Cards

Kabum credit card: what it is and how it works

With the Kabum credit card, you receive exclusive cashback and also participate in the Vai de Visa benefits program. Check it out here!

Advertisement

Kabum: installments in up to 24 installments

Without a doubt, the Kabum credit card has arrived to bring many advantages to its customers.

So, Kabum has been on the market since 2003 and today it is the largest digital store in the technology segment in all of Latin America! Thus, in addition to being a giant in its field, it joined forces with Banco do Brasil and Visa to create a quality financial product.

So, if you're interested in finding out more about the card, keep reading and find out if it's the best option for you!

| Kaboom | |

| Annuity | ZERO annuity |

| minimum income | On request |

| Flag | Visa |

| Roof | International |

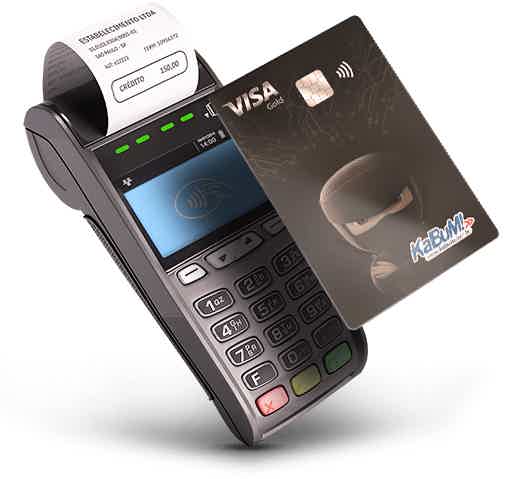

| Benefits | Payment in up to 24 installments, approximation payment |

How to apply for the Kabum card

The Kabum card uses approximation payment technology and you can even split your purchases up to 24 times. Find out how to order yours!

Kabum Advantages

Well, one of the main positive points of the card is that it has no annual fee, which is charged by most traditional credit cards.

Furthermore, you can pay your purchases in up to 24 installments. This way, you can take advantage of the best offers and not miss any opportunities!

Another interesting advantage is for game lovers. As Kabum is a big supporter of electronic games, it created an exclusive cashback benefit for this audience. So, when you make purchases over R$ 300.00 in the main online console stores, you get R$ 50.00 back to use wherever you want. Incredible, isn't it?

Kabum main features

As we already mentioned, the credit card has a Visa brand. Therefore, you can make purchases at thousands of accredited establishments and also participate in benefit programs, such as Vai de Visa.

Furthermore, its international coverage allows you to make purchases in Brazil and abroad, both in physical stores and online, in an easy and practical way.

Who the card is for

So, the card is ideal for those who want to make national and international purchases in thousands of physical and virtual establishments.

Furthermore, the free annual fee is a very interesting feature for those who don't want to worry about extra expenses.

Therefore, if you want to know even more advantages of the Kabum card, continue reading with our recommended content below!

Discover the Kabum credit card

The Kabum card has zero annual fees and international coverage so you can make purchases around the world in a much more practical way. Find out more here!

Trending Topics

Havan card or Blubank card: which one to choose?

Choosing between the Havan card or the Blubank card is complicated: both offer access to those with low scores. Check out the comparison and decide!

Keep Reading

The Invincibles: Know the names of 12 boxers who retired undefeated

Do you know who are the 12 boxers who retired undefeated?! If not, it's time to meet them. Read the text and learn more!

Keep ReadingYou may also like

Discover the Serasa app to check your score and negotiate debts

The Serasa app is the complete solution for taking care of your financial health. Access your credit score, negotiate debts and improve your financial reputation. Download now and transform your finances.

Keep Reading

Nubank or Caixa account: which is the best digital account?

Did you know that digital accounts make your finances easier? With them, all payments and management of your purchases are done online. The Nubank or Caixa account may be the solution you are looking for, as both have several exclusive features and much more! Want to know a little more about these two complete digital account options? Keep reading the post!

Keep Reading

Find out what LCA, LCI is and how to invest

Do you want to make an investment and not pay income tax? Then the best choice is LCAs and LCIs. Check out!

Keep Reading