Cards

Nubank Ultravioleta card miles: how to turn cashback into miles?

The process of transforming your cashback into miles with the Nubank Ultravioleta card is very simple and quick to do! Learn how in this article.

Advertisement

Your cashback can earn you many miles

The miles on the Nubank Ultravioleta card are a very interesting feature that allows you to access the Smiles miles program.

That way, from this program you can use your miles to buy airline tickets and stay in hotels with discounts.

In addition, the Smiles program also allows you to use your miles to purchase products from partner stores and even to fill up your car or motorcycle.

But, to be able to access all these benefits, you need to know about the Nubank Ultravioleta cashback program, which allows you to access Smiles miles.

So, read on and check it out!

How does the cashback program work?

In short, the Nubank Ultravioleta cashback program works in a very simple way.

Therefore, this program allows you to get up to 1% back from all your credit card purchases.

In addition, when you have this money back in your account, it will start yielding 200% of the CDI, which is a high rate since most banks allow yields of up to 100% of the CDI.

How to exchange cashback for miles on this card?

The process of transforming Ultravioleta card cashback into miles for you is very easy.

To do this, you just need to access the Nubank application, log into your account and go to the cashback area.

That way, just click on “Exchange for miles” and, right after, enter how many miles you want to send to Smiles, which is the official partner miles program of Nubank Ultravioleta.

So, after entering the amount, just enter your 4-digit password and wait until the miles appear in your Smiles account.

Namely, to count miles, the program establishes that R$ 0.03 earned in cashback is equivalent to 1 mile!

Who can redeem Nubank Ultravioleta card miles?

Namely, the redemption of miles from the Nubank Ultravioleta card can only be done by the cardholder.

This happens because in the process of transferring miles to the Smiles program, it is necessary for the holder to enter the application, access his account and, after defining the amount of points that will be transferred, he must enter his card password.

In this way, as only the holder of the Nubank Ultravioleta card can access the password, only he can redeem the miles

How to redeem miles?

In summary, after transferring the cashback to the Smiles program miles, it is possible to redeem it in several ways, such as:

- When purchasing airline tickets or hotel reservations;

- Conducting sightseeing tours and excursions;

- Renting cars in Brazil with Localiza;

- Buying products from Shopping Smiles;

- Taking trips with Uber;

- Refueling at Shell stations.

Thus, you can have several ways to redeem your miles from the Nubank Ultravioleta card and use them in different ways.

However, if you want to learn about other card options that exchange points for miles, access the recommended content below.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

The best cities in Brazil with less than 10,000 inhabitants (according to IDHM)

Read our text and find out now which are the 15 best cities in Brazil with less than 10,000 inhabitants according to the IDHM.

Keep Reading

From popular to imported: Get to know the cars of the candidates for mayor of SP and RJ

Keep Reading

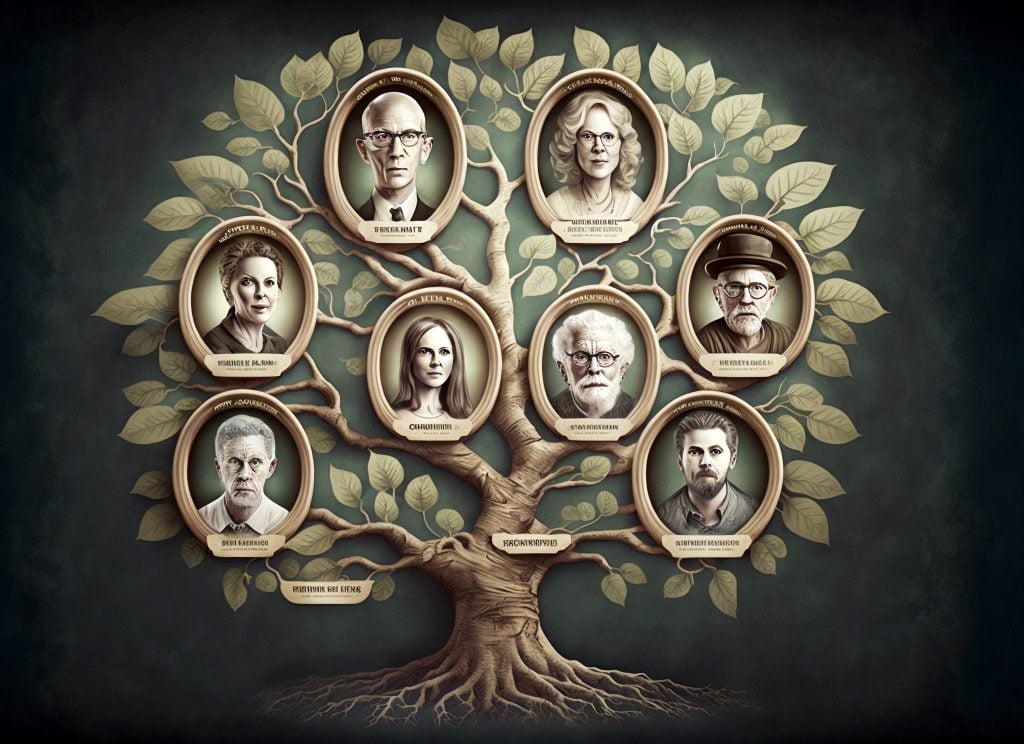

Build your family tree in a few clicks: The 4 best apps available

Discover your roots, unlock family secrets and build your family tree with the best apps available.

Keep ReadingYou may also like

All about the Easy Epa card

The Fácil Epa credit card has an additional card, payment in up to 5 installments with interest, invoice payment within 40 days and much more! Were you curious to learn more about the card and how to apply for it? Come with us!

Keep Reading

Chase Sapphire Preferred Credit Card: How It Works

Want to travel and pay almost nothing? With the Chase Sapphire Preferred Card, you earn as you spend and travel with peace of mind. Read this post and find out how this can be possible.

Keep Reading

Caixa Mulher card or PicPay card: which is better?

The Caixa Mulher card and PicPay are great options for those looking for a product without much cost. Which one will be the best? Continue reading and check it out!

Keep Reading