Cards

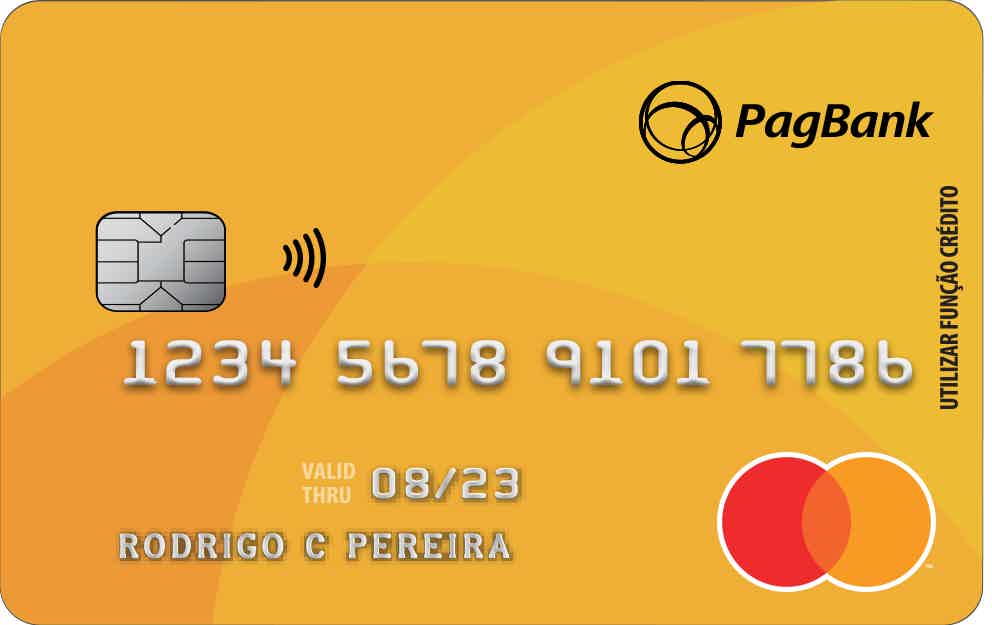

PagSeguro credit card: what is PagSeguro?

PagSeguro is a company specialized in delivering different types of ATMs in Brazil. Now, it is also possible to request a credit card from PagSeguro, which, in addition to being free of annual fees, offers several benefits to users.

Advertisement

PagSeguro credit card

Since most consumers are currently looking for ways to replace cash with other payment methods, the PagSeguro card is the solution.

However, this change has a reason: cards deliver greater security and practicality in transactions.

Besides, walking around with cash in your hand nowadays is dangerous. Precisely for this reason, more and more card options are being created, all serving a certain customer audience.

Likewise, the PagSeguro card was created to make financial life easier for its customers. In addition, it delivers more practicality and safety, it also has excellent benefits!

How to apply for a PagSeguro credit card

The PagSeguro Card has no annual fee, it has the Mastercard flag, in addition to being international! And it still has exclusive advantages. Click here to see how to apply

| Annuity | Free |

| Minimum Income | not required |

| Flag | MasterCard |

| Roof | International |

| Benefits | No need to have a bank account free of annuity With international coverage No credit analysis |

Advantages PagSeguro

Like any payment method on the market, PagSeguro has the following advantages:

- No annuity;

- Less bureaucracy;

- In addition, it has greater security;

- Finally, it is accepted in several establishments.

Main features of PagSeguro

First, it is necessary to mention that the card has no annual fee and international coverage.

That is, the customer can shop at national and international establishments. And, even if the money leaves your account instantly, it is possible to buy in cash credit mode!

Therefore, as it is a prepaid card, the following benefits are guaranteed:

- Users can shop on all Visa-accepting sites;

- Possible to buy on major streaming services. However, it still has other unique benefits;

- In addition, cash withdrawals on the main Banco24Horas networks.

Who the card is for

Above all, the customer must consider whether the features of the card meet their needs. However, it is recommended for customers looking for more practicality and security in their daily transactions.

Finally, it has numerous advantages, targeting a diversifying audience, who are looking for practicality in their day-to-day.

Know the insurance card

The PagSeguro card has exclusive benefits for its subscribers, in addition to having a free annual fee! Click here to learn more about the card!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to register with Serasa Consumer?

Learn how to register for Serasa Consumer, Serasa's free platform to monitor CPF and credit score 24 hours a day. Know how!

Keep Reading

All about the OpaPay Mastercard credit card, one of the best for bad debts

Are you negative and can't get a credit card? If yes, then stay tuned, because with OpaPay Mastercard this situation no longer happens.

Keep Reading

The brands that didn't survive the 2000s: meet the 15 companies that were part of our not-so-distant past

With the advent of technology, we have a list of great brands that didn't survive the 2000s. Discover 15 of them and be amazed!

Keep ReadingYou may also like

Get to know the Getnet card machine

If you are looking for a machine with lower fees and requests via WhatsApp, the Getnet card machine is the ideal option. To learn more about her, just continue reading the article!

Keep Reading

Simplic loan online: reliable credit without bureaucracy

If you need quick cash and want to hire online, without leaving your home, the Simplic loan online can be a good option. To learn more about him, just continue reading and check out more information.

Keep Reading

Discover the LATAM Pass Internacional card: 1.3 points for every dollar spent!

Travel with exclusive benefits! The LATAM Pass Internacional Card offers free annual fees, discounts on tickets and the accumulation of points to make your financial experiences even more rewarding. Request now and transform the way you explore the world!

Keep Reading