loans

Is Agibank personal loan reliable?

Is the Agibank personal loan reliable? The fact is that the company has good credit conditions and seeks to have the best relationship with the customer. Check it out here!

Advertisement

Agibank personal loan: credit for negative borrowers with good payment terms and reduced interest rate

Many people looking for credit have been wondering whether the Agibank personal loan is reliable. This is because Agibank, since its foundation in 1999, has been constantly growing in the market, and has sought to offer quality services to customers.

However, it is very common for us to be worried and carry out research to find out if the financial institution we want to apply for a loan is really trustworthy. So, because of this, we are going to show you some information that will convince you of Agibank's reliability, such as its reputation, information about the loan and much more.

Therefore, follow this reading with us and stay up to date with all the important details about the Agibank loan. Check out!

| Minimum Income | not informed |

| Interest rate | From 1,79% per month |

| Deadline to pay | Up to 84 months |

| release period | Uninformed |

| loan amount | Uninformed |

| Do you accept negatives? | Yes |

Agibank Personal Loan is reliable: reputation on Reclame Aqui

When analyzing Agibank's reputation within Reclame Aqui from 2020 to the present day, we can see that the score is generally above 8.5, that is, it is quite positive according to customers.

In this sense, within the website we can see that more than 70% of customers have returned to do business with Agibank, regardless of any incident that may have happened.

Furthermore, 100% of complaints or requests for help were responded to and 90% of them were resolved by the Agibank team who are always ready to help all customers.

However, we can point out a recurring complaint from customers, which is mistaken calls. Anyway, if we take this and some other events away, the company's reputation is very positive, which reveals that Agibank personal loans are reliable.

Security: is the Agibank personal loan reliable?

Agibank is a Brazilian bank that was founded in 1999. In other words, it has more than 20 years of experience in the market and in many types of common services that a bank performs. Furthermore, he was a pioneer in transforming cell phone numbers into current account numbers. We bet you didn't know that!

But anyway, this means that the bank has been present on the market for years and has been offering very reliable services to more than 1 million customers over the years.

So, we can easily say that Agibank personal loan is reliable. Furthermore, to ensure the safety of its users, Agibank provides some tips:

- Do not share your passwords;

- Never write down your account details on paper that is easily accessible to other people;

- Do not pass on your personal data to strangers.

Therefore, these tips are important to avoid the frequent scams that many have fallen victim to, especially with the advancement of technology. Therefore, when using your account or making requests for loans and cards via computer or cell phone on the internet, it is always recommended to use a good antivirus, for example.

What are the benefits of the loan?

See now some of the main advantages of the Agibank personal loan:

Extended payment term

The first advantage of this personal loan is the number of times the customer who requested the loan has to pay the requested amount to Agibank. Therefore, by requesting an Agibank personal loan, the customer can pay in up to 84 installments.

No SPC/Serasa consultation

In addition, those who are negative can also request a personal loan, considering that no consultation is carried out with the SPC and Serasa.

Online request in a few clicks

Remembering that the entire request process can be done directly from the website, that is, without leaving home.

reduced rates

So, in relation to rates, Agibank informs that loan rates are one of the lowest that exist within the market currently. This is because the interest rate starts at 1.79% per month.

How to take out an Agibank Payroll loan online?

Anyway, making a loan is quite simple, directly through the website we can have access to various information regarding the loan that will help us in the process.

Then, follow the steps to apply for the loan:

- First access the Agibank website;

- After that, select the desired loan;

- Then, click on the request now option;

- Then fill in all the required information;

- Ready! Now just wait for approval.

Did you see? The Agibank personal loan is reliable and very easy to apply for on the bank's website. So, don't delay and see how to apply for this personal loan.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for VestCasa card

The VestCasa card is a product of the partnership between Credz and the VestCasa chain of stores, with an international card full of benefits.

