Cards

Lanistar Card or Santander SX Card: which is better?

Today we are going to show you the main differences between the Lanistar card and the Santander SX card. Both have special advantages for you. Read more!

Advertisement

Lanistar x Santander SX: find out which one to choose

With digital banks and fintechs, it has become increasingly easier to choose a card with less bureaucracy. However, there are so many options that it is common to get lost when making a decision. Therefore, it is important to know the cards and understand their differences, advantages and disadvantages. With that in mind, in today's article we will help you choose between the Lanistar card or the Santander SX card.

The two financial products offer special conditions for you depending on your financial reality. Read on to find out which one to choose!

How to apply for the Santander SX card

Find out how to apply for the Santander SX card. The card full of benefits from Banco Santander.

How to apply for the Lanista card

Want to innovate in your finances? Learn now how to apply for the Lanistar card: the 8-in-1 card.

| Lanistar Card | Santander SX Card | |

| Minimum Income | Not Informed | Account holder: not required Non-account holder: R$1,045.00 |

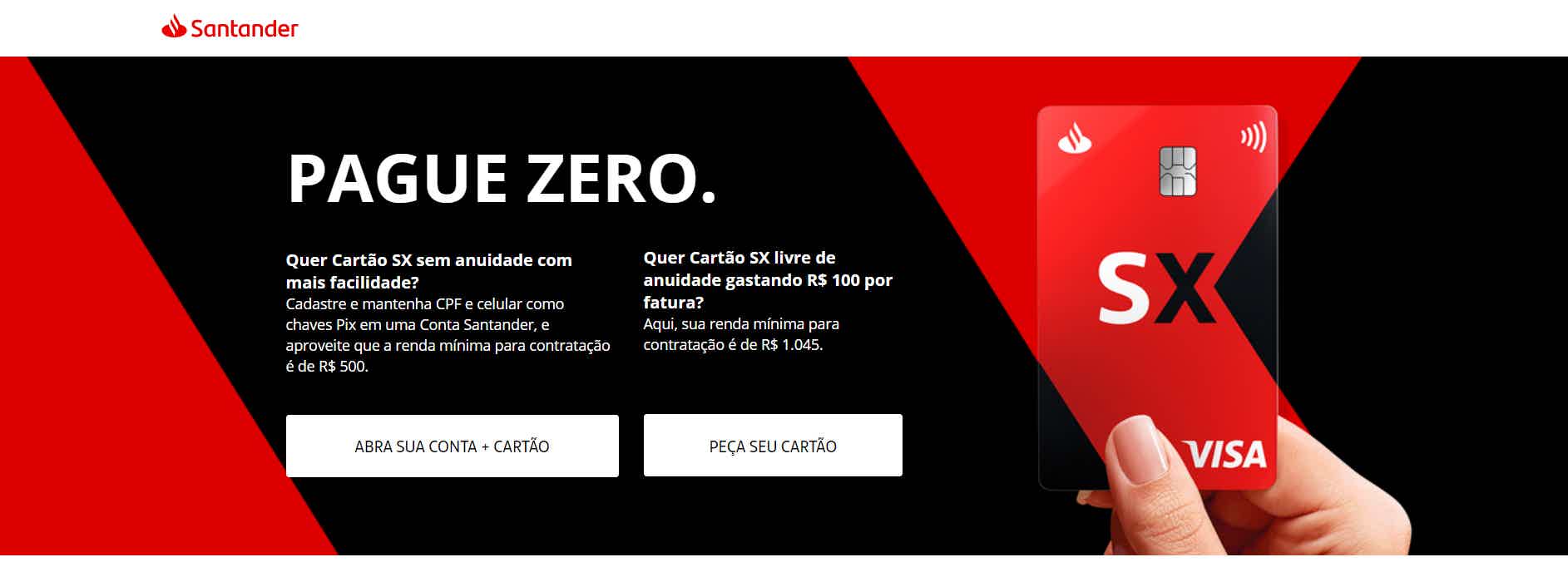

| Annuity | not informed | 12x of R$ 33.25 Exempt if you spend R$ 100/month or join the Pix system |

| Flag | MasterCard | Visa or Mastercard |

| Roof | International | International |

| Benefits | Polymorphic Card; CVV and expiration date change with each purchase. | Discounts with Esfera partners; Cashback at Shopping Esfera. |

Lanistar Card

The Lanistar card emerged from a fintech that promises to innovate in the financial market. Lanistar wants to offer a card that groups 8 in one. In short, in the app you can add all your cards and use only one. Your account works as a kind of digital wallet, which you can change cards at any time. In this way, the Lanistar card limit can reach very high values.

Thus, you must think that the card must not be very secure. On the contrary! The Lanistar card promises to be the most secure card in the world. Fintech promises security with a simple process: with each purchase, the Security Code and card expiration date change.

