Financial education

How to make a cost control worksheet

Controlling spending is key to having a good financial life. But a lot of people don't know how to actually organize themselves. Therefore, in this article we will show you how to make a spending control worksheet. Continue reading and find out more!

Advertisement

Organize your financial life now with an expense spreadsheet

Having a spending control worksheet is essential to have a healthy financial life. Meanwhile, a lot of people don't know what it is and not even how to make one. Although it doesn't seem like it, having an expense spreadsheet can be very easy.

That's why, in today's article, we're going to show you the step-by-step process for you to set up your expense spreadsheet. In addition, we will also talk about the importance of regularly controlling your finances.

Let's go?

What is a spending control worksheet?

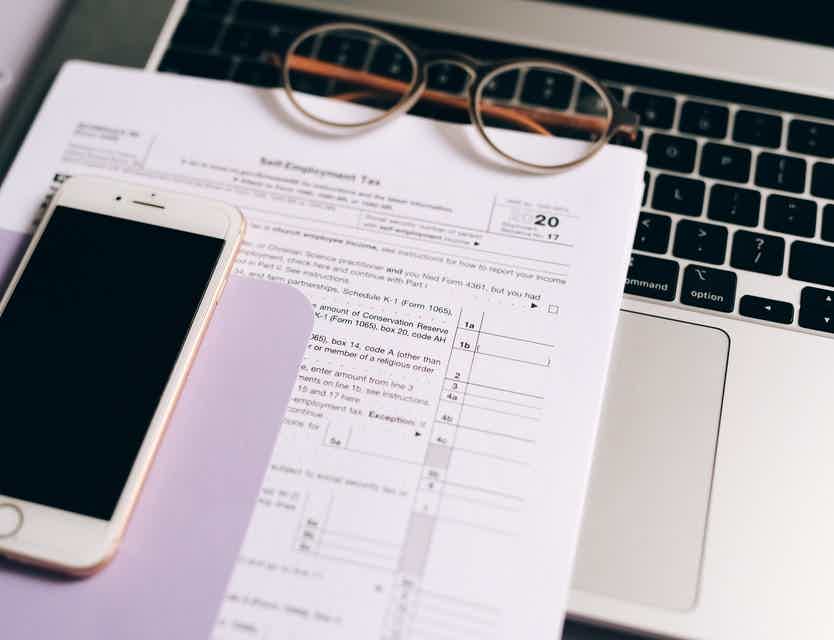

First, you need to know what a cost control worksheet is. Therefore, the worksheet is a place for you to organize all your expenses. That is, a spreadsheet helps you visualize everything in one place.

In addition, you can also understand if you are spending too much in one area or another. That way, you can set goals and save money to reach those goals.

Furthermore, there are several different ways to organize your expenses. For example, many people still prefer to use the expense notebook. And everything is fine! Sometimes it's better to have everything organized on paper than to lose yourself financially.

But if you want to go up a few steps, there are elaborate spreadsheets that organize your expenses very well. By the way, in these expense control worksheets you can divide your expenses into categories. That way, you can more easily see where you're spending.

How important is a control sheet?

Basically, having a spreadsheet to control your spending is the first step. This is so much for those who want to achieve a goal or for those who are in debt. Because it is essential to see the financial context in order to get organized.

In this sense, there are several advantages to having a spreadsheet to organize yourself financially. See the importance of creating yours below.

Have a healthy financial life

Firstly, we can say that the main benefit of keeping a spending control spreadsheet is to be financially calm. Everyone knows how tight it is to be apprehensive about your money situation.

But with a well-made spreadsheet, this situation is farther from happening! That's because you will have control of all your earnings and expenses. That way, you don't spend on impulse and still manage to live well.

Save more and more

Second, having a spending sheet is a great way to save. That's because you visualize the whole scenario and manage to separate expenses by categories.

For example, fixed and variable expenses. Therefore, fixed expenses include monthly bills such as rent, electricity, internet, etc. As for variable expenses, this is where you put your spending on leisure or something you are looking for.

