Tips

Is PicPay safe?

PicPay is a payment tool with more than 30 million users in Brazil. But, is PicPay safe? Read our text and find out!

Advertisement

PicPay is safe: check out Mr Panda's analysis

First, PicPay is one of the most used digital wallet applications in the country. With more than 30 million users, it promises features that go beyond a traditional bank through the technology of an application where you control all your finances from your cell phone. The proposal is attractive mainly for those looking for practicality on a daily basis, but is PicPay safe?

Unfortunately, the theft of bank information through cybercrime is becoming more and more common. In this way, many people still do not feel comfortable exposing their financial data in payment apps.

That's why we brought you an analysis of PicPay and the reasons for you to use this great tool with peace of mind and security. Check it out below!

What is PicPay and how does it work?

Well, PicPay is a fintech founded in 2012 with the mission of bringing financial solutions to its customers in a practical way and with zero bureaucracy. Through the application, which you can download for free in digital stores, you can make transfers, payments and purchases online using only your cell phone.

So, it works like a digital wallet and all transactions are done exclusively through the app. To move your account, you need to add an amount through the deposit via boleto or register your credit card on the platform. Thus, you can enjoy all the benefits mentioned above in a simple way and in the comfort of your home.

In addition, your purchases are not limited to websites only, as PicPay is accepted in more than 3 million establishments across the country through payment via QR Code.

CDB PicPay: one of the best yields on the market

Do you know CDB PicPay? If not, it's time to get to know this daily liquidity yield that is considered one of the best on the market.

Strengths

PicPay presents a series of benefits to its customers, starting with the practicality of a digital wallet with technological integration. That way, you don't have to worry if you forgot your wallet at home. With your cell phone, you can make payments and transfers in a few minutes.

So, your account balance has a daily yield of up to 120% of the CDI. You even earn cashback according to the temporary promotions available in the app, so it's essential to keep an eye on the notifications. In addition, it is possible to pay bills in up to 12 installments using your credit card.

In addition, you can also request your PicPay Card! An international credit card with the Mastercard brand that does not charge annuity or maintenance fees. With it, you receive 5% cashback on in-app purchases.

Negative points

Well, to assess whether a service is interesting, we need to know the positive and negative points, right? So, the disadvantages of PicPay are not many, but they can weigh you down when hiring.

First, there is a fee to add money via credit card, 3.59% in cash and 3.69% in installments. In addition, there is a charge of R$ 6.90 per withdrawal. Payments made in installments with a credit card are also charged at 3.69%, but this amount can change depending on the number of installments.

And, when making transfers to other banks, the deadline for the amount to fall into the account is up to two business days. As it is a digital service, it is expected that the compensation time will be shorter, which does not occur with PicPay.

So, is Picpay safe?

Therefore, after knowing the main features of PicPay, and based on the reputation of fintech on sites such as Reclame Aqui, we can say that yes, PicPay is safe.

First, because it is regulated by the General Data Protection Law, which means transparency in the sense that you know exactly what personal information any company has about you.

Another important point is that PicPay uses means such as encryption and storage of information on extremely secure servers so that your data does not leak in the event of a hacker invasion.

Furthermore, it is necessary to create a personal password that is required whenever you do any banking transaction. And, PicPay also does not show the full number of your credit card on the home screen, which protects you even more in case of robbery or theft of your cell phone.

So, now that you know that security is one of the company's top priorities, how about checking out the content below with some valuable tips on how to earn money in PicPay for free? Let's go!

How to earn money on PicPay for free 2021

Have you ever thought about making money on PicPay for free? Because know that this is possible and it's much simpler than you realize! See more here!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to get name out of red?

Are you negative and want to know how to remove the name from the red? Check out our tips to clear your name in an easy and practical way.

Keep Reading

See how to register for free to resell Natura

Understand how to be a Natura reseller, see all the requirements you need to meet and the entire procedure to become one.

