loans

New rules payroll loan INSS 2022

In 2022, new rules for INSS payroll loans came into effect. Some changes were in the assignable margin, interest rates and payment terms. Find out more here!

Advertisement

Payroll Loan: understand what has changed

The new rules for INSS payroll loans have been released. This is because some aspects have been changed regarding the percentage values of the loan margin and the maximum installments charged.

Therefore, Mr. Panda will show you today all the details of the changes that have occurred in the payroll loan and also talk about how it works, fees and other things that will certainly interest you.

Continue reading and find out more about the new rules for payroll loans!

What is a payroll loan?

A payroll loan is different from other loans we know, such as personal loans or loans secured by real estate or cars. In this sense, the difference with a payroll loan is the payment method.

Therefore, we must understand that the payment of the installments is linked to the salary or benefit of the person who requested it. In other words, it is discounted automatically.

This means that the bank or financial institution providing the credit has more security than it would normally have with common loans, that the customer who requested the loan will be able to pay it back.

In other words, the bank's security of loan repayment is almost 100%. Because of this, interest rates are lower.

However, not everyone can apply for a payroll loan. In other words, there is a specific audience that is eligible to apply for the loan, and we will show you all the details in the next topic.

INSS payroll loan fraud

Learn more about payroll loan fraud, how it happens and avoid falling for it!

Who can apply for a loan?

A payroll loan is very different from other types of loans that we are more accustomed to. But this difference is not only linked to the payment.

In this sense, the target audience is also different from other loans, being intended for:

- INSS retirees and pensioners;

- Public servants;

- Workers with signed employment contracts;

- Military of the Armed Forces.

These people can access a payroll loan from various banks and financial institutions with low interest rates and excellent installment terms. This way, when they apply for the loan, they can offer the bank a payment guarantee, since the discount is made directly from the benefit.

How much is a payroll loan worth?

So, we know how a payroll loan works and who can apply for it. However, we need to find out exactly what the maximum amount available for a payroll loan is.

Therefore, it is necessary to understand that the amount that the client can request will depend on two factors. One is their monthly income and the other is the amount that the bank or financial institution makes available for request.

In other words, the maximum amount that the bank makes available is the ceiling of the consignable margin stipulated by the INSS. Therefore, the applicant cannot exceed more than 35% of his/her monthly income.

This means that the bank can charge a maximum of 35% of its monthly margin. Therefore, the amounts cannot exceed this percentage to guarantee the financial security of the bank and the applicant.

What is the interest rate on a loan?

As we can see so far, the great feature that the payroll loan brings with it is the security that banks have that the amounts of the installments of the loan requested will be duly paid.

In other words, the chances of default are almost zero. This is because the payment is automatically deducted from the applicant's paycheck. Because of this, interest rates are very low.

Therefore, the new rules for INSS payroll loans stipulate a maximum interest rate of 2.14%. However, this rate varies according to the financial institution.

See some examples of interest rates for payroll loans:

- Cash: Rates from 1.55%;

- Santander: Rates from 1,71%;

- Itaú: rates starting from 1.08%.

See how low they are? But of course, these rates are initial. In other words, they can increase. This depends on the amount of the loan and the number of installments.

Therefore, it is worth consulting your bank and simulating the values before applying for the loan.

What are the new rules for payroll loans?

Did you know that the rules for payroll loans have changed? That's right. They have been modified and may impact the financial life of INSS beneficiaries.

So, let's better understand the new rules for INSS payroll loans and find out how they really work!

First, the margin of the loan was 35%. With the onset of the pandemic, the government increased this percentage to 40% until 2021.

However, with the arrival of 2022, this law came to an end and, consequently, the percentage of the margin for the loan ended up returning to 35%. So now, the maximum margin that banks can charge is 35%. That is, 30% for loans and 5% for credit cards.

In addition, there are rules regarding the installments. In this sense, the loan repayment period can only be up to 72 installments (6 years) to be paid.

The only exceptions are retirees, pensioners and federal public servants, whose installments can be up to 84 installments (7 years). Anyway, these are the new rules for INSS payroll loans. Want to know more about the best payroll loans? Then check out our recommended content.

What is the best payroll loan?

