Cards

What is the PagBank credit card limit?

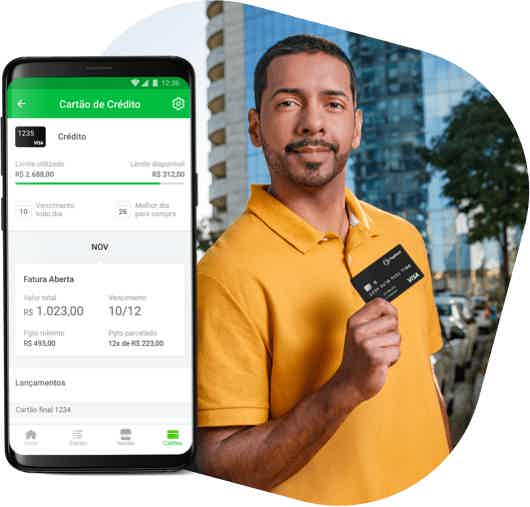

The PagBank credit card has a credit limit that can reach up to 100 thousand reais, according to the credit analysis of the customer's financial profile. With it, the client does not pay an annual fee, has international coverage and all the advantages of the Visa brand. Check out!

Advertisement

Zero annuity and limit of up to 100 thousand reais on a single card

The PagBank credit card limit may vary depending on the financial profile of each customer who requested the financial product at the bank.

Therefore, for various reasons, the credit limit may be lower than the customer is expecting. However, it is possible to increase the limit over time through the purchase history. Therefore, creating a relationship with PagBank is essential.

In this post, we'll tell you about the features of the card, as well as tips to increase your limit, which can reach a maximum of R$100 thousand.

So, continue reading and get to know the PagBank service.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Digital account and zero annuity |

How does the PagBank credit card work?

The PagBank card was developed for bank customers and for users of the famous and widely used PagBank machine. So it's a credit card that works like any other. That is, it has shopping functions, credit limit, installments and some benefits that come with the cardholder.

In this sense, the first thing that we must emphasize as a characteristic of the card is the international Visa flag, which allows the card user to make purchases inside and outside Brazil as he wishes.

In addition, in the case of purchases with higher values, we can make the installments in a simple way with the PagBank card. Customers also have the option of making payments with the balance of their own PagBank account.

Remembering that, with the PagBank card, we can subscribe to the digital platforms of Netflix and Spotify, in addition to being used to hire Uber.

But all this must be done within the limit of the PagBank credit card. Let's talk more about it right now!

What is the PagBank card limit?

Regarding the limit that the customer will have access to when applying for the PagBank credit card, it is analyzed at the time of ordering the card and after a credit analysis carried out by the bank itself.

Then, after this process, a limit credit amount will be established for you to spend as you wish. But what are the criteria for determining the PagBank credit card limit?

It's simple! The bank assesses whether the customer has any debt or financial irregularity. In addition, the client's income and account time are investigated. With this analyzed and other criteria, the bank determines the limit.

Therefore, the maximum limit that your card can reach is up to R$100,000.00 according to the amount invested. Or, if you carry out salary portability, your credit limit can reach 100% of your salary.

Anyway, each one receives a limit value depending on the amount invested or the monthly income.

How to increase PagSeguro credit card limit?

As we said initially, the PagBank card works similarly and almost identically to a common credit card from large financial institutions, that is, banks.

Therefore, if you receive a credit limit that you consider low, there are some common ways to increase this amount and have more purchasing power with your card.

Therefore, we can use our card on a recurring basis and make all payments on time. This way we avoid defaults or delays that harm your history.

Furthermore, the longer we are customers, the more credibility we gain and, consequently, more credit over time. Remembering that we can also increase our income.

Regarding the limit adjustment, you can access the PagBank app and click on the settings to adjust the credit limit you want to use per month.

Anyway, another way to increase the limit of the PagBank credit card is to contact the bank and make an appointment to try to reach an agreement to increase the limit for your card.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Classic Sicoob Card or Santander SX Card: which is better?

Decide between the Sicoob Clássico card or the Santander SX card and enjoy exclusive benefits, such as billing in installments. Learn more here!

Keep Reading

Inter PJ account: how it works

Find out how the Inter PJ account works without fees and digital 100%. This makes it easier to modernize your bank transactions and enjoy benefits.

Keep Reading

Get to know the Good Food program

Discover the Good Food program. It is an income transfer program in Paraná that helps families with food costs.

Keep ReadingYou may also like

How to apply for the Santander real estate consortium

Applying for your Santander real estate consortium is simple! Just make a call, go to a bank branch or, if you prefer, do the simulation online. See more here.

Keep Reading

How to unlock Santander SX card

Do you want to unlock your SX card to enjoy all its benefits? It's easy, fast and completely digital. Check it out here.

Keep Reading

Consult balance: NFP, FGTS and PIS 2021

If you want more information on how to check your FGTS, PIS and NFP balance, we can help you! Check here the step by step to access the information in an uncomplicated way and 100% online without having to leave your home. Know more!

Keep Reading