loans

BMG emergency loan: one of the best for negatives

Do you know the BMG emergency loan? If not, then check out right now what this credit is all about, which is perfect for those with bad credit.

Advertisement

BMG emergency loan: one of the best for negatives

Anyone who has ever been negative in life knows how bad it is to try to apply for a loan to settle debts and receive a no for an answer from the financial institution. Unfortunately, this is the reality: those who need it the most, find the most obstacles to getting the loan that would help them so much. The good news is that this scenario is changing and that new types of credit are being created precisely with the aim of serving this neglected public, as is the case with the BMG emergency loan.

How to apply for the BMG emergency loan

The best emergency loan for those who are negative in the market.

If you still see yourself in the situation of having restrictions on your name, know that this text will help you. That's because we are going to talk precisely about this credit that is one of the best on the market for negatives, the BMG loan. Here we go?!

Get to know BMG bank

Founded on July 31, 1930 in the city of Belo Horizonte, Minas Gerais, under the name of Banco Crédito Predial SA, Banco BMG is a Brazilian multiple-service bank. This means that the financial institution offers several services to its customers, such as the loan in the title of this publication.

Throughout its history, Banco BMG conquered space in the market precisely because it was the first institution in Brazil to work with payroll loans. This event took place in 1998 and, since then, has become the focus of Banco BMG's business. In fact, in 2005, the company was the first bank to launch the payroll credit card, a product that is so well known and talked about in this blog.

So, as you can imagine, there is no doubt that the BMG loan for negatives is one of the best on the market. After all, we are referring to a serious and extremely consolidated financial institution, which is a leader in its “core business“, that is, in its main product, which are payroll loans.

So, what is the emergency BMG loan for bad credit?

So, let's answer the question that doesn't want to shut up: what is the emergency BMG loan for negatives? Well, as the name implies, this is an emergency credit offer with payment in up to 12 months and release of money into the applicant's account within 24 hours.

Ideal for those who are in a hurry, after all, there are times in life when plans do not go as they should, the BMG emergency loan for negatives is also an excellent ally for those who have restrictions on their name precisely because they do not consult with protection agencies to credit, such as SPC and Serasa. Good right? But do you think it's over? Calm down there's more! This type of loan still has cheaper interest rates than conventional ones on the market. Yes, what was good gets even better!

For those who did not yet know about the BMG emergency loan for negatives, know that this novelty appeared in November/2020 and is part of the Super Conta BMG offer package which, more than a current account without fees, guarantees access to several other services. Among them, the agile and automatic loan from the Dinheiro Extra credit line.

Who can apply for the emergency BMG loan for negatives?

One of the most important information about the emergency BMG loan for negatives is that, unfortunately, it is not for everyone. In this case, only people who fit the condition of retiree or pensioner of the INSS (National Institute of Social Security), public servant or employee of a private company associated with Banco BMG can request it.

This restriction, in turn, has a reason: as it is a payroll loan, the loan is discounted directly from the payroll or the INSS benefit. Therefore, how to release this type of credit if there is nothing to withhold at source, right? Those are the rules of the game unfortunately...

Advantages of the loan

Finally, we need to talk about the advantages of the emergency BMG loan for negatives. As we have already seen, the BMG Super Account and the Dinheiro Extra payroll loan, which is nothing more than the name given by the bank to this type of loan, are excellent alternatives for those seeking credit in the market during the new coronavirus pandemic ( Covid-19), but are prevented due to consultations with credit protection bodies, such as the SPC and Serasa.

So, so far, we already have two huge advantages: fast money and no restrictions on those who are negative. But what other advantages would there be? If you also want to know, then let's clear your doubt right now!

1. Lowest interest rate in the financial market

When compared to others on the market, the BMG emergency loan has one of the lowest interest rates, which start from 1.80%. For this reason, those who have more costly debts can take this credit to settle their debts, which is one of the best decisions for their financial life. That way, about more money for you at the end of the month!

2. Up to 84 months to pay

With the BMG emergency loan, you have up to 84 months to pay your debt and, with that, you can take out the loan with an installment that fits perfectly in your pocket. Oh, and attention: the value of the installments does not change over time. That is, you manage to organize yourself even better financially speaking, because you put that certain cost of credit in your budget and that's it. No more worrying about it!

3. Right to the BMG Card

Another great advantage of the BMG emergency loan is that it offers its customers the BMG Card, considered the best payroll-deductible credit card in the country. That is, it is your perfect opportunity for you who are negative in finally having a credit card to call yours!

