Cards

More advantages of the Superdigital credit card

There is no shortage of advantages to the Superdigital credit card, such as exemption from annual fees, no interest rates, among others. In this text, you will discover what are the other benefits that this product offers you.

Advertisement

Superdigital Card

If there were more advantages that were needed to be convinced once and for all to have the Superdigital credit card, then, after this text, you will have no more doubts. Surely, by the end of your reading, you will be ready and determined to have the financial product that will make your life easier. Want to bet?

Or if you are already sure that this card is for you, apply for the card now by downloading the Superdigital application and opening your account in less than 10 minutes.

Find out how to apply for the Superdigital card

Our team separated the step by step to teach you how to apply for this card

But before we talk about the other advantages of this credit card, it is good to remember what are its benefits already known to us. So let's go!

Advantages of the Superdigital credit card

One thing is for sure: there is no shortage of advantages on the Superdigital credit card. In addition to those already known, such as not needing proof of income, as well as not having to consult the name at the SPC/SERASA, there are others that are unknown to the general public, but that make a huge difference in our daily lives. Let's see what are they?

1. No proof of income

Imagine a self-employed person who does not have proof of income and having their credit card application always refused because of this? Situation, to say the least, unpleasant, isn't it? But that changed with Superdigital! Thanks to the bank, you can get your card without having to prove your income.

2. Without consultation with the SPC/SERASA

As mentioned before, another great advantage of Superdigital is the approval of your credit card without consultation with the SPC/SERASA. With this, people who have restrictions in their name and who, because of this, are unable to benefit from banking services, such as the card, have a new opportunity with Superdigital. Indeed, the bank came to serve everyone!

3. No annual fee

A very common practice of traditional banks is to charge an annual fee for their credit cards. However, what is customary for some is not the rule for others. In the case of the Superdigital credit card, it does not charge you an annual fee to use it as long as you spend at least R$500 per month. If you don't manage to spend that amount, you'll need to pay a monthly fee of R$9.90, which, let's face it, is a very low cost compared to all the benefits that this card offers you.

4. No interest or fees;

Although the name is misleading, the Superdigital credit card is actually a prepaid product. This means you must fund your account to use it. Therefore, you make your purchases on credit, but the amount spent is deducted as if it were a debit. Exactly for this reason, the card does not charge you interest or fees, since there is no possibility of you getting into debt with it.

5. No limit on purchases

That's right: the Superdigital card does not impose a limit on purchases, leaving it up to you how much you want to spend. The reason for this is directly related to what we said above: since it is a prepaid card, you can use the amount you deposit on it. With this, the limit of the card will depend on a single factor: what your pocket can afford in cash.

6. Don't leave your account negative

Another 100% benefit linked to the fact that it is a prepaid credit card, this Superdigital product does not leave your account negative. Thus, for those who do not have much financial control, this card is a great way to benefit from credit without losing track of their expenses.

7. Receive and transfer money to any bank

Although it has a single free money transfer per month to any bank, the rest being subject to fees, this is an advantage that stands out a lot compared to conventional credit cards. After all, in these cases, to use the money from your limit, you would have to pay stratospheric interest. Better not, OK?

8. Withdraw at the Banco24Horas Network ATMs

Finally, this advantage of the Superdigital credit card also stands out compared to conventional products. This is because, although there is a fee for withdrawing money from the Banco24Horas ATMs, the cost will be much lower if you used a traditional credit card. Be sure of this!

Did you think that the advantages of the Superdigital credit card are over? Calm down there's more! We couldn't leave out of our list SuperDigital MEI Zero, considered the best choice for individual microentrepreneurs. Check it out!

SuperDigital MEI Zero

Launched in 2019, SuperDigital MEI Zero is perfect for those with CNPJ as MEI. In this case, it is possible to open a PJ account without the bureaucracies that exist in traditional banks, doing this through the Superdigital application itself. Easy and practical!

Regarding its benefits, they remain pretty much the same when compared to the personal account. Also, as with an individual, the legal entity account does not require proof of income from you. Also, there is no consultation with the SPC/SERASA and no credit analysis.

The biggest difference is the fact that SuperDigital MEI Zero is a free account, but it charges for each withdrawal or transfer made. If you prefer, there is the possibility of paying a monthly fee of R$16.90 to have two withdrawals and two transfers for free every month.

Whether you are an individual or a legal entity, the truth is that, with this gigantic list of benefits that we are showing you now, it is practically impossible not to apply for your Superdigital credit card. Therefore, do not waste any more time and request yours soon!

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Debt sale to securitization company: is it worth it?

Have you ever thought about selling debt to securitization companies? We will explain further this operation and if it is worth it for your financial life.

Keep Reading

Leader Card Review 2021

Leader offers great discounts and special payment conditions. But, is your card worth it? Find out in the Leader card review!

Keep Reading

Check out how to buy tickets through MaxMilhas with discounts of up to 50%

See this complete review and decide if buying a MaxMilhas ticket is the right thing to do. Check out all offers on services on this site

Keep ReadingYou may also like

Get to know Banese Real Estate Credit

Do you want to acquire the dreamed home of your own, but still don't have all the money you need? Read the post below and see how Banese Real Estate Credit can help you!

Keep Reading

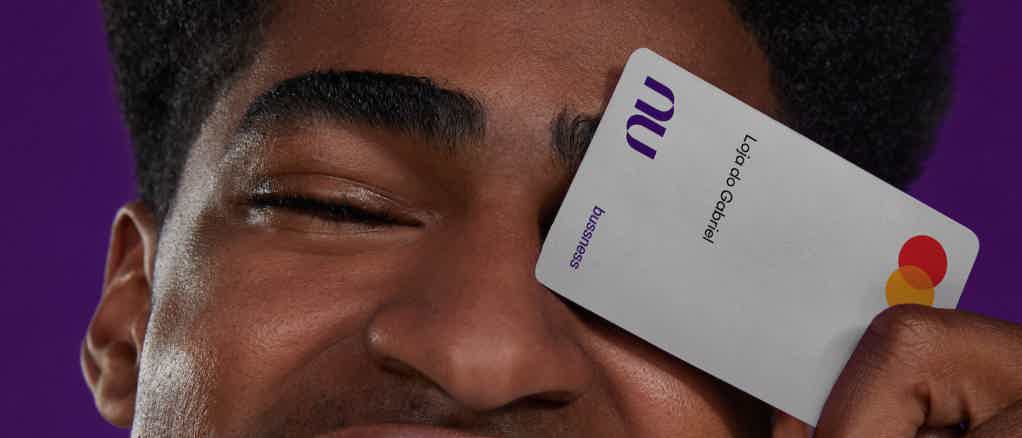

Discover the Nubank PJ Prateado credit card

The silver Nubank PJ credit card is Nubank's new bet to organize the company's finances and bring more advantages to customers. Continue reading and check out more information!

Keep Reading

Bankinter Classic Card: how to apply?

The Bankinter Classic card is a simple and practical way to shop with exclusive installments and other interesting benefits. Learn how to apply throughout this text.

Keep Reading