Cards

Make a Santander credit card: what you need

Do you want to have a Santander card? In today's article we will show you all the card options and we will also show you how to order each one. Continue reading and find out!

Advertisement

Discover how to get a Santander credit card

Getting a credit card is a big responsibility. After all, this requires planning and financial maturity. Well, when choosing a card you need to check its conditions. In addition to understanding whether it really matches your financial life. With that in mind, today we're going to show you what you need to get a Santander credit card.

Furthermore, we will present each type of card offered and also show you what you need to apply for. Continue reading and discover the ideal card for you!

What do you need to get a credit card at Santander?

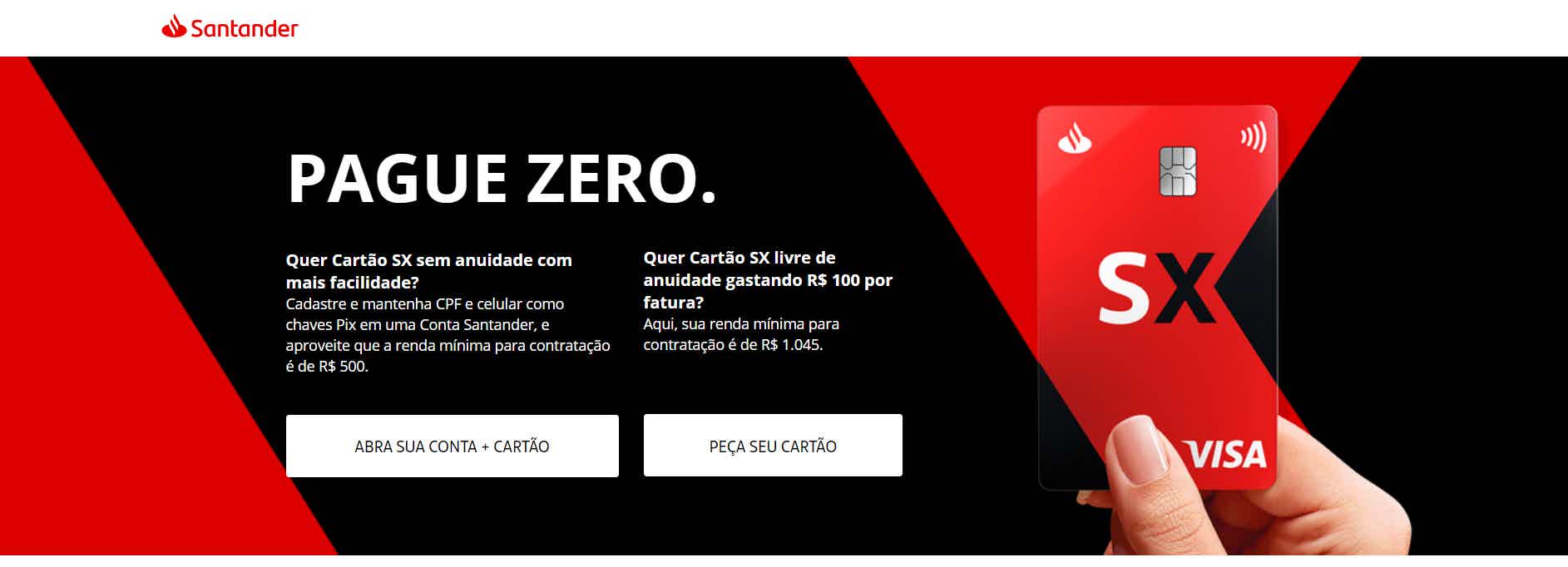

Santander SX

In short, the Santander SX card is the easiest to apply for. This is because you can place your order via the website or go directly to an agency. In this sense, to hire you must have a minimum income of R$1,045. The only way to not have the required income is to be a Santander account holder.

SX University

Requesting SX Universitário is simple, with the process similar to that of Santander SX. Furthermore, this card is special for those who study at universities affiliated with the bank. This is because it is a specific product to pay the monthly fee. In other words, the card provides an extra limit just to pay the college tuition.

123

Firstly, to request a 123 card, Santander has some requirements. For example, you must be a Van Gogh or Select customer. Or, account holders must prove income of R$2,500. Furthermore, if you are not an account holder you will need to prove income of R$4,000. The card can be purchased directly at a Santander branch.

Elite Platinum

The Elite Platinum card was designed for premium Santander bank customers. Therefore, you must have a proven income of R$7,000.00 or be a Van Gogh or Select customer. Additionally, the card has a 12x annual fee of R$46.50. To obtain the Santander Elite Platinum credit card, you must go to an agency. As well, it is possible to request online.

Unique Black

Well, speaking of premium cards, Unique Black is one of them. To obtain a Unique Black credit card, you must prove a high income. If you are a Santander account holder, you must have R$15,000 or be a Select customer. For those who are not account holders, the amount required is R$20,000. Additionally, the card has a 12x annual fee of R$83.00. In the end, requesting is very simple. Just request it on the website or go to an agency in person.

Amex Gold

Unlike the others, this card is the only one with the American Express brand. Amex Gold requires a minimum income of R$8000. Additionally, it has a 12x annual fee of R$45.83. Furthermore, the advantages of this card are mainly linked to travel. With Amex Gold you can enjoy exclusive benefits on your travels. Furthermore, to apply, just ask via the website or go to a Santander branch.