Therefore, for travelers, the Lanistar card is a great option. Since it is accepted in several currencies and it is also possible to exchange the exchange rate through the application. Furthermore, due to the Mastercard brand, Lanistar is accepted in several establishments. To specify, in more than 38 million establishments around the world.

Santander SX Card

The Santander SX card is Banco Santander's annual fee-free card. Typically, such a card is compared to digital bank cards. Because they have similar characteristics. In general, it is possible to do without paying an annuity by spending R$100.00 per month on purchases or by registering your CPF and cell phone as a Pix key in your Santander account.

In addition, Santander SX has a physical and online version. That way, you can do your online shopping with the virtual card quietly. All of this can be monitored directly by the Way app. The app lets you track your spending in real time and even control your card limit.

Together, it is still possible to withdraw money on credit. The amount goes straight to your next invoice. However, it is important to be aware. To hire Santander SX, you must prove a minimum income. Unless you are a Santander account holder. Otherwise, the required income is R$1,045.00.

What are the advantages of the Lanistar card?

First, the Lanistar card is polymorphic. Or sera, gathers 8 cards into one. So, you leave home with a credit card, but you have 8 options in your hand. In addition, it is possible to pay with debit, credit and even prepaid cards.

Another advantage is regarding the limit. The Lanistar card does not require a credit check. Yeah, the limit depends directly on the cards you register in the app. Thus, the credit card grows the limit as you add more cards to the wallet.

See more benefits of the Lanistar card:

- International coverage in several currencies;

- Pay nothing for transfers between Lanistar accounts;

- Monitor the card in real time through the application;

- Enjoy all the benefits of each associated card.

What are the advantages of the Santander SX card?

In summary, the advantages of Santander SX are related to rewards programs. Banco Santander owns Esfera. With it you can earn cashback at Shopping Esfera. In addition, it has several discounts with partner companies. In addition, the Visa brand itself offers benefits. Vai de Visa is a program that offers discounts in stores and restaurants.

The Visa flag also offers purchasing benefits. For example, if you buy an item, and soon after find it for a lower price, you can receive a protection value. All this for free and without registration. However, this condition only applies to items on the list of eligible goods for your card.

In addition, Santander also offers the Way app to help you control your expenses. With the app you can control your limit and save more and more time

What are the disadvantages of the Lanistar card?

The main disadvantage of Lanistar is that it is still in the testing phase in Brazil. In this way, there are still not many reports and tests of operation in the country. However, the usage fee abroad is very high and the card is very popular. So it's worth the test.

What are the disadvantages of the Santander SX card?

In short, the disadvantage of the Santander SX card is for people who are not Santander account holders. Because you need to prove income to acquire the card. Furthermore, if you do not spend R$100 per month or do not register a PIX key, you must pay an annuity.

Lanistar Card or Santander SX Card: which one to choose?

Finally, the two cards have different proposals. While Lanistar offers the option of joining 8 cards in a single digital wallet. Santander SX gives you a digital card option within a traditional bank. Therefore, it is necessary to evaluate and understand which best suits your reality.

In conclusion, if you still have doubts about which one to choose, in the recommended article below we talk about two other cards. Read more and discover the advantages and disadvantages of the Santander SX card and Sicoob Classic card!

Classic Sicoob card or Santander SX card

Understand here the differences between the Sicoob Classic card and the Santander SX card. Then find out which is the best!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Check out how to register for free to resell Hinode

Find out how to be a Hinode reseller. To do so, check here the requirements and the profile of those who work with resellers of this brand.

Keep Reading

Is buying financed house worth it?

Is buying financed house worth it? This is a question for Brazilians due to interest rates, but today we are going to help you decide. Check out!

Keep Reading

Discover the Mooba credit card

Are you interested in advantageous cashback and other exclusive discounts? So get to know the Mooba card and check if it's worth requesting yours!

Keep ReadingYou may also like

How do I apply for the LATAM Pass Internacional card?

Transform Your Financial Lifestyle: Apply for the LATAM Pass International Card. Enjoy free annual fees, discounts on tickets and a unique contactless payment experience. Request now and travel with exclusive benefits!

Keep Reading

Will Bank Card or Caixa SIM Card: which one is better?

A credit card can be the resource that will help you most to organize your financial life, as well as help you in any unforeseen situation that may happen. However, choosing a good credit card is what most influences when maintaining your financial health, isn't it? The Will Bank card or Caixa SIM card are great options for those who want lean cards with the main features for a more fluid payment routine. Learn more about it ahead!

Keep Reading

How to apply for express card

Do you want to buy clothes while gaining perks and benefits? So, meet the Express card. A partnership between the Express store network and Comenity Bank. See here for more details about it and how to order yours.

Keep Reading