Cards

BTG+ credit cards: find out about their advantages

Now that you understand what the BTG+ digital bank is all about and what your credit cards are, then it remains to understand the other advantages that this product offers you. Check out!

Advertisement

BTG+ credit cards

There is no doubt that BTG+ credit cards came to revolutionize the market by innovating with Invest+, a system that reverts part of credit card expenses into a cashback program. In addition to it, there are also other advantages that this product offers you and that you need to know about. Let's find out?

Advantages of BTG+ credit cards

As it is a digital bank, there are numerous advantages related to this characteristic. Among them, the fact that there is no need to go to the bank to open your account and apply for your credit card. Learn more and learn about other benefits of this excellent product!

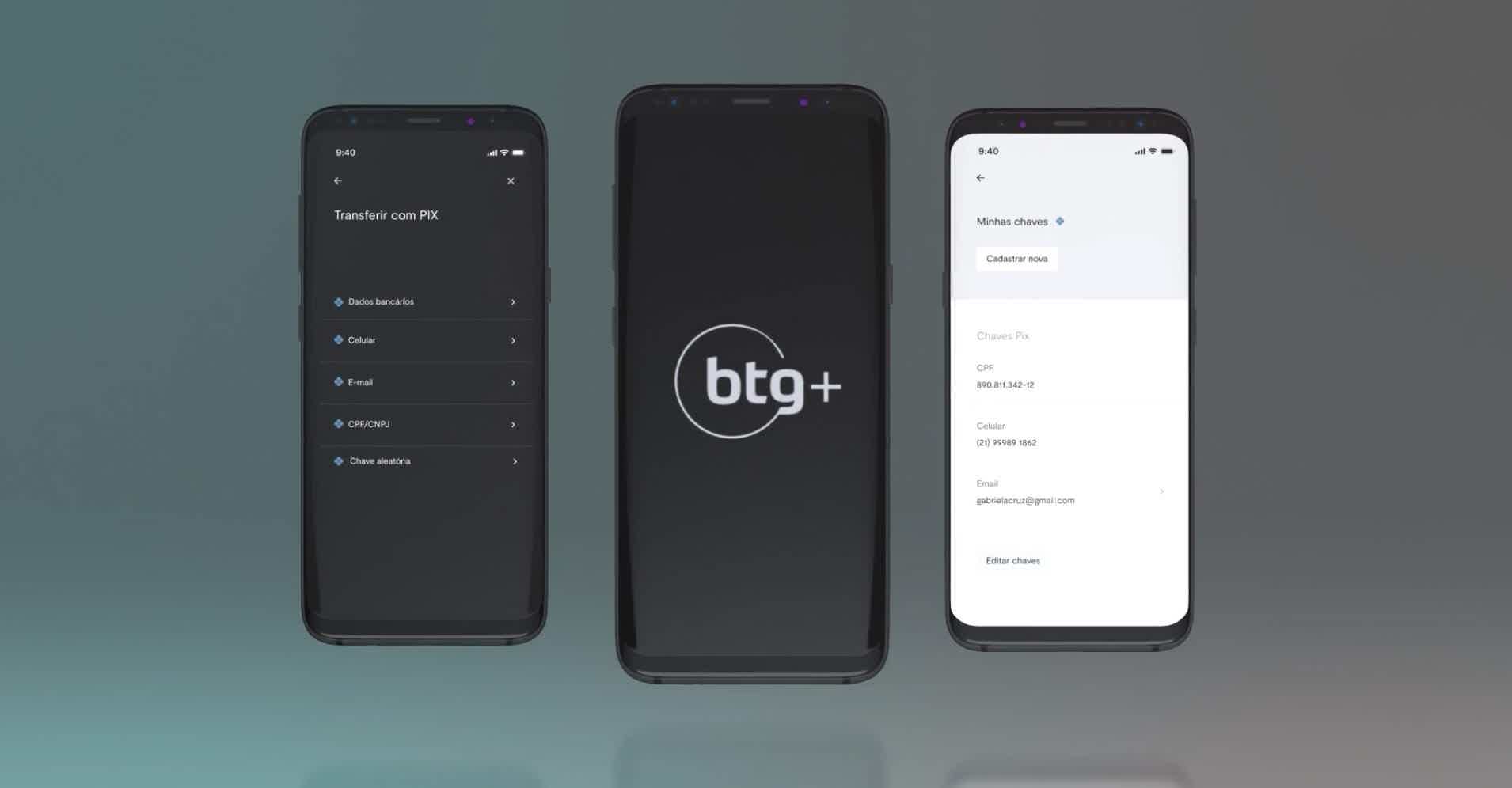

1. 100% digital

As is already known, BTG+ is a digital bank aimed at individuals. Precisely for this reason, an enormous benefit comes to those who are terrified of just hearing about a physical branch: there is no need to go to the bank to carry out any financial procedures whatsoever.

Therefore, you do not need to go to the financial institution to open your digital account, nor to apply for one of the BTG+ credit cards. Everything can be done in the comfort of your home and in the palm of your hand. And if, by chance, there is any difficulty in a certain procedure, just call the call center and your query will be promptly answered.

2. Clear annuity waiver policy

Unfortunately, most BTG+ credit cards are not annual fee-free, except for Mastercard Gold, their most basic product. However, the good news is that they have a clear disclaimer policy. This means that, knowing the amount you spend per month, you can purchase the card that suits you best. And if you don't hit the goal to be completely exempt from the annuity, don't worry, it's still possible to get a 50% discount.

3. Invest+ Loyalty Program

Without a doubt, Invest+ is one of the greatest benefits of BTG+ credit cards. For those who still don't understand what it's all about, this loyalty program means that part of the amount you spend on your card is deposited in a BTG Pactual fund, making your money earn daily. With a return target of 100% of the CDI, all investments are made with the aim of making the fund's return follow this index.

BTG+ credit card rewards program

Interested in learning more about Invest+? So calm down that we will explain everything to you in detail. However, you need to understand that the program offers points according to the value of purchases in real, that is, the fluctuation in the exchange rate does not influence the accumulation. Also, points never expire.

