loans

Jeitto Loan or Creditas Loan: which is better?

Are you in doubt about the Jeitto loan or the Creditas loan? The two options are quite different, but they can offer interesting advantages for you. Find out in this post how to choose between them!

Advertisement

Jeitto x Creditas: find out which one to choose

Jeitto loan or Creditas loan, after all, which one to choose? If you have this doubt, this comparison post can help you make a good financial decision!

In summary, the loan market is huge, and when searching for yours, it is common to be in doubt between two or more options.

| Jeitto Loan | Credit Loan | |

| Minimum Income | not informed | not informed |

| Interest rate | not informed | From 0.99% per month |

| Deadline to pay | Up to 16 months | Up to 240 months |

| release period | Uninformed | Uninformed |

| loan amount | Uninformed | Up to R$ 3 million |

| Do you accept negatives? | Yes | Uninformed |

| Benefits | Discount when paying in advance Process 100% digital | Higher credit amount Accept goods that are not paid |

How to apply for a Jeitto loan?

If you already know and like this option, see here how to request it!

After all, taking out a loan is a big commitment and one that should be taken seriously, as you will spend a good few months paying it off. That way, it's important that this decision is well thought out so as not to harm your finances.

In this sense, to help you make the best decision, we separate in this post a complete comparison between the Jeitto loan and Creditas so you can choose better!

Continue reading and check out the comparison.

Jeitto Loan

So, to get our comparison off to a good start, let's take a closer look at what the Jeitto loan is, how it works in practice and what features it has.

Therefore, Jeitto is a loan platform that was created in 2016 in order to help several Brazilians to have an extra credit every month to pay some basic bills.

To do this, it allows everyone who enters its platform to request a loan from R$ 150.

At first, the amount itself is low compared to other personal loans, but Jeitto does it for a good cause.

The company seeks to offer this amount as an extra credit that the person can count on in an emergency to help pay their bills.

Thus, it is possible to have an extra breath in the month. In addition, by taking out the loan and paying it before maturity, Jeitto can increase the loan limit for you.

That way, you can start borrowing R$ 150 today and in a few months you will be free to borrow R$ 500 or more!

Jeitto does this as a way to help people access credit, but without compromising their finances, thus becoming a great option for those who need to take out a loan, but are afraid of the debt that can be created.

Credit Loan

Now, let's take a look at how the Creditas loan works and what its main features are!

In short, Creditas is a company that offers secured and payroll loans to several Brazilians. The guarantee modalities that he works with are the guarantee of property and car.

In this way, anyone who has a property or vehicle in their name, even if it is not paid off, can take out a loan from Creditas and have access to high credit values.

For you to have an idea, only in the loan with vehicle guarantee, it is possible to borrow up to R$ 150 thousand and transform 90% of the value of your car or motorcycle into credit.

On the other hand, in the loan with property guarantee, you can reach even higher values. Here it is possible to borrow between R$ 50 thousand and R$ 3 million and transform up to 60% of the property value into credit.

And the best part is that Creditas offers a good loan repayment term. By placing your car as collateral, you can pay off the loan in up to 60 months.

By putting your house or apartment as collateral, you can pay off the loan in up to 240 months.

And with the payroll loan, you can access up to R$ 70 thousand of credit and pay it off in 60 months.

Finally, know that the interest rate that Creditas applies is one of the lowest on the market. Here you can get your loan paying from 0.99% per month.

What are the advantages of the Jeitto loan?

Certainly, knowing the advantages that a loan can offer is one of the most important points to know when searching for good credit.

So, let's start looking at the advantages of taking out a Jeitto loan. First of all, we must highlight the fact that the institution is one of the few credit companies that accept negatives.

Thus, even with the CPF restriction, Jeitto manages to approve 3x more than other companies. That way, you can borrow money.

Another positive point is that as you borrow, Jeitto can increase your available credit limit. Thus, by creating a good credit history with the company, you can access this advantage more.

What are the advantages of the Creditas loan?

Now, looking at the advantages of the Creditas loan, we can already highlight the low amount of interest applied, making you pay a fairer installment amount.

In addition, the high credit values associated with the longer payment period are also a great advantage of the company, which allows you to apply for the loan online 100%.

That way, you won't have to face queues or worry about traffic when you want to borrow money. So, just enter the Creditas website and make the loan there.

