finance

Monitoring CPF: how important is it for you?

Did you know that monitoring your CPF is important to protect your anti-fraud data? Find out how to monitor.

Advertisement

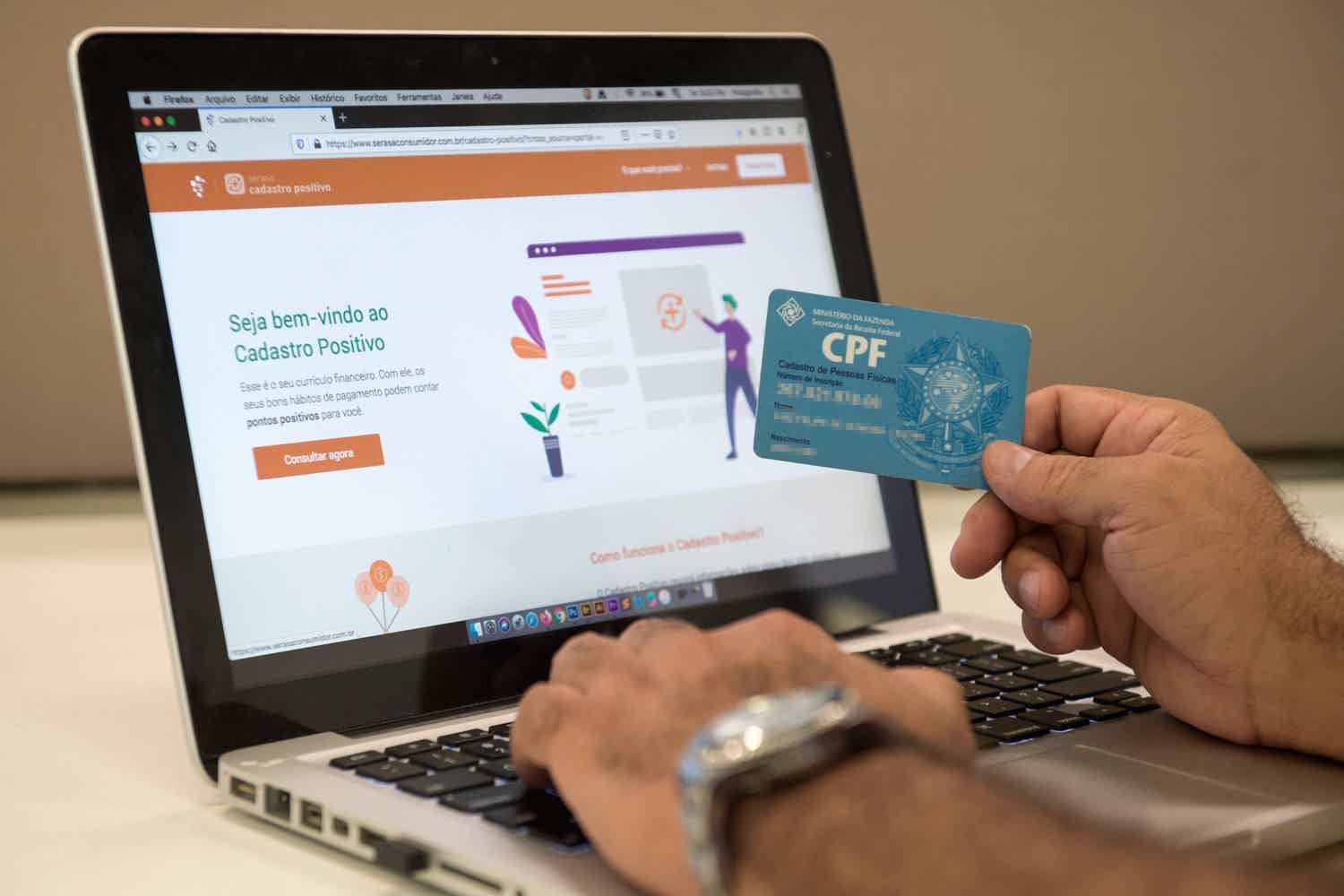

Monitor CPF to protect your data

Many people seek monitor CPF to protect your data. It's getting harder and harder to stay safe. However, little is known about how to reverse this scenario.

Therefore, it is essential that this subject be further discussed. So, it is possible to find efficient alternatives to preserve your information. However, this is a task that requires a lot of research.

The purpose of this post is to make your job a little easier. Here, you will know all the details of this theme. see how monitor CPF to protect your data it might be simpler than it looks.

What is Serasa Antifraud?