Keep Reading

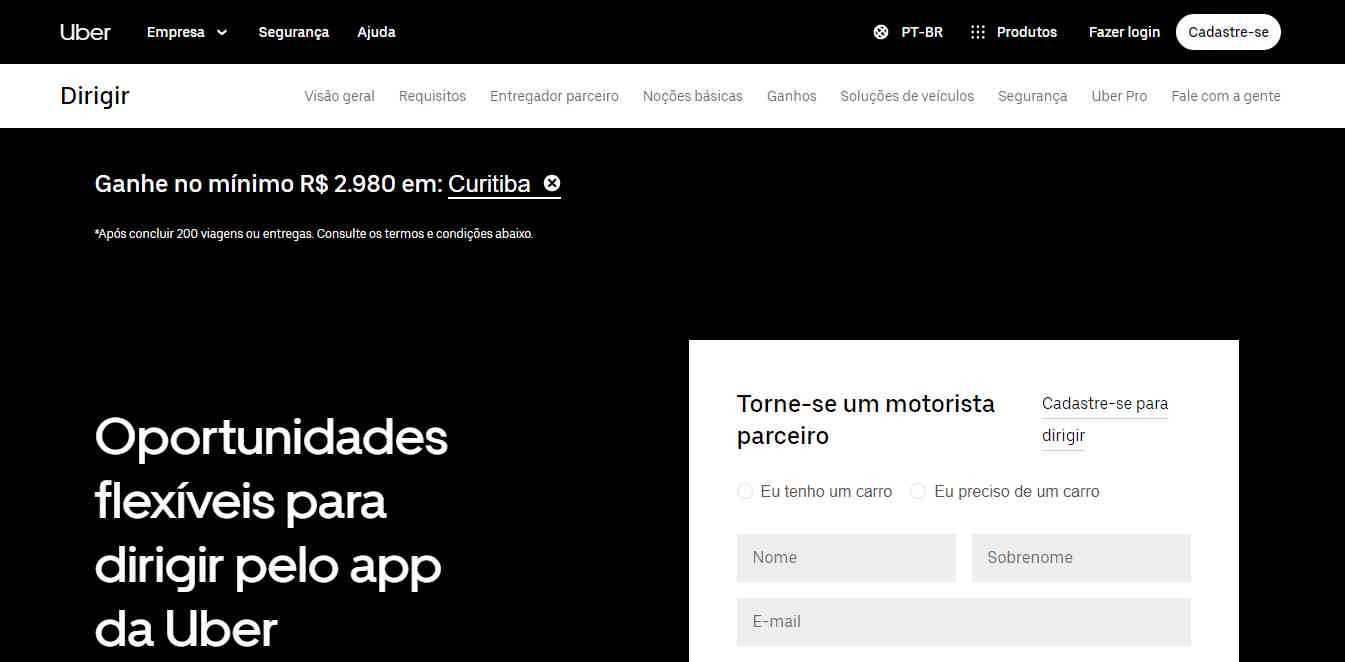

Uber driver: what you need to know

If you want to be an Uber driver, check out in this post everything you need to know to start working with rides in the app.

Keep ReadingYou may also like

Review Revolut Premium Card 2022: save, spend and invest

For those looking for a card that makes it easier to send and receive money in different currencies and more peace of mind when traveling, Revolut Premium may be the solution. To find out if it's ideal for you, check out the full review of this plastic in the post below.

Keep Reading

Mastercard Black Card or Visa Infinite Card: which is better?

The Mastercard Black card or Visa Infinite card are perfect options for those who want more benefits in their financial life. To learn more about them, just continue reading the article and check it out!

Keep Reading

How to anticipate the sale of property Credits

The sale of real estate nowadays, to be more effective, must be as less bureaucratic as possible. In this way, both buyers and the seller benefit. However, we don't always have access to the tools that facilitate this process, or even the capital to renovate the house before the sale. Therefore, the best option is to anticipate the sale of the property Creditas, in which you can get up to 60% of the anticipated value of the property. Learn more here.

Keep Reading