Cards

More advantages of the Olé Consignado credit card

When you read our previous article about the Olé Consignado credit card, did you think you had seen it all, since the benefits mentioned there were already good enough to convince you to apply for the product? Well, you're not done yet!

Advertisement

Discounts at Esfera partners and much more!

Well, what was good just got even better! As if the advantages and benefits of the Olé Consignado credit card mentioned in our previous text weren’t enough, there’s a lot more to come – believe it or not!

But before we talk about the other advantages of this credit card, it is good to remember what are its benefits already known to us. So let's go!

How to apply for the Olé Consignado credit card

The Olé Consignado credit card is international with the Visa flag. It has no annual fee and also offers discounts with Esfera partners. Find out how to apply here.

Discover the main advantages of the card

1. Pre-approved credit

Without a shadow of a doubt, what sets the Olé Consignado credit card apart from others is the pre-approved credit for retirees, pensioners and public servants. With this, this product has become a great facilitator for this public who, often, need credit, but cannot get it because of their negative credit rating.

2. Exclusive assignable margin of 5%

The Olé Consignado credit card also offers an exclusive 5% consignable margin. Thanks to this benefit, retirees, pensioners and public servants who have already used the 30% consignable margin will have an additional 5% to apply for the card.

3. Cheaper interest rate than the conventional card

Because it is a payroll loan product, the Olé Consignado credit card has lower rates than conventional cards. Since the minimum payment of the installments is guaranteed, as it is automatically discounted from the benefit or paycheck, there is no reason to charge high interest if the bill is not paid.

4. Approval without consulting SPC or SERASA

The last benefit mentioned in the previous text is about the approval of the Olé Consignado credit card without consulting the SPC or SERASA. As we said, with this benefit, there is no reason not to apply for your card, since anyone, as long as they are retired, pensioner or public servant, can obtain it.

More advantages of the Olé Consignado credit card

So, what other advantages would the Olé Consignado credit card have besides those already mentioned? The truth is that there are several! In fact, this product is unbeatable and offers its customers a huge variety of benefits. Check it out!

1. Olé Award Winning

Have you ever thought about applying for your Olé Consignado credit card and still earning R$$3,000? It may seem like a lie, but know that this possibility exists thanks to Olé Premiado.

About Ole Premiado, it is a raffle, in which each Olé customer receives a lucky number and enters into 2 monthly draws worth R$3,000.00, throughout the year. So, why not apply for the Ole Consignado credit card and try your luck? Maybe luck will be on your side!

2. Olé Advantages

In addition to Ole Premiado, there is also Olé Vantagens, which is a program in which you get discounts on your purchases when using the Ole Consignado credit card. However, be careful! These are not just any purchases, okay?

To get discounts, you need to shop at one of the bank's partners, such as Netshoes, Fast Shop and Zattini. In addition to these, you can also get discounts at stores, restaurants, airline tickets, among others. In other words, a world of options and benefits, without paying anything extra for them!

3. Transfer of the limit to the current account

You know those times when money is tight and having a little extra in your account would really help your finances? Well, with the Olé Consignado credit card you won't have to go through that anymore!

With it, you can transfer your card limit to your checking account to use however you want. As not everything is perfect, there are some fees charged for this operation, but, like everything at Ole, the prices are very affordable, precisely to make your life easier when you're in a tight spot.

4. International Card

You may not have expected this, but the Olé Consignado credit card is international, which means you can use it to make purchases abroad. Because it has a Visa or Mastercard logo, it is widely accepted in stores, which will save you a lot of headaches.

5. R$100.00 welcome

Which bank in Brazil will offer you R$100.00 when you sign up for their service? None, right? Well, you're wrong, because when you sign up for the card, you'll automatically receive R$100.00 in credit on your bill to spend however you want. Amazing, right?

6. Intuitive application

Nowadays, it is very difficult for someone to go to the bank to carry out banking activities, such as transfers and bill payments. With the internet and apps, all these functions can be performed online, which has made people's lives much easier.

As expected, with Ole, it would be no different. All transactions carried out with the card can be monitored through the app that Olé makes available to its customers. Simple, easy and accessible!

7. ATM withdrawals

In addition to the ease of use of the app, the Olé Consignado credit card allows you to make withdrawals from ATMs, especially those in the Banco24horas network. This is actually a very interesting and important thing to have, because you know that you won't be left high and dry when you need money quickly and conveniently.