It is a paid type of service. Its main function is to monitor your CPF in order to protect the consumer from possible scams. Thus, any action involving unauthorized use of it is easily recognized.

Whenever your CPF is consulted, Serasa Antifraude will send you a notification. In this way, it is possible to monitor these movements and avoid unwanted unforeseen events.

However, this is not the only function of this scheme. It is even able to identify criminal networks. The Dark Web is the prime example of this category. That's because it has marketplaces that specialize in selling personal data.

How to monitor CPF and know if someone consulted your CPF?

This is a very common question among consumers. Before understanding how this happens, it is interesting to understand some points first. Then you will understand why monitor CPF to protect your data.

How to query CPF at Serasa

Did you know that it is possible to consult your CPF at Serasa and find out what your debts are and how your score is doing? Check the necessary steps

These queries are not made randomly. They are intended to study the credit risk and to avoid situations of fraud. This is because they have the ability to identify cases of cloning and embezzlement.

However, all these reviews are confidential. They are stored in Serasa's own database. That way, you don't have to worry about this information being leaked.

You can request a report from Serasa. For this, it is necessary to have some important documents at hand. Are they:

- Certified copy of RG, CPF or CNH;

- Application. It is a simple text signed by you requesting the report of your CPF consultations in the last 30 days.

With that, you can make this request in two ways:

- Send a letter to Serasa Experian;

- Go to a Serasa Consumer agency. Here, you can choose the one closest to your home.

So, then just wait for the report to come out. It takes about 10 days to complete. Then the company will send a letter to your address. That way, you will have access to what you asked for.

In addition, Serasa also has a premium service. Therefore, you can follow these same changes in a more practical way. Monitor CPF to protect your data it doesn't have to be complicated.

How does Serasa AntiFraude work?

