loans

Superdigital loan or SIM loan: which one to choose?

Superdigital loan or SIM loan: Do you know which one is the best option when taking out a personal loan? Check the conditions!

Advertisement

Superdigital x SIM: find out which one to choose

To begin with, the Superdigital Loan or SIM Loan are two loan options that are among the best on the market! In this, they have very interesting proposals with various facilities and everything you need to uncomplicate your financial life!

So, to learn a little more about the pros and cons of these loans, we have brought a comparison for you to do an analysis! Check out!

How to apply for the Superdigital loan

Learn all about how to apply for this loan with amounts of up to R$25 thousand, low interest rates and up to 18 months to pay off the credit. Check out!

How to Apply for a Loan

Want to know how to apply for a quick and easy loan? So find out right now how to do it at Sim, the best on the market.

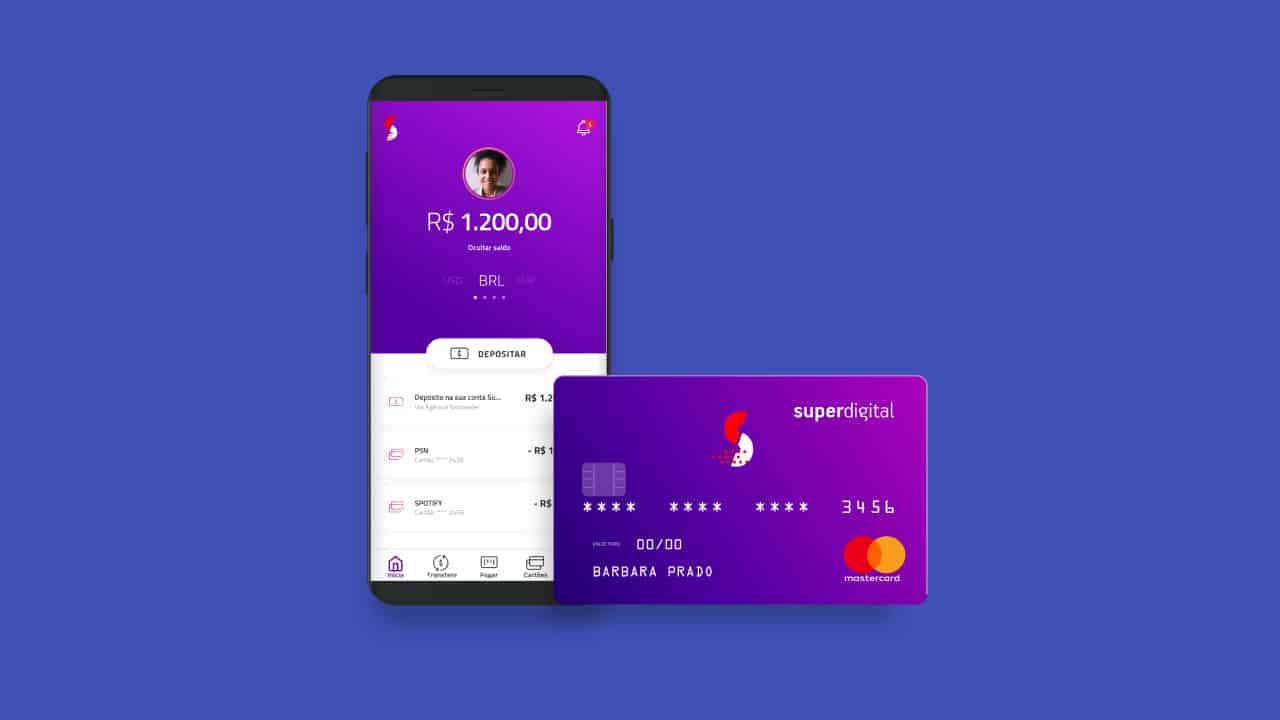

Superdigital loan

So, the Superdigital loan is a 100% digital loan, which has several facilities to help you have a more uncomplicated financial life!

And besides, it has all the security and transparency you need when taking out a personal loan!

You can also do the simulation in up to 02 minutes, being able to pay in up to 18 installments with low rates and amounts from R$500 to R$25,000.00.

Also, to apply for a Superdigital loan, you must be a Superdigital customer! So, just install the application, open a Superdigital account, register and make a deposit, and wait to enjoy all the advantages of the Superdigital loan!

