After that, enter the document number and a previously created password.

Finally, wait just a minute for the list of debts to appear on the screen. Thus, you can analyze the options and choose the ones that fit in your pocket.

So, it is possible to take advantage of interesting agreements, since the platform has negotiations with installments of up to R$ 100.00.

Who the platform is for

To clarify, Agreement Right is indicated for any negative that seeks alternatives to get out of the red as long as the debts are with the platform’s partners.

So, take the opportunity to learn more about her by clicking below!

Get to know the Agreement Right platform

Get to know the Agreement Right platform and find out how to negotiate to clear your name with up to 99% off the debt amount.

Trending Topics

Banese Invoice: how to issue the 2nd copy

If you are having trouble issuing the 2nd copy of the Banese invoice, check out this post for the complete step-by-step process.

Keep Reading

Nubank boxes: what are they and how to use them?

Find out how Nubank's boxes work and how they help you save your money with a better return!

Keep ReadingYou may also like

Meet the NuTap card machine

Are you looking for a card machine with reduced fees, no rent and no membership and maintenance fees? If so, take the opportunity to get to know, in the following post, the NuTap machine, which is 100% by cell phone and has what you need.

Keep Reading

How to open a Coinext account

Check in the post below how to open an account at Coinext brokerage and not pay a monthly fee for custody of investments. As well as learn how to make the first deposit via PIX.

Keep Reading

The best online loan options

Discover the best online loan options now. Find out which option best suits your needs and find out how to apply.

Keep Reading