finance

Serasa eCred loan: the best for negatives

The Serasa eCred Loan brings together, on a platform, several online personal credit options with different financial institutions. Meet!

Advertisement

Ideal loan for those with name restriction

But who never went through that moment in life when the budget tightened and, with that, debts were created and not honored, which ended up dirtying your name with Serasa, right? Unfortunately, this situation is part of the reality of the vast majority of Brazilians. But there is a very easy way, unknown by many negatives, to improve their financial health: the Serasa eCred Loan.

So how about getting to know more about him huh?

How to apply for the Serasa eCred Loan

So, the answer to the question everyone wants to know has arrived: how to apply for the Serasa eCred Loan? So, let's find out?

Serasa eCred: the largest credit marketplace in Brazil

Before we delve into the loan issue, we need to introduce you to what Serasa eCred is, one of the brands of Serasa Experian, leader in analysis and information services for credit decisions and business support. Known by many thanks to the Serasa Score, which is nothing more than the famous score used by banks and retailers when analyzing whether or not to grant credit to you, the company goes far beyond that, you know?

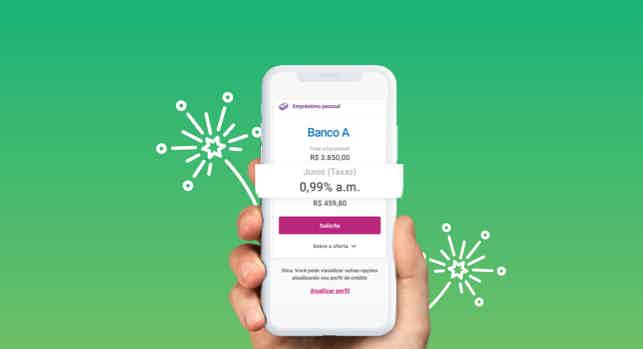

So it is! Among Serasa Experian's services, there is the largest credit marketplace in Brazil – and it is precisely there that the Serasa eCred Loan, the subject of our publication, is located. It is, in this case, the brand that bears the same name: Serasa eCred, an online platform for comparing loan and credit card rates.

Designed for the public whose name is negative, Serasa eCred is, as described on its website, like a virtual shopping mall, where you have access to loan and credit card offers from various partner companies such as banks, fintechs and other institutions. With the aim of offering the best experience and opportunity to its users, it is no wonder that the company has become the number 1 of those who want to obtain a credit to solve their financial situation

How does the Serasa eCred Loan work?

On the Serasa eCred platform, it is possible to take out a loan online, the so-called Serasa eCred Loan, quickly, conveniently and without bureaucracy. For this, you need to enter the company's website, where you will have access to the best offers made for your profile. Just answer a few initial questions and, in a few minutes, you will be able to compare rates and payment terms, choosing the most suitable for your pocket. All this 100% online and free, huh?

By the way, attention! When simulating your Serasa eCred Loan, keep in mind that there are different types of loans available to you. Are they:

01. Personal loan

Also known as “personal credit”, this is an option that is generally more suitable for different needs, such as debt payment, high-value purchases, investments, travel and much more. Generally speaking, you place your order and choose how you are going to use your money. That simple!

02. Loan with property guarantee

Do you own a home that has already been paid off? So how about putting it up as collateral? Although it seems like a rather radical idea to place your property as collateral, the truth is that, by doing so, you will get longer payment terms and the lowest interest rates on the market. In this case, it is possible to convert up to 60% of the value of your home, apartment, land or commercial property into credit. Not bad, don't you agree?

03. Self-employed loan

Are you self-employed and, because you don't have solid proof of income, you can't get a credit to call yours? Calm down, that changes with the Serasa eCred Loan! Documents that prove your banking activity and your good behavior as a credit payer can contribute to the approval of your loan application for self-employed.

04. Loan for self-employed negative

If applying for a loan for a self-employed person is not easy at all, imagine, then, when it comes to a negative self-employed person? Can you imagine that this person's life through traditional banks complicates a lot, right? But, again, the company brings the solution. For companies, this story of “those who are negative cannot get a loan for self-employed” is a thing of the past! With it, it is possible for a negative self-employed person to obtain credit to take care of their financial health.

05. Loan without proof of income

Make no mistake: it's not just the self-employed who can't prove income. For example: a student and an unemployed person, how do you do it? Well, it doesn't! However, as in previous situations, the Serasa eCred Loan also thought about this public. But it's important to stress: because you don't have proof of income, interest rates are higher!

06. Loan for negative

Finally, the Serasa eCred Loan also has a place for negatives in general. In this case, in addition to being a little more difficult to find options with low interest rates, the public that obtains credit is more restricted. For example, civil servants, pensioners and/or retirees can have their loan deducted from their payroll or benefit, which gives them differentiated conditions and facilities in obtaining a loan.

But then, let's be honest: with six types available in the Serasa eCred Loan, it's impossible not to choose one to call yours. Impossible! Because if you still have any doubts about it, the time has come to find out about some of the advantages that this excellent product that Serasa Experian offers its customers. So let's go?

Advantages of the Serasa eCred Loan?

As well as offering you a huge range of loans, allowing you to find the one that suits you, there are several other advantages of obtaining a Serasa eCred Loan. Check it out:

- Lowest rates on the market: as it is a platform, there you will find the lowest rates available to you, starting with 0.99% am Too good, isn't it?

- Free and online simulation: Do you want to simulate your loan without any commitment? Know that this service is free, with no fee being charged. But the best: made 100% online!

- Fast loan: with the Serasa eCred Loan, no one is left in the lurch. If you need money, know that there it enters quickly and directly into your bank account.

- Privacy and security: As we know, the Serasa eCred Loan is part of Serasa Experian, a leader in analysis and information services for credit decisions and business support. Thus, being the renowned company that it is, it would never put its name at risk by offering a service that does not guarantee the privacy and security of its customers' information.

So, you liked it, right? But know that there is more! Well, check out right now how to apply for your Serasa eCred loan in our recommended content below.

How to apply for the Serasa eCred Loan

So, the answer to the question everyone wants to know has arrived: how to apply for the Serasa eCred Loan? So, let's find out?

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Easy Prepaid Card

Learn right now how to request your prepaid Easy is one of the products that is conquering more and more space in the market.

Keep Reading

Learn about Leroy Financing

Find out about Leroy financing and how it can help you buy those materials and pay for services you need so much! Check out!

Keep Reading

Itaú loan without consultation with Serasa: did you know it existed?

Do you know the Itaú loan without consulting Serasa? If not, it's time to get to know this bank service that is little known to us.

Keep ReadingYou may also like

Superdigital or Neon: which is better?

Super digital or Neon? Both have a digital account and ZERO annual fee, but Superdigital has a monthly fee. Learn more about each one!

Keep Reading

What are the risks of revolving card credit and what to do to avoid falling into this trap?

The use of revolving card credit was one of the most sought after features in 2021 and reached the highest levels in the last ten years thanks to the fragility of the current Brazilian economy. However, this loan category has several disadvantages and can make the user even more indebted. Understand more here!

Keep Reading