SIM loan

Well, the Sim loan is a completely online loan modality. That is, you can simulate and contract your loan through the SIM website!

And besides, it is an ideal loan for people with bad credit, because, even if you have your name in the credit bureaus, SIM accepts bad credit.

It also has reduced interest rates, with its average rate being around 3.4% with no registration fee.

Just as, to enjoy other conditions, you can register a family member as a guarantor!

Therefore, Sim also has unique offers for those who need fast money, safely and with great conditions, such as having the money directly in your account in up to 3 business days!

What are the advantages of the Superdigital Loan?

So, the Superdigital loan has several advantages, including the term of up to 18 months to be able to pay.

And in addition, it has interest rates that can be reduced throughout the loan period, to reduce the risk of default!

It is also not necessary to have a bank account and you can receive directly through Superdigital!

And best of all, it is also available to freelancers and professionals! Therefore, the Superdigital loan is a great option if you are self-employed or a liberal professional and are looking for a secure loan with exclusive conditions!

What are the advantages of SIM Loan?

Well, the SIM loan also has several advantages, including the fact that it is a 100% digital loan, that is, you can simulate and contract the credit directly through the SIM!

And besides, it has an interest rate of about 3.4% and the company does not charge any fees for registration!

It is also an ideal credit modality for negatives, because, even if you have a dirty name, you can try to borrow from SIM!

And still at SIM, payments are facilitated, because you have up to 24 months to pay the loan installments.

That's because, if you pay the installments in advance, you can get an excellent discount from the institution! Too much isn't it?

Therefore, the SIM loan has great advantages for those who need quick money, safely and looking for discounts when paying the bills!

What are the disadvantages of the Superdigital Loan?

So, one of the biggest disadvantages of the Superdigital loan is the fact that you need to open a Superdigital account in order to apply for the loan!

This is because only account holders will be able to apply for this loan, bringing a little more bureaucracy to the process!

And in addition, some more exclusive conditions of the loan regarding interest rates, for example, can only be accessed after simulating the loan!

Therefore, before choosing to take out the Superdigital loan, evaluate with others in the market to find out if it really is the best option according to your financial situation!

What are the disadvantages of SIM Loan?

Well, one of the disadvantages of the SIM loan is the loan payment terms, which are around 24 months.

That's because there are loans on the market that offer longer terms with lower interest rates than the SIM loan!

Therefore, the SIM loan has several advantages, but the fact that it only has 24 months to pay off loans with amounts that reach R$25 thousand reais, may not be a good option! So, it is recommended that you assess your financial situation before hiring!

Superdigital loan or SIM loan: which one to choose?

Well then, the Superdigital Loan or SIM Two Loan are two loan options that have all the credibility, security, ease and accessibility that these financial institutions offer to their customers!

Therefore, make an analysis of the loans that are available to you in the market and see which one is the best option for you! And if you still have doubts, see a recommended content below about personal loans that we brought!

What is the best personal loan?

Do you know the best personal loan? Today we will show you how to know if he is reliable and 5 personal loan options! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

All about the BTG+ credit card

BTG+, BTG Pactual's digital bank, innovated by creating the BTG+ credit card, one of the best on the market in terms of cashback. Check out!

Keep Reading

Which bank makes online loan in 2021?

There are more and more good options for banks that make loans online, such as BMG and Inter. See 10 of the best financial institutions here!

Keep Reading

Best apps for editing Christmas and New Year photos!

We'll explore the best apps for editing Christmas and New Year photos. With the arrival of these festivities, we all want to immortalize the moments!

Keep ReadingYou may also like

Find out about the Finx Capital loan

Many options, better conditions and high chance of success? Yes, that's what Finx Capital offers. Want to know more?

Keep Reading

How to make money with crafts? Check the options

Securing an extra income in the comfort of your home can be simple and easy. For this, knowing how to earn money with handicrafts is very important, as you will have several job opportunities to choose from. Were you curious? Continue reading the article to find out more!

Keep Reading

How to apply for the Olé payroll card

If you belong to the category of civil servants, retirees or INSS beneficiaries, Olé Consignado can be a good alternative for your banking and credit activities. Learn more below!

Keep Reading