Cards

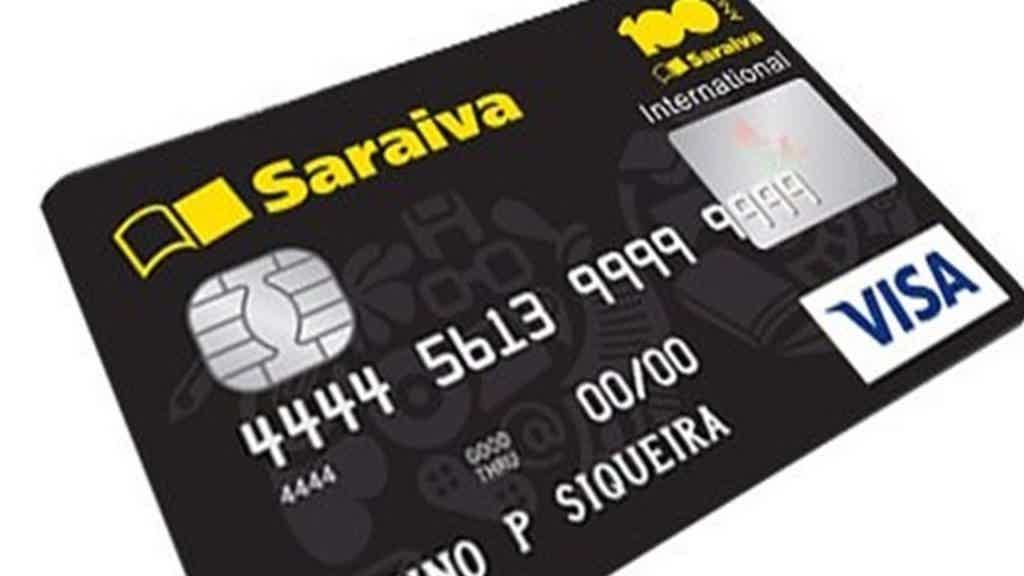

Discover the Saraiva credit card

The Saraiva credit card has no annual fee and is an international Visa. In addition, it can be applied for online with no minimum income requirement. Follow the details!

Advertisement

Saraiva credit card, with no annual fee and no minimum income requirement

O Saraiva credit card is offered by Livraria Saraiva in partnership with Banco do Brasil. It is completely free and can be requested without needing proof of income. If you want to know more about the benefits of the Saraiva card and how to apply for one, follow the text below and we will explain the details.

| Annuity | Exempt |

| Flag | Visa |

| minimum income | not required |

| Roof | International |

| Benefits | Saraiva Plus, Latam Air Miles Plus |

How to apply for the Saraiva card step by step?

Find out now everything you need to know to apply for a Saraiva credit card. Follow the step-by-step process to apply for your card.

Discover the Saraiva card

The Saraiva credit card is offered in partnership with Banco do Brasil. Therefore, to carry out all the monitoring of the card, it is necessary to download the Ourocard bank application, available for IOS and Android.

In addition, it has a Visa flag and international coverage. It is worth remembering that due to the partnership with Banco do Brasil, it will define the credit card limit, but after six months it is possible to request a limit increase.

Benefits

One of the main advantages of the Saraiva credit card is the annuity exemption. Also, you don't need to have a minimum income.

Another advantage is that you can participate in two different reward programs at the same time. Saraiva Plus, which accumulates points to exchange for discounts on the Saraiva network and Air Miles, you can exchange points on Latam Pass.

Disadvantages

The main disadvantage of the Saraiva credit card is that, due to the link with Banco do Brasil, account holders have more opportunities to be approved. Also, the card is not very advantageous for those who do not like to accumulate miles to travel or are customers of Saraiva stores.

How to apply for Saraiva credit card

To apply for the card, follow these steps:

- Access the cards area of the Banco do Brasil website or app;

- Go to Cartão Saraiva and then to “Order yours now”;

- Enter your personal data;

- Complete the registration and wait for credit approval.

Alternative recommendation: Inter Card

If you are a consumer of the Saraiva network, this card is an excellent option on account of Saraiva Plus. But, if you are looking for another card with several benefits, see the comparison we made with the Inter Card:

| Saraiva card | Inter Card | |

| Minimum Income | not required | Minimum wage |

| Annuity | Free | Free |

| Flag | Visa | MasterCard |

| Roof | International | International |

| Benefits | Saraiva Plus, Air miles | Cashback Program |

Did you like the content? So enjoy and learn how to apply for your Inter credit card in the following article!

How to apply for Inter credit card

Do you want to know how to apply for Inter's credit card, one of the best on the market? Then read our text and find out!

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Pan Mastercard Internacional credit card: how it works

Find out how the Pan Mastercard Internacional card works. With it, you can zero the annuity and also take advantage of several benefits, such as PAN MAIS.

Keep Reading

How to apply for Avista card

The Avista credit card has one of the simplest credit analyzes on the market. Approval is quick and easy. Want to know more? Check out!

Keep Reading

How to apply for an Itaú loan with property guarantee

Find out in this post how to apply for an Itaú loan with a property guarantee online without having to leave your home to access credit.

Keep ReadingYou may also like

Genial Brokerage: what it is and how it works

Genial offers zero brokerage for all its assets and free access to Profit, Tryd, GTrader and Metatrader platforms. Learn more here!

Keep Reading

9 best accounts to receive salary

Receiving salary in a salary account can be quite interesting. The services are free, people with name restrictions can apply and much more. Interested? Read today's article and check out the best accounts to receive your salary!

Keep Reading

How to make money on Facebook? see the options

There are many ways to earn money with Facebook, from advertising to selling products and services. If you want to know more about making money on Facebook, check out our article!

Keep Reading