finance

More advantages of the Uber loan in partnership with Digio

That Uber's new line of credit came to innovate the market, no one doubts that. However, would you know how much benefit it has to offer its customers? If not yet, then check out what are the advantages of Uber loan

Advertisement

Uber loan in partnership with Digio

One thing is for sure: there is no shortage of advantages of the Uber loan. In addition to being an innovative line of credit, giving people in need the opportunity to have their financial life more organized, this financial service also has low interest rates and facilitated payments. Want to know what else it has to offer you? So check it out!

Advantages of the Uber loan

As already mentioned in the introduction, there are, in fact, several advantages of the Uber loan. However, if you haven't read our previous text – which we highly recommend!, it is worth remembering what these benefits are. Come on:

01. Lower interest rates

One of the great advantages of the Uber loan is certainly the lowest interest rates. This is because, if you are not part of the public that has the payroll loan at your disposal, which, in this case, are civil servants, retirees and pensioners, then you are at the mercy of the personal loan, whose interest rates are quite high. However, in this new line of credit, you only pay up to 2,97% per month, which is a much lower cost than what is traditionally charged.

02. Good credit values

Another positive point of the Uber loan is the fact that it is possible to have good credit values. With the release of R$1,000 to R$5,000, this money can certainly help you in a moment of despair, but it doesn't ruin your financial life. This is because it is not a large amount that is completely out of your financial reality. For example, working hard for two months as an Uber driver, you pay off your debt in full.

03. Easy payment

Although you have 01 year to pay off your debt, it is undeniable that the weekly payment is, by far, one of the best advantages of the Uber loan. As the company withholds part of your income weekly, you do not feel the financial “loss” as much as you do not run the risk of not paying your installments.

More advantages of the Uber loan

Then you, who read our text about the general information about this credit line, must be wondering: “but are these the only advantages of the Uber loan? I already knew that!” If that question crossed your mind, then calm down because there's more yes! Let's find out?!

01. No concern with the payment of installments

That you, Uber driver or delivery person, already know that the application withholds the amount of your loan weekly, this is nothing new. However, did you know that you don't even have to worry about paying off debt? So it is!

Payment is made automatically and works as follows: the date of your first weekly discount depends on the day you took out the loan. You will be informed of this date at the time of contracting and the retention can take place between 20 and 40 days from the signing of the contract.

Well, from then on, a fixed amount will be deducted from your earnings every week. The weekly fixed installments will be considered to be carried out in four cycles, that is, four weeks. When you accumulate the total amount of the installment, it is paid! That simple.

02. Also without concern for outstanding amounts

A question you may have had is about not being able to pay off the full amount of the debt by the due date. In this case, you can rest assured that the next weekly retention will settle the amount

opened. Only after the total payment of the debt will the withholdings begin to deduct the values of the current installment.

03. Earnings discount

Another advantage of the Uber loan is that the company works with the so-called “earnings discount”. If there is not enough earnings balance to pay the full amount of the monthly installment over the four weeks, Uber sends you a slip with the residual amount with a due date equal to the monthly installment. But attention! If the remaining amount is equal to or less than R$ 10, the billet will not be issued and it will be inserted in your

next installment without accruing interest.

04. Warranty and security

Among the advantages of the Uber loan is the fact that, behind them, there is the digital bank Digio, which actually grants the credit. Therefore, there is no reason to doubt the guarantee and security of this loan, as the financial institution is serious and highly respected. No wonder, Digio has more than 1.6 million customers, who are fully satisfied.

05. Ease at the time of request

Applying for an Uber loan is much easier than you might think! Just enter the Digio digital bank website, go to the specific loan page and select the amount you want to borrow, which can be between 1,000 and 5,000 reais. After defining the amount, you will select the number of installments in which you want to make payments and that's it!

So how to apply for this loan?

Now that you know all the advantages of the Uber loan and have seen how easy it is to apply for it, the question remains: how does the whole credit application process work? If you also want to know, just click the button below and voilà! The answer is right before your eyes in a matter of seconds.

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the uConecte personal loan

The uConecte personal loan is approved in a few hours and is ideal for those who need money quickly. Check more here!

Keep Reading

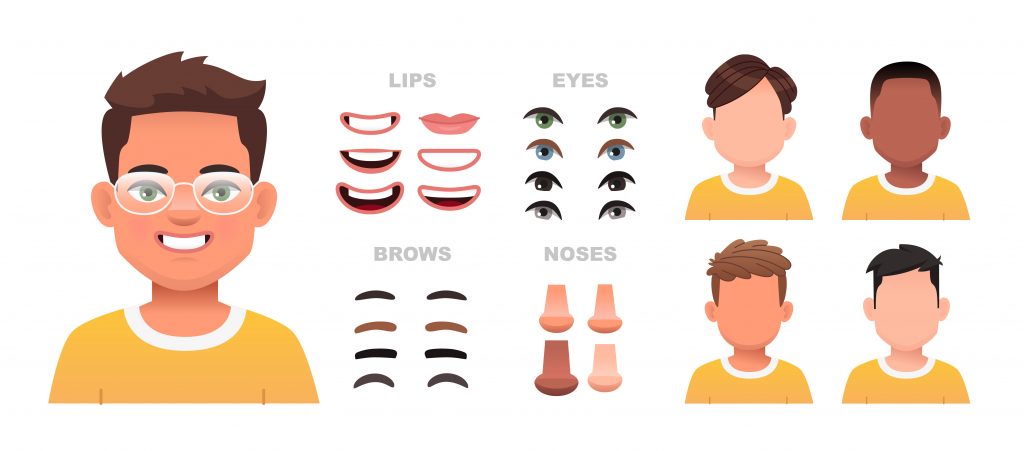

Avatar Maker Apps: Create fun cartoons

Explore avatar maker apps and personalize your online identity in a fun and unique way. Know more!

Keep Reading

How to apply for the Caixa Gold card

To apply for the Caixa Gold card, go to a branch or nearest bank correspondent. Learn more here.

Keep ReadingYou may also like

Méliuz Card or Superdigital Card: which one to choose?

If you are undecided between the Méliuz card or the Superdigital card, how about reading our comparative text and checking which is the best option? Continue reading and check it out!

Keep Reading

15 best countries for Brazilians to study abroad

There are better countries for Brazilians to study abroad, work and even learn English. They range from the US to Malta. Check out!

Keep Reading

How to apply for Abanca Personal Credit

Have you ever thought about having a loan of €75,000 to boost your dreams and only needing to repay the bank in 84 months? See here how to apply for Abanca Personal Credit and enjoy advantages like these.

Keep Reading