How to apply for the BMG Emergency Loan?

Now that you understand what the BMG emergency loan is all about and, above all, what its advantages are, the time has come to find out how to apply. After all, you don't want to stay out of this, do you?

How to apply for the BMG emergency loan

The best emergency loan for those who are negative in the market.

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Vacancies G10 Transportes: how to check the options?

Check out the main open G10 Transport vacancies and work in one of the biggest companies in the industry that offers good benefits!

Keep Reading

Believe Who Wants: check out how to participate in this framework

Find out in this post how the Believe in Who Wants framework works in practice and check out the main advantages of participating in it!

Keep Reading

Digio card review 2021

Meet the Digio card review. It has international coverage, does not charge revolving interest and also has the benefits of the Visa brand.

Keep ReadingYou may also like

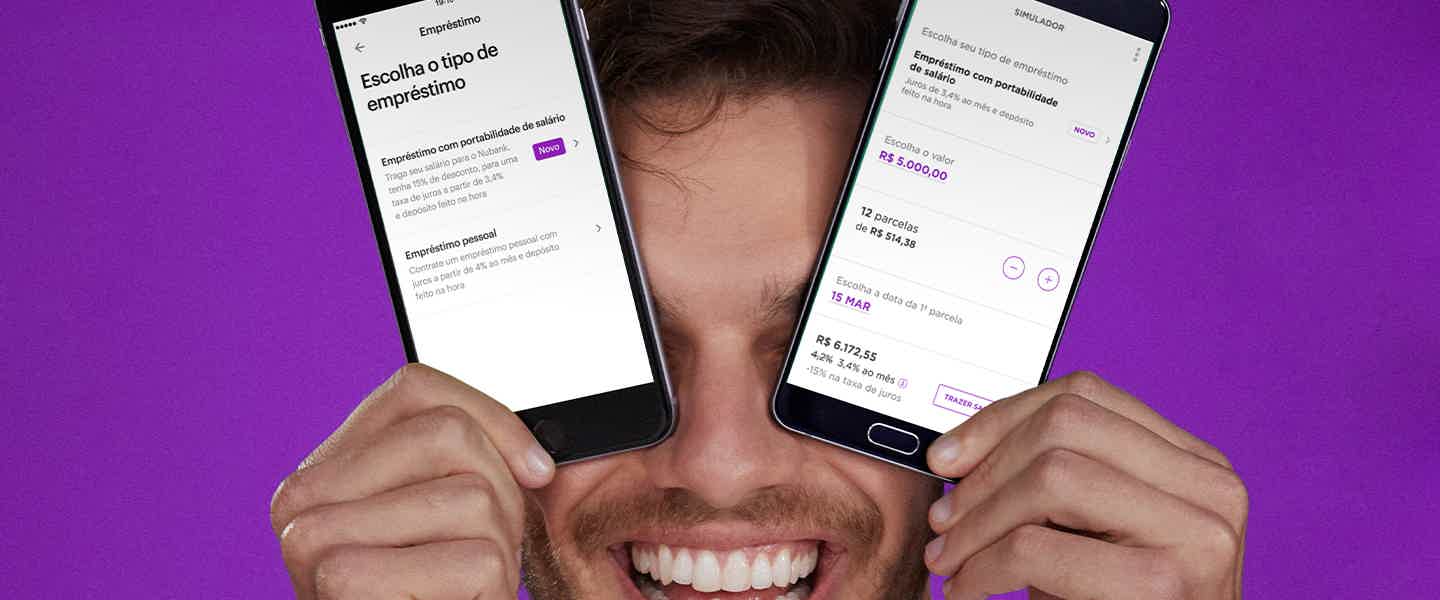

Nubank offers a personal loan in seconds and with zero bureaucracy on your cell phone!

Applying for a personal loan no longer needs to be a bureaucratic and time-consuming process. With Nubank, it is possible to apply for a credit line directly in the app and the amount is released within seconds after contracting. See more here!

Keep Reading

How to increase Nubank limit fast?

The Nubank card has been gaining more and more users due to its practicality and low cost. However, many of its users complain about the limit provided by the company. Want to know how to increase? Check out the tips in this article!

Keep Reading

How to choose a property to buy?

Buying our home is one of our greatest achievements, isn't it? Having our little corner, building a new story and having all things the way is priceless. However, when we are still in this process, one of the most frequent questions we ask ourselves is: how to choose a property to buy? Are you curious to know the answer to this question and which properties you can choose? Come with us throughout the review!

Keep Reading