In this sense, when setting up your expense control worksheet, remember to write down all your earnings and your expense planning.

Impulse purchases: how to control?

Need to save money but do a lot of impulse shopping? See here for tips to control yourself!

Start making investments

For those who want to invest, but can never make the money left over, a spreadsheet is a good one. That's because you can stipulate the money for all categories, before you even spend it.

This way, the investment can be made at the beginning of the month. Before you even receive your salary, already plan where your money goes. Therefore, remember to plan the amount to be invested.

Also, if your goal is to retire, for example. It might be a good idea to save that money by investing. That's because long-term investments have a high yield value.

Over time, this value can rise more and more and you can create a planning of investments only.

Understand where your money goes

Do you have the feeling that you spent your money and don't know where? With a spending control worksheet this does not happen. That's because, that way, you always write down where the money went.

That is, you can visualize each category and understand where you are spending more. This way, you can better structure your financial life and get organized. In that sense, you can have expenses in a much healthier way.

An example is that a lot of people end up spending on different things that they don't even remember. For example, old subscriptions that you keep paying for can take up a large chunk of your budget.

put goals

Finally, with a well-made expense control worksheet, you will be able to organize yourself to achieve your financial goals. That's because, without it, it's very easy to just spend without thinking much about what comes next.

Therefore, if you have the dream of conquering your own car or a house, having a spreadsheet is fundamental. Even if you need to plan for a trip, it's important to have financial control before anything else.

Remember that to achieve any goal, hard work and effort is needed. With financial goals it would be no different. Therefore, sometimes it will be necessary to stop doing some leisure activities in order to achieve these goals.

How to set up a spending control worksheet?

In short, putting together a spending control worksheet is something very personal. That's because each family group has its earnings, habits and goals. But there are some standard tips that can help you at this time.

At first, it is worth mentioning that on the internet there are several templates available for spreadsheets. That way, you can download some and adapt it to your reality. By the way, they are great for those who have no idea where to start.

With that in mind, you can start by putting together a personal expense spreadsheet. With it, you can start to control your finances. Therefore, just enter your individual expenses. It's a great option for those who live alone, for example.

However, if you need a family budget, the worksheet is another. That's because it should include everyone who lives with you. That is, it is common to have more than one income and more expenses to count.

Furthermore, if you prefer, in addition to ready-made spreadsheets on the internet, it is also possible to organize yourself by applications. Currently, there are several apps that help you control spending. In addition to creating complete reports for you to understand where your money goes.

That way, you don't have to do the work of formatting the entire worksheet. Just enter some information in the application and everything will be organized. In addition, some apps even have integration with banks. That is, all your expenses go directly to the application.

So, if you like the idea of using an app instead of a spreadsheet, let's help. See in this other article we have 5 apps to help you have a healthier financial life!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Extra income ideas for 2022

See a list of ideas to guarantee extra income with solutions that can help many people in 2022. So, read this post and check it out!

Keep Reading

Is Mister Panda safe?

Is Mister Panda safe? It is the ideal site for negatives and other people who want to learn about personal finance. Check out!

Keep Reading

Is Banco Inter good?

Is Banco Inter any good? Read this post and see the answer as we will talk about all the perks it offers like a free 100% account. Check out!

Keep ReadingYou may also like

Get to know Inter account

One thing is for sure, digital accounts are the best option to manage your finances, and the Inter account is ideal for anyone looking for more than a bank, but a tool to manage their money. Do you want to see it? So, learn more about it here.

Keep Reading

Find out how Cashback Ame Digital works

Did you know that with the Ame Digital cashback, part of the amount spent on your purchases comes back to you? That's right! To learn more about the subject, just continue reading.

Keep Reading

Discover the Novo Banco Base current account

Do you need a current account that gives you access to cards, transfers and withdrawals at no additional cost? Then find out more about Novo Banco's Base current account, and find out how to subscribe to the services you need. Learn more below.

Keep Reading