loans

More advantages of the Serasa eCred Loan

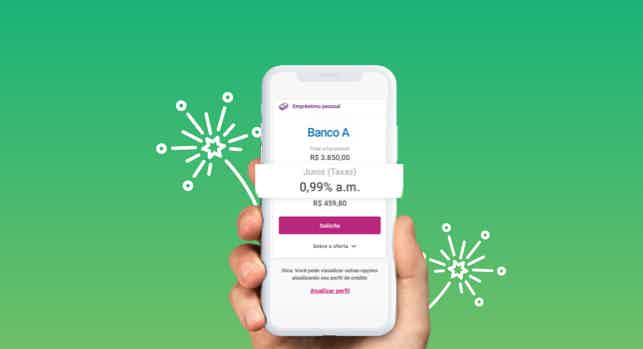

The Serasa eCred Loan is a great option for those who are negative, come and understand better about the product and its benefits that make it the market's favorite.

Advertisement

Many advantages of this loan option for negatives!

In our text on the Serasa eCred Loan, we explain what this arm of the company Serasa Experian is all about, leader in analysis and information services for credit decisions and business support. In addition, we mentioned the six loans available to you and we saw that it is very difficult not to find one to call yours, isn't it?

Quickly, we also talk about the advantages of the Serasa eCred Loan. However, regarding this subject, there is still much more to be explored. This is because the benefits are so many and so good that they deserve a post completely dedicated to them. So let's know more?

How to apply for the Serasa eCred Loan

So, the answer to the question everyone wants to know has arrived: how to apply for the Serasa eCred Loan? So, let's find out?

Advantages of the Serasa eCred Loan

You can be sure of one thing: with the Serasa eCred Loan, you will never feel dissatisfied with the service provided. With so many advantages and benefits, it's practically impossible not to feel happy with what the company offers you. Check it out and see if we are not right in our thesis:

01. Products for everyone

We already mentioned it above, but we repeat it again: in Loan Sim, there are six types of loans available to you, being very difficult not to find one to call yours. This variety, in turn, has a reason: the company is 100% focused on the Brazilian public and knows exactly what to offer for each situation of financial need. In this way, no one can say that they did not find what they needed on the platform.

02. Credit for negatives

Are you negative and, because of this, you cannot get credit in any institution? So you still haven't tried to simulate this financial aid in Serasa eCred, because no is accepted there. For the company, this story of “those who are negative cannot get a loan” is completely a thing of the past! Whichever modality you choose, you will have no problems obtaining your credit if you have a restriction on your CPF, since, in line with what we said above, the Serasa eCred Loan welcomes those with negative credit very well.

03 Lowest market rates

Considered the largest credit marketplace in Brazil, Serasa eCred is an online platform for comparing loan and credit card rates. This means that there you will find several options of companies that offer financial solutions for your specific case, being able, consequently, to choose the lowest rates available for you. Not bad, don't you agree?

04. Free and online simulation

Do you want to do a simulation on the Serasa eCred Loan without any commitment? So know that you can! Just enter the platform to simulate the money you want to take and, if applicable, contract your credit online 100%. This service is free, with no fee being charged – even if someone charges you for this, know that you are being the victim of a scam.

05. Unlimited simulations, without impacting your Score

And since we are talking about Serasa eCred Loan simulations, know that there are no limits to carrying out this procedure. And the best: they have no influence on your Score. Therefore, you can simulate your loan as many times as you want without fearing that this could harm you in any way because it will not!

06. Fast loan

Because anyone who has tried to take out a loan from traditional banks knows how time-consuming and bureaucratic the process can be. So this is obviously quite problematic, considering that most people, when applying for credit, need it almost urgently. Well, the good news is that, with the Serasa eCred Loan, no one is left in the lurch. So, if you are in need of money, know that there it goes quickly and directly into your bank account.

07. Easy payments

Because at Serasa eCred, your loan payments are very easy. In addition to being able to divide up to 48 months, you can anticipate your installments, getting a nice discount for it! In addition, in any situation other than with the company, it is important to know that the rules of the National Monetary Council guarantee the customer the right to full or partial early settlement with a proportional reduction in interest.

08. Indication of guarantors

So, another huge advantage of Serasa eCred is that, in the event that proof of income is not possible, it is also possible to register someone to be the guarantor of your loan. He needs to be a close person, such as father, mother, child or spouse (union by marriage or stable union), as he will participate in the contract, proving income or assets that will act as collateral. This way you will get better loan conditions.

09. Security and privacy

If you are told about Serasa Experian, you will know that they are referring to an extremely serious and respected company in the market in which it operates. Precisely because it works with clear security and privacy guidelines for its customers' data, it has become a leader in its segment. With this, when simulating and/or contracting credit with the Serasa eCred Loan, you can rest assured that you will know that the process is completely safe and guarantees total data protection.

10. Taking out loans without bureaucracy

Finally, the last advantage of the Serasa eCred Loan is that you can hire it without any bureaucracy. Because it occurs online, free of charge, without having to prove income and without obstacles for those who have a negative name, the loan application is extremely simple and easy. So how about knowing how to order yours?

How to apply for the Serasa eCred Loan

So, the answer to the question everyone wants to know has arrived: how to apply for the Serasa eCred Loan? So, let's find out?

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Spotify Credit Card: What is Spotify?

Spotify prepaid credit card allows you to have premium access to the platform, in addition to other benefits. Learn more here!

Keep Reading

BTG+ credit cards: find out about their advantages

Now that you know what BTG's digital bank is, it only remains to understand the advantages that BTG+ credit cards offer you. Check out!

Keep Reading

Discover the BV Visa Gold credit card

The Bv Visa Gold credit card allows you to make purchases and payments with savings and an international flag. Learn more advantages!

Keep ReadingYou may also like

How to make the first investment in Clear

Do you want to invest in the brokerage that has zero fees for all its products? So, check here how to open your account and make your first investment right now!

Keep Reading

5 loan options for commissioned servers

Taking out a loan can be quite interesting for anyone looking to buy a house, a car or even pay off debts. In this sense, there are many options for commissioned servers. Interested? Continue reading and check it out!

Keep Reading

Discover the Aliexpress credit card

Do you want a credit card that doesn't do credit analysis? One of the largest ecommerce platforms in the world, Aliexpress launched its card. Find out more!

Keep Reading