Discover the 7 best payroll loan options and take advantage of their benefits.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out about the administrative assistant course

Get to know the administrative assistant course and see how it opens doors for professionals who want to grow in their careers.

Keep Reading

Discover the TPM Bank account

Discover the TPM Bank account here. The first bank exclusively for women in the world with financial solutions and without any bureaucracy.

Keep Reading

Prime Cursos free app driver course: learn how to do it!

Get to know the app driver course, see how it can help you increase your financial profit using travel apps.

Keep ReadingYou may also like

What does inflation and indexation of the economy mean?

When we talk about wage adjustments in times of financial crisis, it is necessary to pay attention to the long-term consequences that these corrections may have. According to the Minister of Economy, Paulo Guedes, inflation and indexation are the two main risks. Check out more below!

Keep Reading

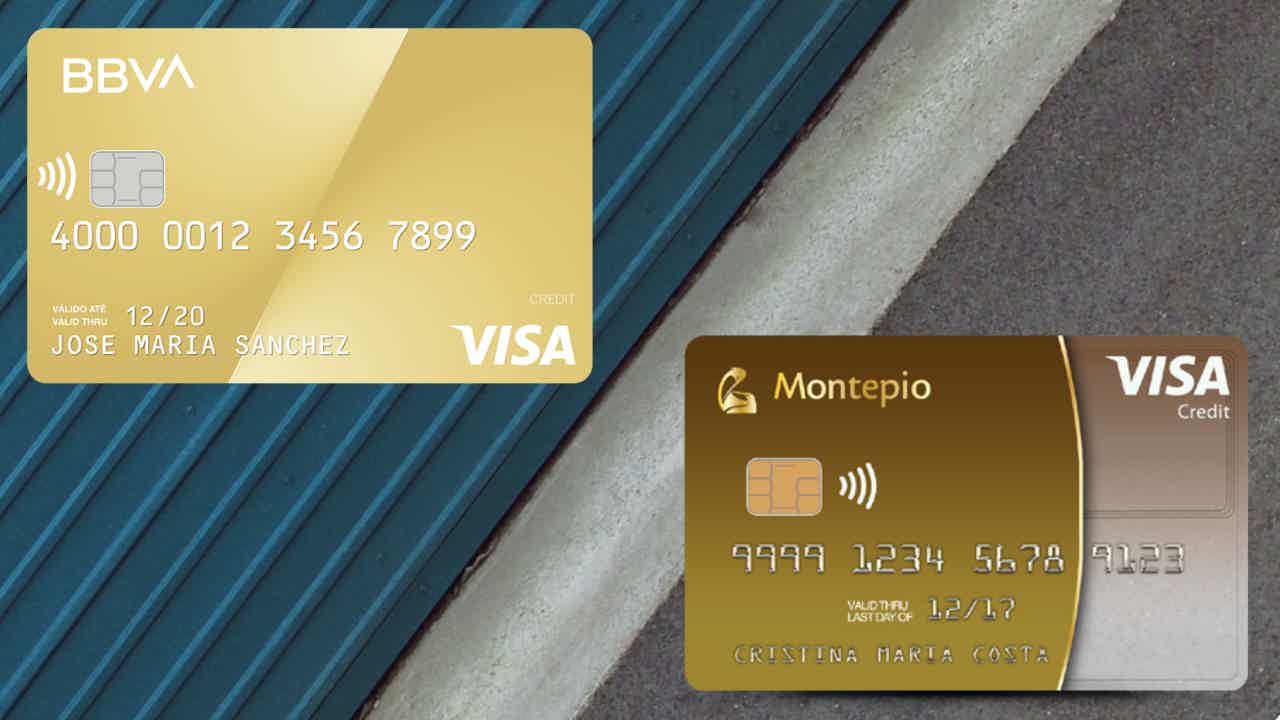

After BBVA Gold Card or Montepio Gold Card: which is better?

Would you rather have more discounts on your credit card or do you prefer full insurance coverage? If you want to have more discounts, then the card will be the After BBVA Gold, now, for insurance, you should choose the Montepio Gold. Want to better understand this choice? Then keep reading this article!

Keep Reading

Discover the Itaú Personnalité account

Read the content until the end and find out how to apply for Itaú Personnalité. At the end, let us know in the comments if you were approved!

Keep Reading