loans

Payroll loan Alfa Financeira: what is Alfa Financeira?

How about learning a little more about the Alfa payroll loan? Keep reading because we'll tell you everything about this loan! Check it out!

Advertisement

Alfa Financeira payroll loan

So, the Alfa Financeira payroll loan is a type of credit that offers excellent credit conditions to its customers, such as quick credit release, as well as a discount directly from the payroll or benefit, and several other exclusive advantages!

So today, we’re going to show you some other useful information about this loan, as well as teach you how to apply for it and find out who it’s for! Check it out!

How to apply for the Alfa Financeira loan

Do you want to learn how to apply for an Alfa Financeira payroll loan with exclusive terms and rates? So keep reading to learn step by step!

| Value | uninformed |

| Installment | depends on the agreement |

| Interest rate | depends on the agreement |

| release period | Uninformed |

Alfa Financial Advantages

So, the Alfa Financeira payroll loan has several advantages, the first of which is that it has an online 100% process where there is no bureaucracy, that is, you do not need to go to a financial institution like Alfa to request the amounts for your loan!

And in addition, you can count on the speed of credit release, as well as discounts on installments from your payroll or benefits, because, unlike personal loans, the loan amounts are taken directly from your payroll!

And you can also count on reduced interest rates, as well as great payment conditions and other exclusive advantages such as terms that vary depending on the agreement! Therefore, you can count on several interesting conditions and proposals, especially for civil servants, retirees and pensioners of the INSS!

Main features of Alfa Financeira

Well, Alfa Financeira offers a specific type of credit for each agreement with private companies and public bodies. This is because, as it is a payroll loan, it is considered a more exclusive and less accessible loan.

And in addition, it has interest rates that vary from 1,50% to 60,10% per year, as well as payment terms from 3 to 96 months and, in addition, you have access to several other differentiated payment conditions.

In other words, depending on your agreement, you may be able to count on more or less discounts on your payment! Therefore, if you are within the indicated group, this may be a great loan option for you, but if you are not part of this group, unfortunately it will not be the right loan for you!

Who the loan is for

Therefore, the Alfa Financeira payroll loan is recommended for employees of private companies, retirees and pensioners of the INSS, public servants (municipal, state, federal, legislative and judicial), as well as military personnel of the Armed Forces (Army, Navy and Air Force).

Therefore, the company or public body must be linked to the agreement with the financial institution. In other words, if you belong to this group and need money quickly, this loan may be a great option for you! And what's more, it is available to those with bad credit!

But it is important to mention that only those with negative credit ratings who are part of the group we mentioned previously!

So, if you want to know a little more about this loan, click on the recommended content below to get more information, as well as to clear up any doubts you may have! Check it out!

Discover the Alfa Financeira payroll loan

Discover the Alfa Financeira payroll loan and see if this loan is what you need at the moment! Ah, it's ideal for negative people! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to open a BB Conta Jovem account

Go to the nearest branch and open your BB Conta Jovem account quickly, simply and securely. Learn more about the process here!

Keep Reading

Is it safe to pay to increase the score?

In general it is not safe to pay to increase the score, but you can opt for some services. Understand how to increase the score fast!

Keep Reading

How to apply for the Meu Galo BMG card

The Meu Galo BMG card is full of advantages, international, Mastercard and even has exclusive benefits for rooster fans.

Keep ReadingYou may also like

Federal Government announces microcredit program for MEI and negatives

According to the Federal Government, Caixa should provide microcredit for MEI and people with negative credits starting in February. The idea is to offer a low-interest loan to strengthen entrepreneurship in the country.

Keep Reading

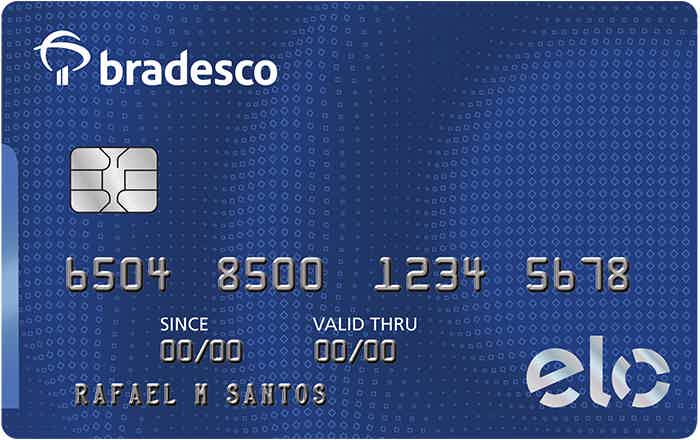

Get to know the Bradesco Elo Internacional Basic card

Do you know the Bradesco Elo Internacional Basic card? He can help you with everyday shopping. Continue reading and find out more!

Keep Reading

Discover the Inter Limite Investido credit card

With the Inter Limite Investido credit card, you set the limit when investing your money and also have several advantages, such as international coverage, Mastercard brand and even control your finances online 100%. Check out its main features here!

Keep Reading