loans

Inter Consigned Loan or C6 Consig Loan: which is better?

Choosing a loan can be a daunting task. Therefore, today we are going to show you the advantages of the Inter payroll loan and the C6 consig. Read on, find out the details and find out which option is best for your financial situation!

Advertisement

Inter Consignado x C6 Consig: find out which one to choose

If you are looking for the best payroll loan, today we will help you. You will know the Inter consigned loan or C6 conseg loan. Therefore, as they are payroll loans, they are intended for an exclusive group of people.

Basically, Inter payroll offers fair interest rates and exclusive conditions. That is, you have personalized service to apply for your credit. In addition, like most payroll loans, installments are debited directly from your benefit.

Speaking of the C6 consig, it works in a very similar way. This is because the loan is also intended for retired people and INSS pensioners, or public servants. As well as offering fair rates to your customers.

In this way, in today's article we will show you all the advantages and disadvantages of each one. Read more and see which one to choose: Inter payroll loan or C6 consig loan.

How to apply for the Inter payroll loan

We will show you step by step how to apply for Inter Consignado!

How to apply for the C6 payroll loan

Want to find out how to apply for the C6 payroll loan? Look here!

| Inter Consignment | C6 Consig | |

| Minimum Income | not informed | not informed |

| Interest rate | not informed | not informed |

| Deadline to pay | Up to 96 months | Uninformed |

| release period | Up to 3 working days | Uninformed |

| loan amount | depends on the benefit | depends on the benefit |

| Do you accept negatives? | Yes | Yes |

| Benefits | Team of experts to serve you Custom installments and rates for your case | fixed installments online hiring |

Inter Payroll Loan

First, let's talk a little about the Inter payroll loan. Like most payroll loans, it is intended for a specific group of people. In the case of Inter credit, it can be requested by:

- INSS retirees and pensioners;

- Federal civil servants;

- State civil servants;

- Military.

Therefore, the value of each installment is debited directly from the salary or benefit. Therefore, it is necessary to fit into these categories. In addition, the Inter payroll loan offers specialized consultancy.

That is, interest rates and the value of installments are established based on a series of analyses. In this way, the bank can offer you exclusive and much fairer conditions.

In fact, to apply for a payroll loan, you must have a consignable margin. That is, an amount available from the salary or benefit to debit the installments. This amount cannot correspond to the full benefit.

But the assignable margin went up by 5%. Therefore, values can get even higher and interest rates fairer.

C6 Consig Loan

The C6 Consig loan works in a similar way to the Inter loan. This is because it is also designed exclusively for INSS retirees and pensioners and federal civil servants.

In addition, with credit, the rates are personalized, that is, it takes into account your financial reality. From this, the bank stipulates conditions that match what you can pay.

By the way, the installments of the C6 consig loan are fixed, that is, the interest does not increase over time. That way, you avoid getting lost in the accounts over time.

Another thing is that the loan can be charged by bills. Therefore, it is very important to be careful to avoid fraud. Mainly, in order not to make payments on false bills.

What are the advantages of the Inter Consignado loan?

In general, the main advantage of the Inter payroll loan is the fact that it has different rates for each customer. In this way, interest rates are lower and are also specific to your financial reality.

Therefore, you can also choose the loan amount and the number of installments. That is, planning to find out how long you can pay off the credit. All this without even having to leave the house. For it can be resolved directly online.

Another advantage is that with payroll loans, the installments are debited directly from your salary or benefit. In that sense, you don't have to remember to pay or worry about even more debt.

In addition, the money from the Inter bank payroll loan falls into your account in up to 3 days. That way, you get paid quickly and can start planning how you're going to use that amount.

What are the advantages of the C6 Consig loan?

Like Inter consigned, C6 consig also has several advantages for you. First of all, we can mention the fact that it is a completely digital credit. That is, you don't need to leave the house to resolve and hire.

In this way, the application process is done directly over the internet. By the way, when sending the documentation, you can do it through your computer and cell phone.

As already mentioned, payroll loans are exclusive to federal civil servants, retirees and INSS pensioners. Therefore, the C6 consig can offer much lower interest rates, as the installments are debited directly from the salary or benefit.

Therefore, the bank already has a guarantee of payment of the installments and is able to offer better conditions.

In addition, it is common for some people to still prefer to resolve negotiations in person. And the good news is that C6 has banking correspondents throughout Brazil.

That way, if you need it, you can also go to the agency closest to you.

What are the disadvantages of the Inter Consignado loan?