Keep Reading

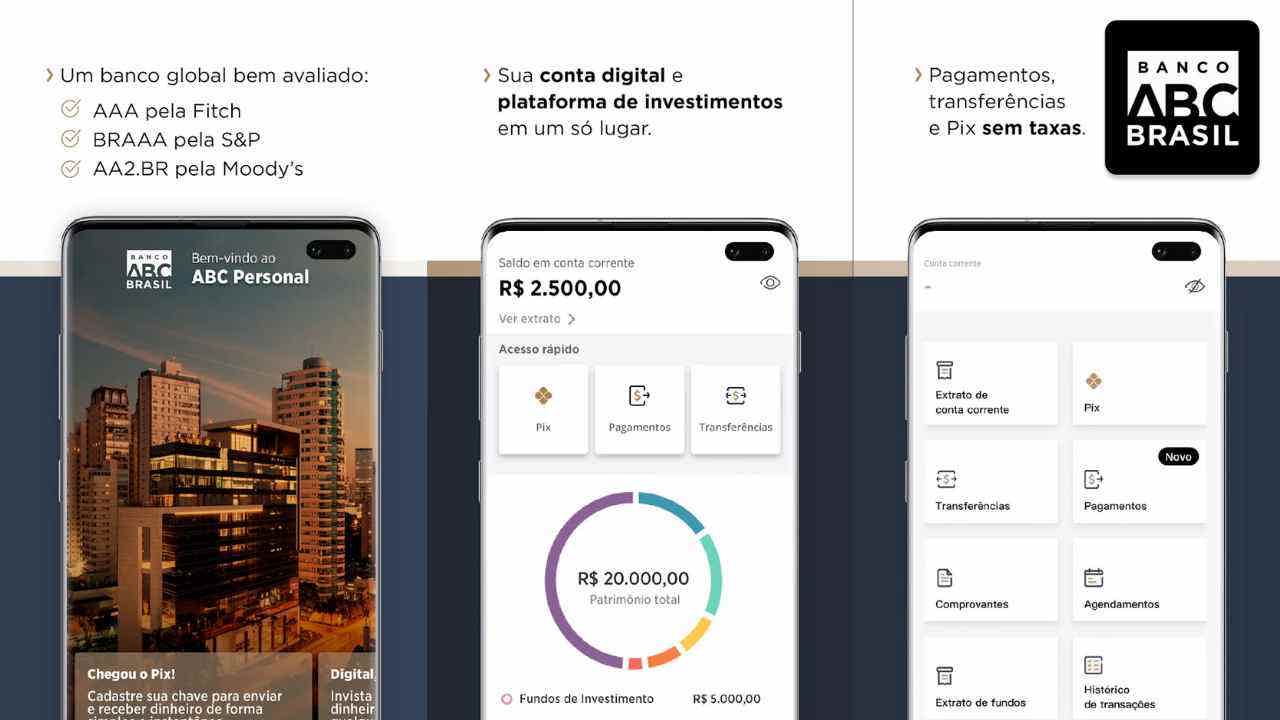

How to open an ABC Personal account

Learn how to open your ABC Personal account without leaving home. As well as take advantage of the opportunity to invest in fixed income funds without paying fees.

Keep Reading

How do you consult Vale Gas by CPF?

Find out how to consult Vale Gás through the CPF, see the benefit amounts, payment dates and if you are entitled to assistance, check it out!

Keep ReadingYou may also like

What types of financing are there?

Are you looking for a good financing option? Because here we explain what types are available and bring valuable information. Check out!

Keep Reading

What is the cost of living in Canada? Look here!

If you dream of living in Canada, you must first assess the cost of living to decide if it is within your expectations. Here you will find the main information regarding essential expenses. Continue reading to check it out.

Keep Reading

How to apply for the Unibanco Classic card

If you live and work in Portugal, how about acquiring the Unibanco Clássico credit card? It offers a great points and cashback program. Read this post and check out the step-by-step process. Let's go!

Keep Reading