Government Aid

Fies or Pravaler: which is the best option?

As a university student, you need to understand the best financing option, Fies or Pravaler. Check out all these programs here and find out where to finance your studies!

Advertisement

Discover the best way to finance your graduation

If you want to get into college, but you can't afford the course, this analysis to decide between Fies or Pravaler is definitely what you need.

They are great alternatives for those looking to improve their lives, but don't have the money to pay for a university.

Understand how to sign up for Fies

Check out everything someone looking to be part of Fies should do!

To make the choice between Fies or Pravaler, you first need to understand what each one is. This way, it will be easy to decide which way to go.

Well, just read on, and everything you need to understand about Fies and Pravaler will be laid out.

What is Fies and how does it work?

Fies is a government program that takes low-income people to university. That way, you can work with what you like and earn more money.

Unlike other government programs, this one will make the person finance his studies and after completing the course, he will start paying for college.

That way, you can pay for the course without getting into debt, as Fies fees are lower than those of banks.

For students who meet the program requirements, this is undoubtedly an excellent alternative to study without having to worry about the bills.

Check out the hardest courses to pass

Discover here all the most popular courses with the highest cut-off points in Brazil!

What is Pravaler and how does it work?

Pravaler is a way to get more people to university. Incidentally, the program provides enormous practicality for the student to finance part of his college.

Many people have already managed to complete their course thanks to Pravaler, giving them more time to organize their finances and pay for their studies.

They help all types of students, from those who still don't know which course they are going to take, to those who are already enrolled and are looking for opportunities to finance their studies.

What are the advantages of Fies?

Now that you understand how these two financing programs work, check out the advantages of using Fies:

- There are more than 1,400 universities you can apply to with Fies;

- It is easier to meet the criteria for this program;

- It enters institutions of great quality through it;

- Pays a low annual interest rate.

Okay, these are the main benefits of Fies, but to decide between it and the other option, it's important that you look at Pravaler's positive points. So, read on.

What are the advantages of Pravaler?

Pravaler is a program where you will enter university and there are many advantages if you choose it over Fies. See the benefits below:

- Those who are at university or not yet can apply for funding;

- You don't need the Enem;

- The program is available year-round;

- More than 300 partner universities.

When you think of Pravaler's finance program, these are the main benefits. Keep reading and you will understand how to apply.

How to sign up for Fies?

Enrollment in Fies is open only twice a year, as they use the Enem score to select students.

That's right, you won't always be able to finance through Fies, you must first pass the selection process, which is based on the average of your Enem grades.

By the way, if you didn't take the last exams of this entrance exam, don't worry, you can use the score of any exam from 2010 onwards.

Afterwards, you only need to select two educational institutions and apply. This is the process for enrolling in Fies.

Okay, you've applied and been selected for funding at a university, what to do?

You will have to present some documents to prove that you really do not have the financial condition to pay for that course.

The income of the people in your family cannot exceed 1.5 minimum wages per person.

To find out if you meet this criterion, you just need to add up the income of all the people in your family and then divide by the number of people in the household, the amount must be less than 1.5 minimum wages.

How do I sign up for Pravaler?

The first step for you to be able to sign up for Pravaler is to access their website.

After that, you must register, informing all the requested data.

Thus, the company will carry out an analysis of your credit and as soon as it is pre-approved, inform the documents that Pravaler asks for.

It is worth remembering that to get financing at Pravaler, you must have a guarantor.

The guarantor of a person who will pay the debt if you do not pay the loan, is like a guarantee.

By the way, this is one of the reasons why Pravaler has one of the lowest monthly fees in Brazil, which can range from 0% to 0.99%.

University students can pay for college in two different ways:

- Pay while you study: in this case, traditional financing where you will start paying in the next month;

- Pay half of the monthly fee twice as long: in this case it will take longer to pay, but the monthly amount will be reduced.

In this way, you can choose the form that best fits your reality. Remembering that the number of installments may increase or decrease depending on your financial situation.

Fies or Pravaler: which is the best option?

Now you understand the details about Fies and Pravaler, but which one is ideal? It really depends on your reality.

Therefore, if you get Fies, where the interest rate will be lower, perhaps this is the best option.

However, if you cannot pay the monthly fee for your course, but also did not meet the Fies requirements, Pravaler is the correct option.

Therefore, analyze your situation, only then will you be able to find the ideal option for you.

On the other hand, you can study at a private university without paying anything.

This alternative is through Prouni, a scholarship program, which makes young people start at university, without having to worry about the course fee.

Interested in Prouni? Then check out the post below, where you will see the step by step to apply and get a scholarship.

Step by step to sign up for Prouni

Check out all the Prouni criteria, discover the types of scholarships and everything about how to apply.

About the author / Felipe Silverio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Will Bank Card or Banco Pan Card: which is better?

Will Bank card or Banco Pan card? Which one is the best? Both are international and with several benefits. Check out!