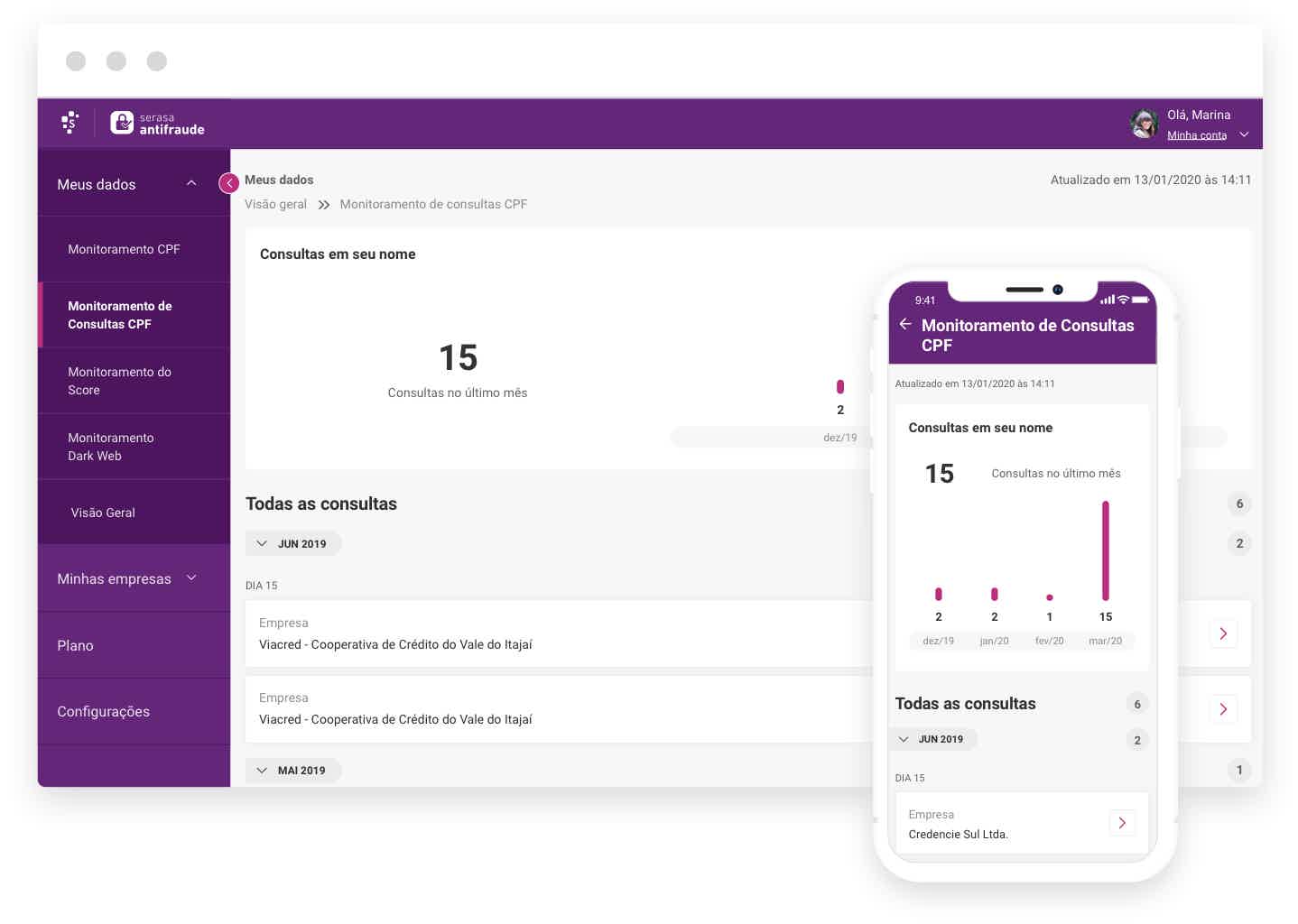

Thus, as stated above, this is a service to constantly monitor CPF. In this way, you receive an alert communicating any type of movement.

This includes queries from banks to release some credit and even loan requests. So, the important thing is that you do not remain unaware of a detail involving your Individual Registration.

Also, despite its name, this service does a lot more than prevent fraud. It allows you, as a user, to have a relationship with the credit market.

Also, it is possible to identify when you are about to be denied and when your name leaves the default register. So there are many things involved in a single platform.

All in the most practical and transparent way. Thus, the next topic will address this in more detail.

Resources within Serasa Antifraude to monitor CPF

The features go far beyond just monitoring CPF and CNPJ. Serasa offers 4 major services. Are they:

- Score monitoring;

- Analysis of queries;

- Dark web monitoring.

By now, you've understood how these first two points work. So one is related to your credit as a consumer. The other is more directly related to data protection.

Anyone who is concerned about information leakage needs to pay attention to the Dark Web. So, it can be defined as a segment of the Deep Web. In it, you have hackers, criminals and so on.

The function of these people is to buy and sell personal data. That's why keeping an eye on this network is so important. Serasa Antifraud does this like no one else. This service is capable of detecting several infractions.

Leaking emails, CPF, passport and so on. Therefore, the moment this identification takes place, you will be alerted. Furthermore, it is important to know that Serasa Antifraude has its versions, free and premium.

So, at first you have very limited information. So, it is only possible to know if your email was found on the Dark web. However, the paid version gives you countless other possibilities.

With it, in addition to knowing about your e-mail, you are aware of which site the leak occurred on. So, if it's in that location, it's because it's been exposed and will probably be sold. Then your data is in danger.

Therefore, acquiring this more complete package makes all the difference. No other form of protection will be as effective as this.

Now, you need to consider the value of that investment. Later on you will understand more about how it works. realize that monitor CPF to protect your data it is simply essential.

Your Data Is Available on the Dark Web: Now What?

This is a situation no one would want to go through. However, it is more common than most people think. So, imagine that you went to monitor CPF and realized that this happened to you.

An email from Serasa Antifraude arrived saying that your data was exposed on the Dark Web. It's understandable to be upset about what happened. However, there are more logical ways to deal with this unwanted scenario.

The first is to immediately change your email password. Now, if you use the same password for other services like credit cards, beware. It is essential to change the password for each of them as well.

Many people have this habit of using one code for everything. In a world where people specializing in fraud do not exist, this is quite interesting. However, the current reality no longer allows this type of carelessness.

The other possible option is to change all your passwords. This even if nothing happened. So, if you noticed that your codes are too simple, stay alert and change them as soon as possible.

So try not to leave anything too easy. Use unique elements that only make sense to you. After all, these types of data are of no interest to anyone but their own.

In addition, it is interesting to invest in special characters, numbers and uppercase and lowercase letters. This tactic will further protect information that is important to you.

Supported plans, pricing, and platforms

The premium plan offers two very interesting alternatives, monthly and annual. First of all, understand that both will provide the same features.

This division is for you to find the best way to afford the investment. So, the big difference is in the values of each option. The monthly modality costs a total of R$ 19.90.

However, the annual plan to monitor CPF can be paid in two ways. The first one is cash, which in this case would cost R$ 169.90. Also, you can opt for 12 installments of R$ 14.16.

