Cards

BTG+ credit cards: find out about their advantages

Now that you understand what the BTG+ digital bank is all about and what your credit cards are, then it remains to understand the other advantages that this product offers you. Check out!

Advertisement

BTG+ credit cards

There is no doubt that BTG+ credit cards came to revolutionize the market by innovating with Invest+, a system that reverts part of credit card expenses into a cashback program. In addition to it, there are also other advantages that this product offers you and that you need to know about. Let's find out?

Advantages of BTG+ credit cards

As it is a digital bank, there are numerous advantages related to this characteristic. Among them, the fact that there is no need to go to the bank to open your account and apply for your credit card. Learn more and learn about other benefits of this excellent product!

1. 100% digital

As is already known, BTG+ is a digital bank aimed at individuals. Precisely for this reason, an enormous benefit comes to those who are terrified of just hearing about a physical branch: there is no need to go to the bank to carry out any financial procedures whatsoever.

Therefore, you do not need to go to the financial institution to open your digital account, nor to apply for one of the BTG+ credit cards. Everything can be done in the comfort of your home and in the palm of your hand. And if, by chance, there is any difficulty in a certain procedure, just call the call center and your query will be promptly answered.

2. Clear annuity waiver policy

Unfortunately, most BTG+ credit cards are not annual fee-free, except for Mastercard Gold, their most basic product. However, the good news is that they have a clear disclaimer policy. This means that, knowing the amount you spend per month, you can purchase the card that suits you best. And if you don't hit the goal to be completely exempt from the annuity, don't worry, it's still possible to get a 50% discount.

3. Invest+ Loyalty Program

Without a doubt, Invest+ is one of the greatest benefits of BTG+ credit cards. For those who still don't understand what it's all about, this loyalty program means that part of the amount you spend on your card is deposited in a BTG Pactual fund, making your money earn daily. With a return target of 100% of the CDI, all investments are made with the aim of making the fund's return follow this index.

BTG+ credit card rewards program

Interested in learning more about Invest+? So calm down that we will explain everything to you in detail. However, you need to understand that the program offers points according to the value of purchases in real, that is, the fluctuation in the exchange rate does not influence the accumulation. Also, points never expire.

How does it work in practice? Well, for every R$ 1.00 spent on your BTG+ Black card you earn 1 point in Invest+, while in Platinum it offers 0.75 points per real spent and 0.5 in Gold. Points are converted into reais in the proportion 100 points = R$ 1, so it is as if the card offered cashback from 0.5% to 1%, going from the most basic to the most sophisticated category.

For example, suppose you spend R$10,000.00/month on your BTG+ Black card, right? With this, you will have in return, in addition to the daily income of 100% from the CDI, the cashback of:

- 6 months: R$ 602.37;

- 12 months: R$ 1211.68;

- 24 months: R$ 2,465.67.

How about it, huh? But attention! This program is free for 12 months only until March 31, 2021. After that date, a monthly fee of R$ 30 will be charged to Platinum and Gold card customers who activate the service. Black card users will be exempt from the charge.

Completion of BTG+ credit cards

With Invest+, BTG+ credit cards have become a great option for those who want to have cashback on their monthly bills. Still, there are several other advantages that make, in fact, the product one of the best on the market. If you want to know how to apply, just continue reading by clicking the button below. Good text!

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to enroll in GINEAD courses

Find out how to enroll in GINEAD courses and enjoy all the benefits of online courses to always be up to date. Check it out here!

Keep Reading

How to earn miles with the Gol Smiles card: understand the process

Find out how to get miles with the Gol Smiles card, how the card works and what benefits it offers to those who request it!

Keep Reading

Banco do Brasil Corporate Loan: how it works

The Banco do Brasil Empresarial loan is the ideal line of credit to help you pay your debts and make your dreams come true. Check it out here!

Keep ReadingYou may also like

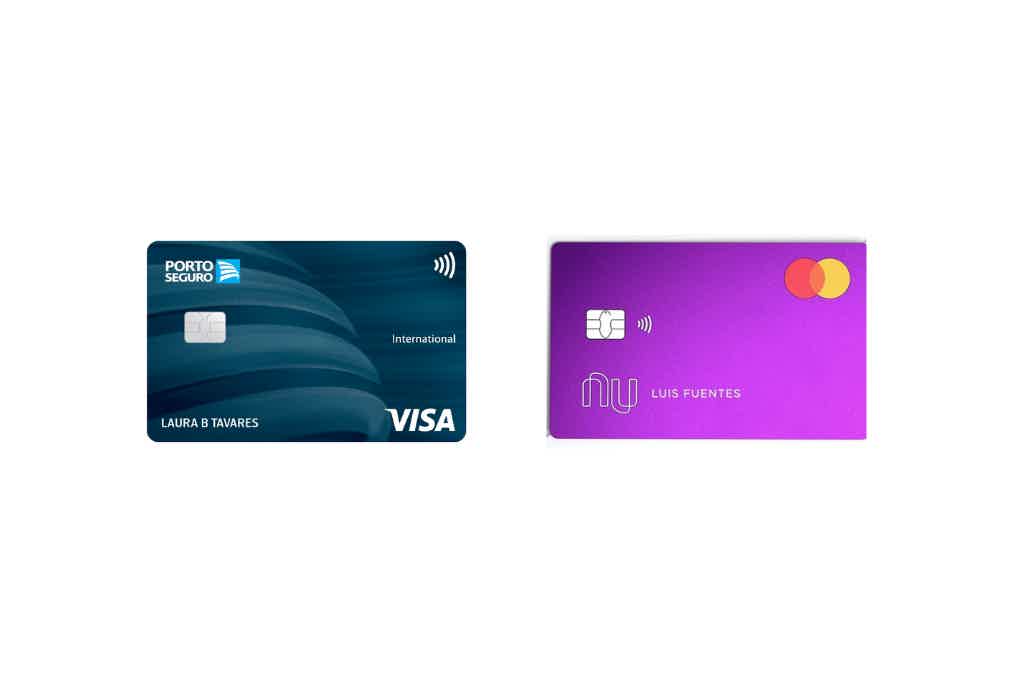

Porto Seguro Card or Nubank Card: which is better?

For those looking for more modernity and lower fees on their credit cards, one of the two best opportunities is here, Porto Seguro card or Nubank card. If you're curious to learn more about these alternatives, stay with us!

Keep Reading

Get to know Millennium BCP Personal Credit

Have you ever thought about hiring up to €15,000 to go on a trip or fill your house and do everything online? If so, get to know the Millennium BCP Personal Credit that makes it possible for your goals to come true. Check out!

Keep Reading

Get to know Cetelem personal consolidated credit

With Cetelem consolidated credit, getting amounts of up to 75,000 euros and payment in up to 84 installments is simpler and faster. See more on the subject here.

Keep Reading