What are Banco Santander cards?

Santander SX

The Santander SX card is Santander bank's no-annual-fee card. However, the annual fee is only free for those who register a Pix key with the bank or, if they spend R$100 per month on the card. Additionally, the card gives access to some rewards programs.

The first is Santander's own, Esfera, which offers discounts to partners. The other is related to the card brand, which can be Vai de Visa or Mastercard Surpreenda. Furthermore, it is possible to control spending and card limits directly through the Way app.

| Minimum Income | Account holders: not required Non-account holders: R$ 1,045 |

| Annuity | 12x of R$ 33.25 Exemption from registering Pix key or spending R$100 monthly |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Discounts with Esfera partners |

How to apply for the Santander SX card

Request your Santander SX card online and have access to all the benefits

SX University

Firstly, it is worth saying that the SX Universitário card was created to help pay for college. Therefore, Santander teamed up with partner universities. If the customer studies at one of these universities, they can pay the monthly fee directly via card. Furthermore, the SX Universitário card has the same functions as the regular SX. In this sense, the only difference is the extra limit to pay for college.

| Minimum Income | not required |

| Annuity | 12x of R$ 33.25 Exemption from registering Pix key or spending R$100 monthly |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Extra limit to pay for university |

How to apply for a Santander Universitário SX card

Read this post and check out the step-by-step instructions for applying for the Santander SX University card.

123

The 123 card is Santander's product focused on points. In other words, if you are looking for a card to earn points and exchange points for discounts on travel and restaurants, this is the option. However, the card has some conditions. For example, in relation to the minimum income, if you are an account holder, you must have R$2,500 or be a Van Gogh or Select customer.

If you are not yet a Santander account holder, you must prove R$4,000. Furthermore, the annual fee for this card is 12x R$37.00. However, it is possible to get a discount on this rate. Just be an account holder and spend R$1,000 on purchases and the annual fee has a discount of 100%.

| Minimum Income | Account holder: R$ 2,500 or be a Van Gogh or Select customer Non-account holder: R$ 4,000 |

| Annuity | 12x of R$ 37.00 |

| Flag | MasterCard |

| Roof | International |

| Benefits | Every dollar spent multiplies your points on the card |

How to apply for the Santander 1|2|3 Gold card

The Santander card has exclusive advantages for you. Learn how to request it and find out!

Elite Platinum

Firstly, it is important to highlight that the Elite Platinum card was designed for Santander's premium customers. That is, customers with a higher income. In short, the main differentiator of the card is the score. Every 1 dollar spent is equivalent to 1.5 Sphere points.

Although the card has an annual fee, it is possible to get a discount in two ways: by being a Santander account holder, or by spending more than R$2,000 on purchases on the card. Furthermore, the card has contactless payment and can also be used to make purchases via cell phone.

| Minimum Income | R$ 7,000.00 or be a Van Gogh or Select customer |

| Annuity | 12x of R$ 46.50 |

| Flag | Visa |

| Roof | International |

| Benefits | 1 dollar = 1.5 Esfera points to use in the Esfera Point Program. |

Unique Black

The Unique Black card is also part of Santander's premium line. With it, every 1 dollar is equivalent to 2 Esfera points to be used in the Esfera Point Program.

| Minimum Income | Account holders: R$ 15,000 or be a Select customer Non-account holder: R$ 20,000 |

| Annuity | 12x of R$83.00. |

| Flag | Visa |

| Roof | International |

| Benefits | Benefits associated with the flag |

Amex Gold

The Amex Gold card has exclusive travel and restaurant benefits. It is a Santander premium line card and has the American Express brand. Furthermore, all payments can be made directly by contact.

| Minimum Income | R$ 8,000 |

| Annuity | 12x of R$45.83 |

| Flag | American Express |

| Roof | International |

| Benefits | Benefits associated with the flag. |

How to get a Santander SX credit card?

In short, getting a Santander SX credit card is very simple. If you are not a Santander account holder, you will need to prove income of R$1,045. After that, just request the card via the website or in person. Take the opportunity to request your Santander SX card using the button below.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the EasyCrédito loan

The EasyCrédito loan offers easy conditions and the lowest interest rates on the market. Learn more how to apply for your loan here!

Keep Reading

Get to know the Americanas personal loan

Meet the Americanas personal loan that has up to 70 days to pay and reduced interest rate. Check here all the advantages of this line of credit.

Keep Reading

How to know which is the best company for personal loan?

Want to know which is the best company for a personal loan? So keep reading and we'll tell you what to do to find out.

Keep ReadingYou may also like

Cheaper electricity bill eases the pockets of Brazilians in 2022

Due to the water crisis, the electricity tariff flag was at the red level, level 2 and weighing on the pockets of Brazilian families. Now, IBGE already announces a drop in the value of electricity bills since the first month of 2022.

Keep Reading

Who are the black billionaires of today? Meet now 30 names on the list!

Among today's black billionaires we range from artists like Beyoncé to Aliko Dangote, a Nigerian tycoon. Check out our list!

Keep Reading

Discover the Smiles Bradesco Visa Gold Card

If you like accumulating miles, this could be the card for you. You can earn up to 1.75 miles per dollar spent. Learn more below!

Keep Reading