Thus, those who prefer the annual version have a good discount. They are R$ 68.90 less with access to absolutely everything. After choosing which one you want to purchase, it is important to pay attention to the payment method. In this case, it would be via credit card.

Also, you might be wondering how to access this service. As one of its greatest advantages is its versatility, it works on several platforms.

So, in the case of the computer, it is possible to choose between Chrome and Firefox. Still, Safari can be one of your alternatives here, no problem. However, if you want to use Serasa Antifraude on your cell phone, that's fine.

It is available for download on the Play Store and Apple Store. That way, it doesn't matter if you have Android or iOS. This service is compatible with virtually all options available today.

anti-fraud glossary

The universe of scams includes a number of not-so-popular terms. If you find yourself in such a situation, you may find it difficult to understand what is going on.

So it's important to have an idea of what some things mean. Thus, in addition to protecting yourself against danger, you stop being layman on the subject. So, meet some points that deserve your attention.

- Bad check: When such a check is issued and it is returned twice by the bank, pay attention. In these cases, this occurrence will be included in the Register of Bad Checks. Also called CCF, it is part of the responsibility of the Central Bank.

- Financial pending: It can be characterized as any overdue account that was sent by the creditor. In addition, pending financial issues are registered in the Serasa Experian database.

- Protest: It is when a company protests a certain debt in a notary. Generally, this happens after much insistence from the creditor. Even so, the debtor does not pay what he owes.

- Lawsuit: A process where the debtor becomes a defendant. Thus, this refers to the distribution of any debt. It is from it that decisions to resolve a given situation will be taken.

- Participation in bankruptcy: Here, it is as if you had a stake in a company that is going bankrupt. Then, a note is issued in your CPF.

Imagine the following scenario. You do not have the Antifraud service contracted. However, he discovers some time later that his CPF was used to open a company illegally.

In this case, understanding these terms is essential. Thus, it is easier to solve the problem. After all, those who find themselves in this situation will come across them all the time.

Is it worth monitoring CPF?

Before having a clear answer about monitoring CPF, it is important to understand the Brazilian context. Serasa has already released data where it says that every 17 seconds there is a fraud attempt.

Your CPF is at serious risk on a daily basis. After all, it is a necessary document in most financial operations. In this way, scammers give him a lot of value.

Now, what do these criminals do with a leaked CPF number? Practically everything. They can buy products in your name, apply for financing, and even start a business.

The end is only one, the victim is seriously harmed financially. Therefore, it is very worthwhile to monitor your CPF. This is the best option to ensure your data remains secure.

Understand that unfortunately the credit market has high risks. Today, there are several ways that criminals use to get relevant data.

Don't think this can't happen to you, unfortunately it's a reality. Thus, prevention is very important in this context. Leaving it to take action after leaked information is not a good idea.

Depending on the situation, the consequences may be left for you. Do not think that once you discover a fraud, it will be resolved easily. That's why subscribing to Serasa Antifraude is worth it.

In this way, it is possible to have your information constantly monitored. Still, all for a very affordable price. Not to mention that it offers other features as seen above.

Conclusion

Finally, you already know everything about monitoring CPF. Remember the concepts covered and the terms as well. Each element of this text was designed for you to know how to act in preventing and containing damage.

Now it is your turn. Take the tips exposed here and apply them. See the best way to hire this service offered by Serasa.

How does the Serasa score work?

Your credit score is essential for your financial actions and your credit applications. So, see how serasa score works and how to improve it

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Pão de Açúcar vacancies: how to check the options?

Find out how to find open positions at Pão de Açúcar and learn about the salary and benefits that this supermarket offers its employees!

Keep Reading

How to earn extra income online?

If you are looking for a reliable extra income online, let us show you. Read this post and see the options we've put together for you!

Keep Reading

Ponto Frio Card or Casas Bahia Card: which is better?

Do you want products with discounts, but are you in doubt about the best choice? Decide between Ponto Frio Card or Casas Bahia Card here!

Keep ReadingYou may also like

Get to know details about the Beblue digital account

Pioneer of cashback in Brazil, Beblue now also offers the option of a digital account on its platform. Prioritizing the customer experience, fintech promises differentiated services and maintains the focus on its main product: cash back when making purchases. Understand.

Keep Reading

Discover the N26 debit card

The N26 debit card has annuity waiver, international coverage and allows cheaper purchases abroad. Learn more in our article!

Keep Reading

What is the Méliuz Mastercard credit card?

The Méliuz Mastercard credit card allows you to earn cashback of up to 2% and also allows you to earn double cash back using the Ame app! Check out more information about him here!

Keep Reading