Keep Reading

What is the Social Energy Tariff and how does it work?

See how the Social Energy Tariff can benefit you and your family with discounts of up to 65% on your electricity bill!

Keep Reading

See how to earn up to 100% in profit with your own business

Check out the whole routine of the Hinode dealer now and find out how much he earns and how to start reselling this brand's products.

Keep ReadingYou may also like

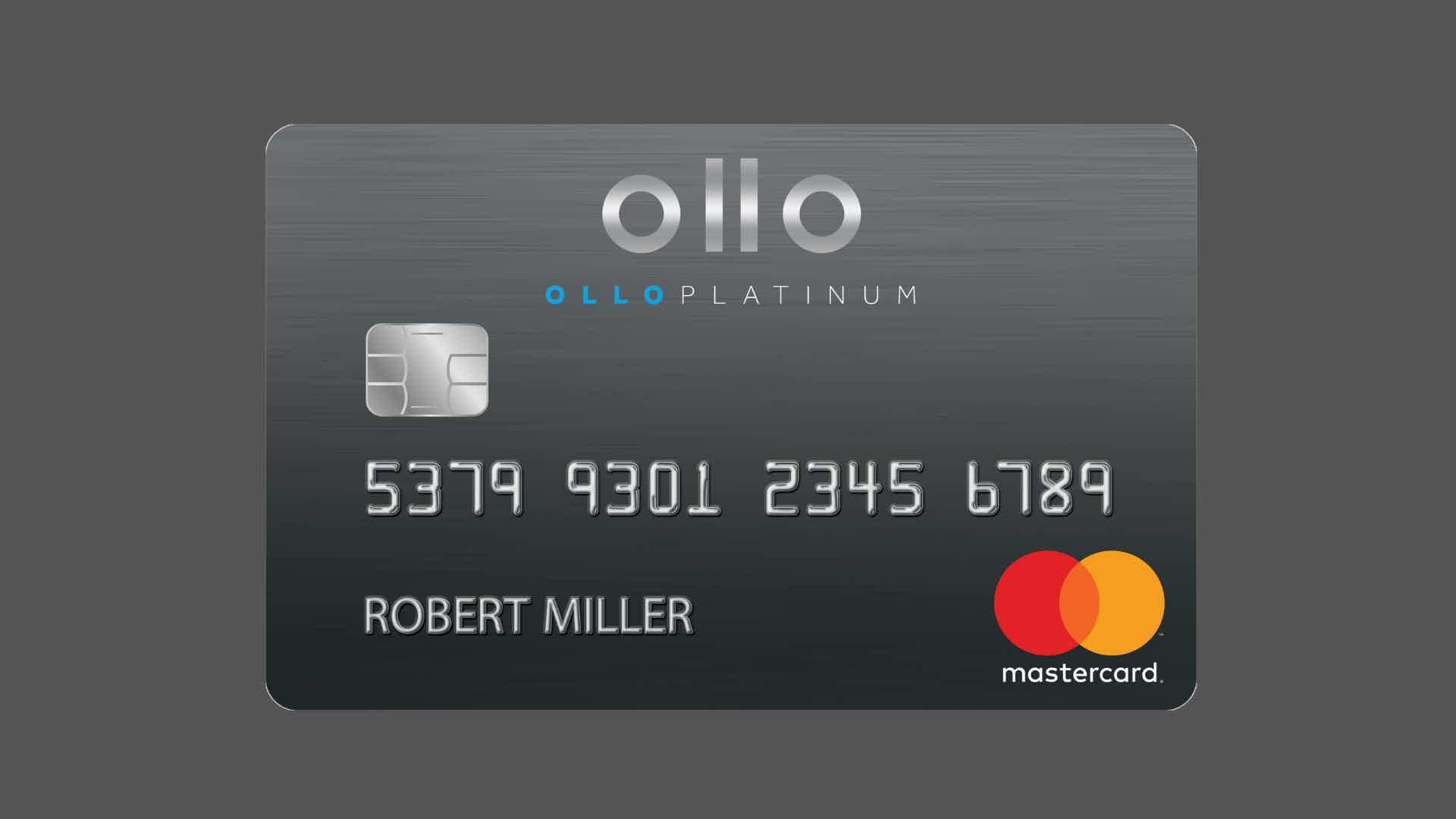

How to apply for Ollo Platinum card

The Ollo Platinum card has no annual fee, no foreign transaction fees or other hidden fees. Furthermore, it is international, and you can use it for your shopping or traveling. Want to know how to request yours? Check it out here!

Keep Reading

Magazine Luiza card: get to know the Magalu card

Discover the Magazine Luiza credit card, with no annual fee, with exclusive benefits from the Visa brand, payment in up to 24 installments and up to 2% of cashback. Learn more below.

Keep Reading

Meet investment robots

Want to invest and don't have time to research what are the best options? Because now you can invest with the help of investment robots, check out:

Keep Reading