A disadvantage of the Inter payroll loan is that it is intended for a specific group. In this sense, if you are not included in this group, it will not be possible to apply for credit.

In addition, there are some loans with immediate release. Therefore, for some urgent situations, the 3-day release may be very time consuming. Therefore, it is worth reviewing all conditions before hiring.

What are the disadvantages of the C6 Consig loan?

All in all, the C6 consig loan does not have a lot of information available online. As such, this is a disadvantage. For an online loan, it would be essential to provide all the necessary information.

In addition, it is also not possible to do a credit simulation on the website. To do this, you need to contact C6 and solve it on your cell phone. However, there is no platform on the site that allows the simulation.

Inter Consigned loan or C6 Consig loan: which one to choose?

Finally, both loans have advantages and disadvantages. For example, the Inter payroll loan has a very simple and less bureaucratic credit analysis. That way, the hiring process doesn't get stressful.

The C6 consig, on the other hand, is a 100% payroll loan online and super easy to hire. In this way, a great option for those looking for practicality and good interest conditions with great payment terms.

Therefore, just reflect on the pros and cons of each one and understand the best option for you. In any case, taking out a loan requires planning, so as not to get into even more debt.

If you still want to know some more types of loan before deciding, we will introduce you to two more. Access the recommended content below and get to know the SIM loan and the Geru loan now!

SIM loan or Geru loan: which one to choose?

Get to know the SIM loan and the Geru loan and find out which one to choose!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Santander SX Card Review 2021

Check out the Santander SX card review and see how to apply for this card without having to be a Santander account and also enjoy several advantages.

Keep Reading

Havan Card or Crefisa Card: which is better?

Havan card or Crefisa card? Both are great cards, but offer distinct advantages. Read the post and learn more about our comparison.

Keep Reading

Show do Milhão game: have fun with the famous question and answer game

Discover the Show do Milhão game and embark on a journey of knowledge and fun. With varied questions!

Keep ReadingYou may also like

Banco Best Personal Credit: what is it?

How about getting to know a personal loan that helps you realize your ambitions? So, see here the advantages of Banco Best Personal Credit and take out a loan of up to €50,000 without leaving your home. Know more!

Keep Reading

HASH11 or QBTC11: which is the best ETF?

In today's post we will talk about HASH11 and QBTC11. Both are ETFs focused on cryptocurrencies and can be a good start for anyone looking to enter this market. Interested? Check out!

Keep Reading

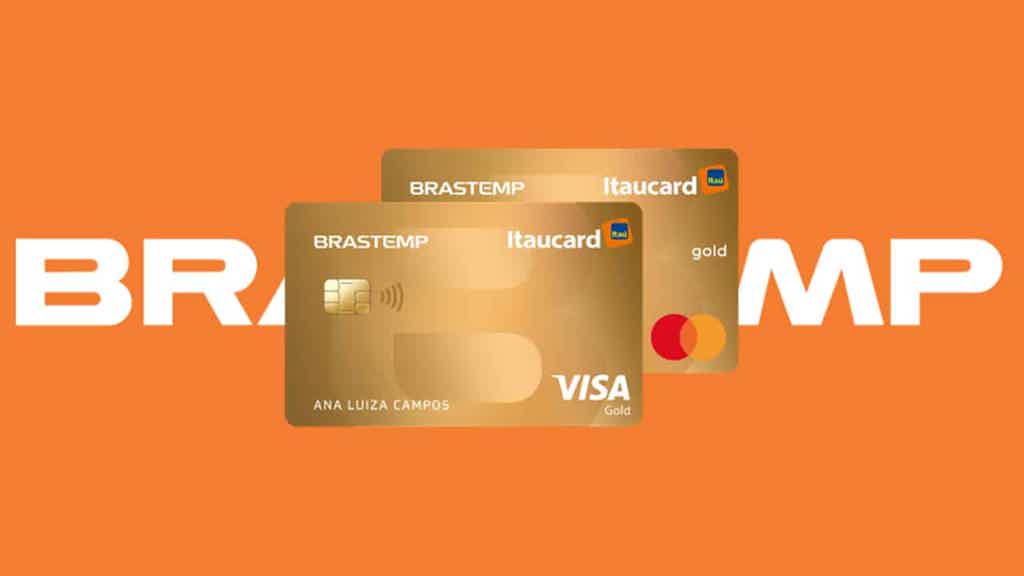

Discover Brastemp Itaucard Gold

Want a credit card that gives you a 5% discount on cash purchases and 3% off the gross value in points? Discover the Brastemp Itaucard Gold credit card.

Keep Reading