digital account

Pagbank how it works: get to know the digital account and card

Ever heard of PagBank? This is the digital account corresponding to the PagSeguro payment platform. With it, you can access an online wallet, credit card, debit card and even personal lines of credit. In today's article, we'll show you how PagBank works. Check out!

Advertisement

Know all the details of Pagbank

PagBank is the platform that works as the PagSeguro account. Today we will show you how PagBank works. Therefore, you will know both the digital account and the available card options.

In short, PagBank offers a free digital account. Both for individuals and for legal entities. In this sense, the account has services such as transfers, payments and automatic income.

In addition, PagBank has credit card, debit card and other financial services. Like the personal loan with lower rates than traditional banks.

With that in mind, in this article we will tell you how PagBank works and make an overview of all its products and services.

How does PagBank work?

The PagBank account is part of the online payment platform PagSeguro. This online payment method is one of the best known in Brazil. Therefore, it has a lot of credibility in the market.

Therefore, PagBank is an option for those who already use PagSeguro and want to unify the two services in one place. In addition, it is also a free digital account alternative with basic financial services.

In general, PagBank offers a digital account with automatic income. This account yields according to the CDI rate based on the amount deposited. In this account, it is also possible to purchase a debit card and a credit card.

But it is worth remembering that to apply for credit you must undergo an analysis by the company. If you are not accepted at first, we recommend that you continue using the account. In this way, PagBank understands your financial habits and can offer you a proposal.

What is the advantage of PagBank?

At first, the great advantage of PagBank is that it is a completely online platform with a complete service. That is, in the same place you can manage payments, your account and even request lines of credit.

We will give you more details of each service, check it out:

PagBank Digital Account

First, learn a little about the PagBank digital account and how it works. Basically, with this account you can make withdrawals, transfers and payments all for free.

However, it is worth remembering that some services – such as free withdrawal – are only available to customers who have carried out salary portability. Or, for those who choose to invest in PagBank's CDB.

In addition, one of the main features of the account is the fact that it has automatic income. Just leaving the money in the account already yields up to 30% more than in savings.

With this account, customers have access to an account card, prepaid and international. What a great option to stay out of debt. You can use the card on websites, apps, but everything is debited directly from your account balance.

Finally, the PagBank digital account can be monitored by the application. As it is an online account, finance management is easily handled with the palm of your hand. Just download the application to manage your PagBank account.

| open rate | Exempt |

| minimum income | not informed |

| rates | Without portability or investment in the CDB, the withdrawal is R$7.50 |

| credit card | International and free |

| Benefits | Yields up to 30% more than savings Application to monitor the account |

PayBank credit card

When acquiring a PagBank account, you are entitled to apply for a credit card. But still being subject to a platform credit analysis.

In short, the card has no annual fee or fees. That is, you don't have to pay anything to apply for the credit card. In terms of the limit offered, it depends a lot on each client.

PagBank performs an individual analysis of each case. This to understand what your financial habits are. In this way, the bank is able to offer a proposal that really makes sense according to your financial life.

In addition, the PagBank credit card has no annual fee. Therefore, you have an international card, with the possibility of installments, without having to pay anything for it. But this exempt rate is only valid in cases of customers with salary portability.

Another way of not having to pay the annuity is by investing in PagBank's CDB.

When we talk about scoring program, the credit card has the Visa flag. Therefore, customers have access to Vai de Visa; with exclusive discounts in restaurants and establishments.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Go from Visa |

How to apply for PagBank card

Find out how you can apply for your PagBank credit card with no annual fee!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Online LATAM Pass Card: turn your purchases into points

Check out in this post how the online LATAM Pass card works and see what exclusive benefits it can offer you!

Keep Reading

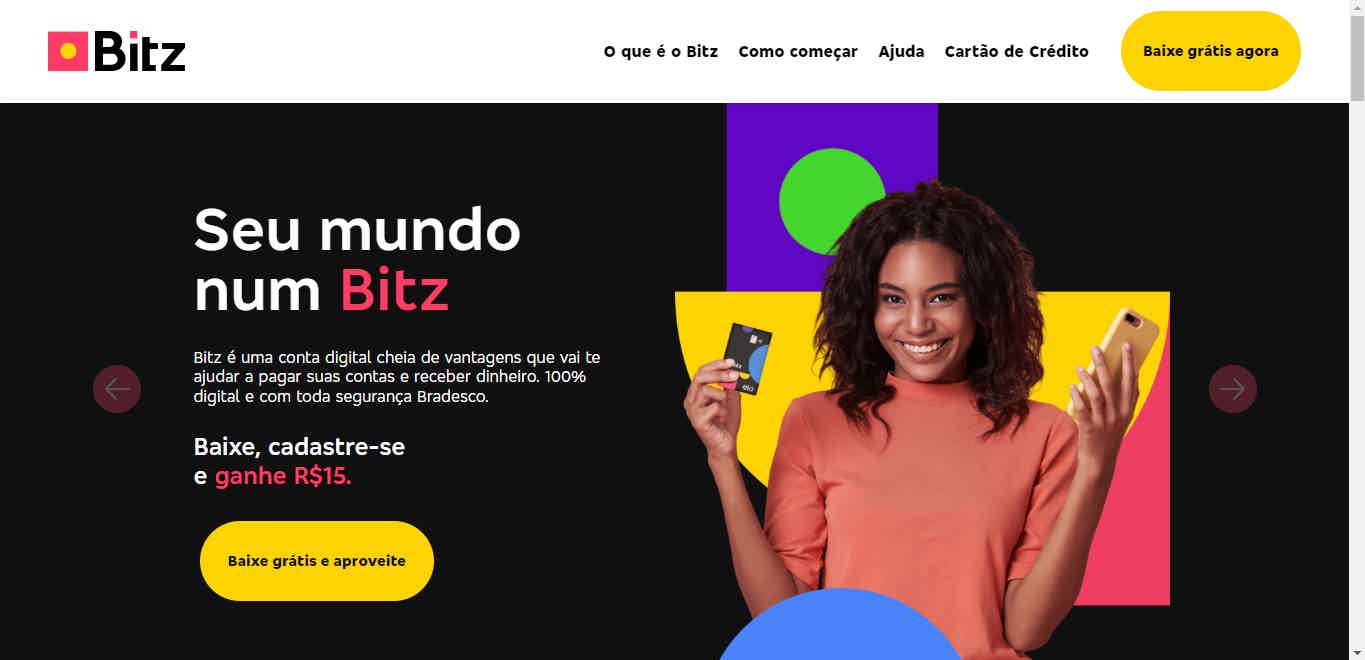

Discover the Bitz digital account

The Bitz digital account is an application managed by Bradesco that offers you many facilities. Learn all about her in this post!

Keep Reading

How to apply for a Shoptime card

See here how to apply for the shoptime card, with exclusive benefits for the shoptime and submarine stores, and the Mastercard Surpreenda program.

Keep ReadingYou may also like

Safra Real Estate Financing: what is it?

Do you want to check out a real estate loan option that allows you to finance up to 85% of the property? So now find out about the advantages and characteristics of Safra real estate financing.

Keep Reading

How to lower the overdraft limit

Do you know how to lower the overdraft limit? So, continue reading and check out how to do this process and avoid default.

Keep Reading

Where to invest in cryptocurrencies in Brazil?

Want to start investing in cryptocurrencies but don't know where? So check out the best brokerages to invest with more security here.

Keep Reading