Finally, even if the loan is secured, you can still use your asset normally while it lasts.

What are the disadvantages of the Jeitto loan?

In addition to the advantages, it is also essential to note the negative points that the two loans have.

Therefore, a major negative point of the Jeitto loan is its low credit value, which even has limited use.

Thus, when borrowing, you will only be able to pay consumer bills, recharge your cell phone or buy digital services, such as Uber and Netflix.

Also, Jeitto Loan does not disclose its interest rate on its website. In this way, to find out about it, you will need to get in touch and start the hiring process to find out what rate is applied.

What are the disadvantages of the Creditas loan?

On the other hand, Creditas also has some disadvantages in its loan. At first, the biggest one is the fact that it only offers secured or payroll loans.

This means that the financial service offered by the company is limited to being requested only by people who already have an asset in their name or are CLT employees.

In addition, despite the fact that the loan is online, its process is still bureaucratic, since it involves more steps, such as the evaluation of your asset.

Finally, anyone who wants to take out a vehicle loan needs to know that the company only accepts cars that were manufactured from 2010 onwards. Thus, vehicles made before that year are not accepted for the loan.

Jeitto loan or Creditas loan: which one to choose?

In summary, the Jeitto loan and the Creditas loan are two very different options that serve different audiences.

In this way, to know how to choose between them, it is essential to do a self-observation and know what you need to achieve your goals.

Therefore, if you are a person who already has assets in your name and would like to take out large loans that can be paid off in a longer period of time, the Creditas loan may be a good option.

Thus, here it is only necessary to pay attention to the requirements that the company may have in relation to the state of its property.

On the other hand, if you are a person who is negative, who has difficult access to credit or who just needs to pay simple bills in the month, the Jeitto loan can already help.

And the best part is that it is a platform that thinks about your finances. That way, the proposal offered will always be something you can afford without major problems.

But if, after knowing more about the two options, you are still in doubt, it may be interesting to know other loan options for you to apply for.

Therefore, in addition to the Jeitto loan or Creditas loan, you can check in the post below two more credit options and their characteristics for you to know and, who knows, apply for!

SIM loan or Geru loan?

Learn more about these two options and find out which one is best for your financial life!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

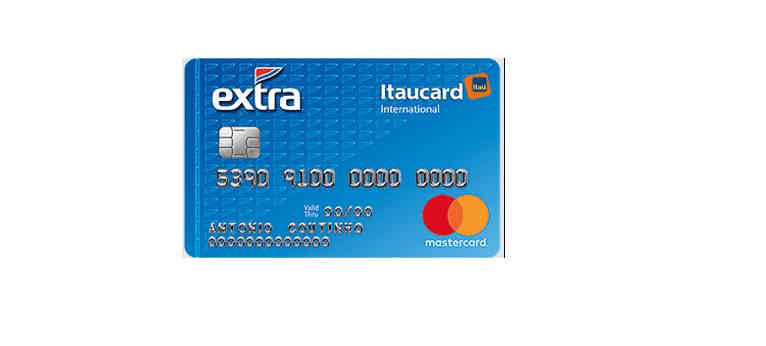

Discover the Extra Itaucard 2.0 card

Check out the advantages and disadvantages of the Extra Itaucard 2.0 card, the benefits and understand if it is worth requesting yours!

Keep Reading

BMS personal loan: what is BMS?

Do you already know the BMS loan? It is a fast and secure credit modality. So keep reading because we'll tell you all about it!

Keep Reading

How to apply for the Pan Mastercard International card

Find out how to apply for the Pan Mastercard Internacional card. It has all the advantages of the Mastercard brand and is also international.

Keep ReadingYou may also like

Get to know the Brazil Aid benefit

The social program Auxílio Brasil has the power to help countless families in situations of poverty and extreme poverty in the country. Read the post and understand all about the benefit!

Keep Reading

Discover the Bankinter Platinum credit card

The Bankinter Platinum credit card is a Portuguese financial product that offers many benefits to its customers, such as contactless payment and exclusive insurance. Do you want to know more about him? So read this post and check it out!

Keep Reading

Discover the Will Bank Basic card

With the Will Bank Basic card, you are exempt from annuity and administrative fees, have access to the Mastercard benefits program and guarantee a free digital 100% account. See more here.

Keep Reading