Cards

8 best bad credit cards online

Are you negative? Rest assured, you can still apply for a credit card. In today's article, we'll show you the eight best credit cards online for bad debts. Continue reading and check it out!

Advertisement

We have the ideal card for you who are negative

Before talking about the best negative credit cards online, it is important to mention that a credit card can make your financial life much easier. This is because, with it, it is possible to have access to some goods without necessarily having all the money at the time of purchase. In addition, you may have the possibility to pay your purchases in installments. However, without a good financial organization, the credit card can cause problems.

For these and other reasons, some people end up being negative. That is, with the dirty name. Therefore, when this happens, banks usually withdraw all credit functions from the customer. Mostly, to preserve yourself. However, there are some institutions and modalities that offer cards for negatives. Continue reading and discover the best bad credit cards online.

What are the best bad credit cards online?

Check here the best online credit cards for negatives in the Brazilian market. Follow!

1. Mercado Pago

Mercado Pago is the Mercado Livre account. As much as many people think that the account is only available to those who sell on the platform, this is not the case. Therefore, it is clear that those who sell through Mercado Livre benefit from Mercado Pago.

However, anyone can apply for your account. Thus, you can access the Mercado Pago credit card. In this sense, the card has the Visa flag and can be used internationally. In addition, it has no annual fee and can be requested in a few minutes through the app.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Approximation payment; Virtual card available. |

How to apply for the Mercado Pago card

Learn how to apply for the Mercado Pago card with contactless payment!

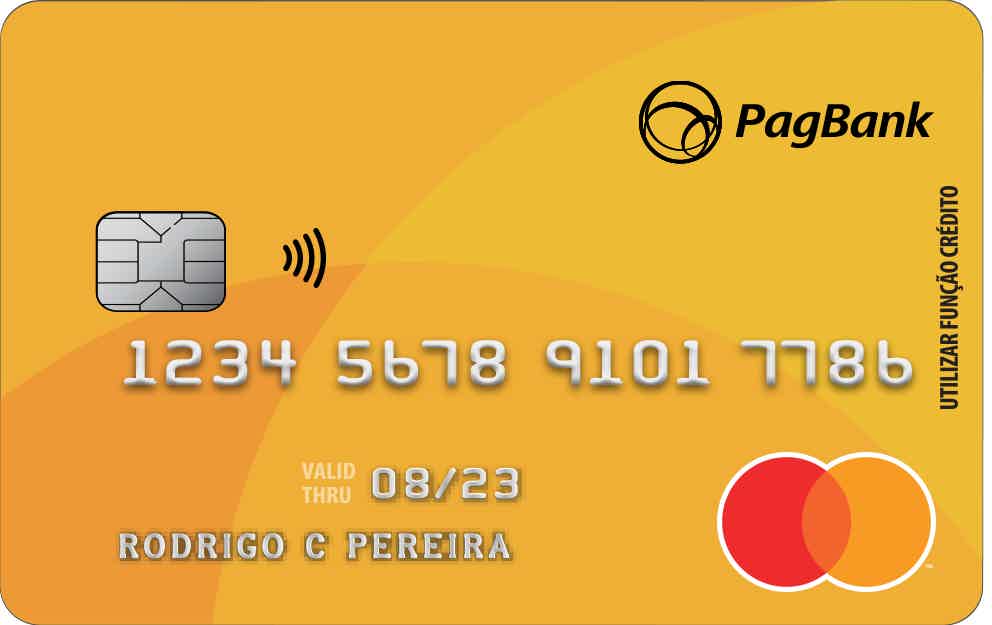

2. PagSeguro

Like Mercado Livre, PagSeguro also has its payment account: PagBank. That's where they offer several card options. In this sense, in the case of negative credit cards, the card is Prepaid.

Therefore, the card operates in the credit function normally. Incidentally, the card is still international and can be used for online purchases. That is, if you want a card to have subscription services, this is a good option.

| Annuity | Exempt |

| minimum income | not required |

| Flag | MasterCard |

| Roof | International |

| Benefits | Buy online securely; Easy to reload. |

How to apply for the PagSeguro prepaid card

Find out how to apply for the PagSeguro prepaid card for negatives!

3. RecargaPay

RecargaPay is one of the best-known options when it comes to credit cards for negative credit cards. Like PagBank, this card is also prepaid. Incidentally, the card has no annual fee for customers who have the account.