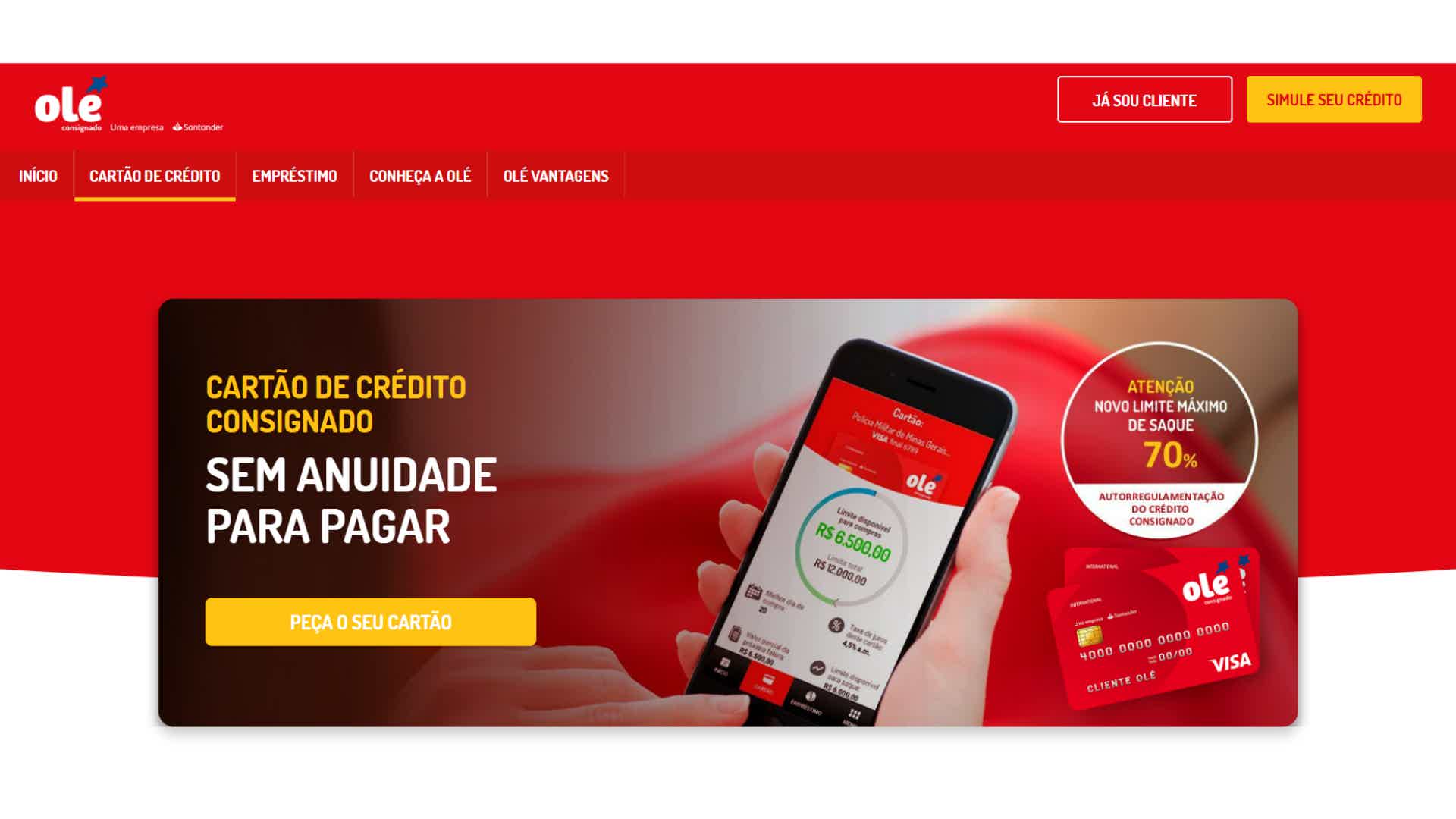

8. Card with no annual fee

When we talk about the Olé Consignado credit card, you probably suspected that there would be an annual fee behind all of this, because, after all, the benefits are many. Fortunately, this assumption is more than wrong!

As surreal as it may seem, we are talking about a credit card with no annual fee. Yes, you read that right! Considering that, on conventional cards, this fee can exceed R$100 per month, then there is no doubt that this is one of the great advantages of the Olé Consignado card. So, what are you waiting for to apply for your card?

How to apply for the Olé Consignado credit card

The Olé Consignado credit card is international with the Visa flag. It has no annual fee and also offers discounts with Esfera partners. Find out how to apply here.

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for a Geru loan

Learn how to apply for the Geru loan and other useful information about this loan, so you can get out of the red!

Keep Reading

Get to know the PagSeguro card machine

Get to know all the features offered by the PagSeguro card machine and see how it can be a great ally for your business!

Keep Reading

Relationship apps: best options for finding love!

Find love or a new friendship with our selection of the best dating apps. Check it out now!

Keep ReadingYou may also like

INSS table: see how the calculation turned out

The INSS Table changed with the 2019 Pension Reform. Now, the calculation is progressive and has some rules. Do you want to know how to calculate your rate and how much you can contribute? So, check out more information below.

Keep Reading

Discover the Finmatch loan

Do you have a micro-enterprise and need money to grow more? The finmatch loan can help you. Want to know how? Follow here!

Keep Reading

Central Bank may authorize the redemption of values forgotten in bankrupt banks

Since its launch, the Values Receivable System has assisted almost 26 million people with money forgotten in banks. Now, the Central Bank is studying to release the amounts forgotten in bankrupt financial institutions. See more here!

Keep Reading