How does it work in practice? Well, for every R$ 1.00 spent on your BTG+ Black card you earn 1 point in Invest+, while in Platinum it offers 0.75 points per real spent and 0.5 in Gold. Points are converted into reais in the proportion 100 points = R$ 1, so it is as if the card offered cashback from 0.5% to 1%, going from the most basic to the most sophisticated category.

For example, suppose you spend R$10,000.00/month on your BTG+ Black card, right? With this, you will have in return, in addition to the daily income of 100% from the CDI, the cashback of:

- 6 months: R$ 602.37;

- 12 months: R$ 1211.68;

- 24 months: R$ 2,465.67.

How about it, huh? But attention! This program is free for 12 months only until March 31, 2021. After that date, a monthly fee of R$ 30 will be charged to Platinum and Gold card customers who activate the service. Black card users will be exempt from the charge.

Completion of BTG+ credit cards

With Invest+, BTG+ credit cards have become a great option for those who want to have cashback on their monthly bills. Still, there are several other advantages that make, in fact, the product one of the best on the market. If you want to know how to apply, just continue reading by clicking the button below. Good text!

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the VestCasa credit card

The VestCasa credit card has numerous benefits and points programs, and can be used for national and international purchases!

Keep Reading

How much score do I need to finance a motorcycle?

How much score do I need to finance a motorcycle? In this article we will answer that and also give you tips to increase your score. Check out!

Keep Reading

Booking app: find out how to buy cheap tickets and accommodation

See how to download the Booking app, in addition to information about how it works and its pros and cons.

Keep ReadingYou may also like

How to make real money online in 2022

Still don't know how to make real money on the internet? Read the post below and check out 7 job tips that have given good results in 2022.

Keep Reading

How to prepare for a job interview

Want to know how to prepare for job interviews still in 2021? We separate tips so you know how. Continue reading and find out!

Keep Reading

10 advantages of the Bradesco Neo card

Want a card that gives you more financial autonomy and ease in everyday life? The Bradesco Neo card offers annuity exemption, international coverage and you can carry out your transactions directly through the app.

Keep Reading