In addition, to avoid paying the membership fee, just recharge R$20.00. Therefore, the card is accepted in several establishments, since it has a Mastercard flag. Furthermore, there is the possibility of paying an annual fee of R$ 19.99 per month and receiving more cashback on your purchases.

| Annuity | Exempt |

| minimum income | not required |

| Flag | MasterCard |

| Roof | International |

| Benefits | 1% cashback on all purchases; Mastercard Surprise Program. |

4. BMG Consigned

Firstly, payroll cards are usually a great option for those with bad credit. However, it is worth remembering that they have some conditions. This is because, in the case of BMG Consignado, it is an exclusive card for INSS retirees and pensioners. In this way, its interest rates are much lower than other types of credit.

In this sense, with BMG Consignado, it is possible to have a limit of up to 1.6x of your benefit. Incidentally, the minimum amount is deducted directly from the payroll. Therefore, if you need it, you can also make cash withdrawals with this card. Furthermore, in this service you can request up to 70% from the available limit. In addition, the charge is only made on the following month's invoice.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Cash withdrawal with fees of up to 2.7% per month |

5. Consigned Cash

First, Caixa Econômica Federal offers the Caixa Simples card in the payroll mode. So it's a great option for retirees and pensioners who are negative. This is because Caixa does not carry out a CPF consultation either at Serasa or at the SPC. However, if any of your debts are with Caixa, you must settle them before applying for the card.

Incidentally, only a minimum amount of the invoice is deducted from the customer's payroll, with 5% of the amount of their benefit or salary. Although it has many advantages, a negative point of this card is that it has an issue fee. But this amount can be paid in up to 3 installments on the invoice.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Link |

| Roof | International |

| Benefits | Elo Flex Platform |

How to apply for the Caixa Consignado card

Learn how to apply for the Caixa Consignado card with exclusive advantages.

6. Banrisul Payroll

Firstly, the Banrisul Consignado card is a card designed for INSS retirees and pensioners. That way, with this card you start paying your bill within 45 days. In addition, Banrisul offers a non-annuity card with international coverage. Furthermore, it is possible to withdraw 70% from the limit value.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise Program |

How to apply for the Banrisul payroll card

Find out how to apply for the Banrisul card and enjoy the benefits.

7. Payroll Pan

First, Banco Pan offers the payroll credit card that is also valid for negative credit cards. Incidentally, it is worth mentioning that the payroll card is only for retirees, INSS pensioners and public servants. In this sense, the card is international and with the Visa flag. That is, it is possible to make purchases anywhere, both online and physically.

Furthermore, the request is very simple. Just simulate a proposal, send the documents and wait for your card to arrive. In addition, with the Pan Consignado card, it is possible to have a limit of up to 2x the salary amount. Therefore, the card has an interest rate 4x lower than the market.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Limit of 2x the salary amount; Available for negatives. |

How to apply for the Pan payroll card

Learn how to apply for the Pan payroll card and get access to exclusive benefits!

8. Superdigital

Just like the cards we mentioned at the beginning, Superdigital's credit card is also prepaid. That is, it has all the features of a common credit card. However, it depends on recharge to be used.

Therefore, with the Superdigital negative credit card, you can make purchases in physical stores, online and even internationally. In addition, if you are looking for a card to subscribe to a streaming service, it is also possible with it.

In this sense, Superdigital's prepaid card does not require a CPF consultation either at the SPC or at Serasa. That way, you can have your credit card without disorganizing your finances and creating even more debt.

| Annuity | Exempt |

| minimum income | not required |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise Program |

How to apply for the Superdigital credit card

Learn how to apply for the Superdigital prepaid card with cash credit function and many benefits.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the free Veduca courses

Get to know the free Veduca courses and be surprised by their advantages, such as online courses at no cost, certificate option and much more.

Keep Reading

Federal, state and municipal competition: what are they and how to choose?

Find out in this post the main difference between the federal, state and municipal contest and learn how to choose between each one of them!

Keep Reading

Santander Payroll Loan: how it works

Santander Consignado is ideal for employees of partner private companies and public servants, as it has attractive interest rates. Check out!

Keep ReadingYou may also like

How to apply for UCI Housing Credit

Do you want to easily hire housing credit? So, check out how to apply for the UCI loan and have an option with competitive interest rates and a 35-year repayment term. Don't miss it!

Keep Reading

How to renegotiate debts with Nubank

Having no debt is a great way to make the consumer's life peaceful. In this sense, knowing how to renegotiate Nubank pending issues may be interesting for your customers. Want to know how this works? Come check it out!

Keep Reading

PIX in installments: see how to avoid debts when using the new resource

PIX in installments provides purchasing power to citizens who do not have access to a credit card. But if not used carefully, it can lead to debt. See how to plan so you don't end up messing up next!

Keep Reading