loans

Click Cash personal loan: what it is and how it works

The Click Cash personal loan is the perfect line of credit for those who need financial assistance without bureaucracy. This is because it offers a credit of up to R$ 10,000 with a payment period of up to 24 months. Want to know more? Check out!

Advertisement

Click Cash: up to R$ 10k with an interest rate of up to 14.9% per month

First, Click Cash is a fintech founded in December 2019 with the mission to offer a personal line of credit in a digital and secure way.

Therefore, if you need fast cash without bureaucracy, this loan may be the ideal product for you.

So, do you want to know more about the characteristics of credit? Check out the content below!

| click cash | |

| Minimum Income | not informed |

| Interest rate | From 4.0 to 14.9% per month |

| Deadline to pay | From 6 to 24 months |

| release period | one business day |

| loan amount | From R$1,000.00 to R$10,000.00 |

| Do you accept negatives? | No |

| Benefits | Fast money and no bureaucracy Everything done online 100% First installment in 45 days |

How to apply for the Click Cash loan

The Click Cash loan is the ideal option for those who need quick cash without bureaucracy! Want to know how to apply? Check out!

Click Cash Advantages

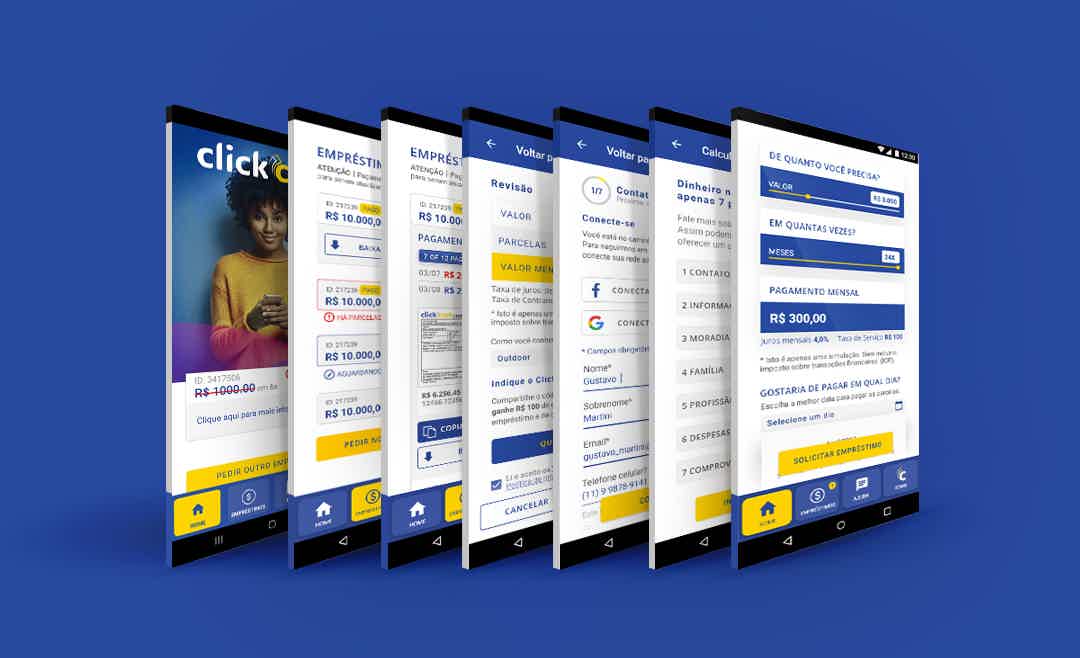

In this sense, the first positive point that stands out is the ease of use. That is, the request is made through the application and can also be followed there. Which means more practicality and less bureaucracy.

In addition, Click Cash has its own credit analysis system that uses your Positive Registration with the SPC/Serasa. That way your proposal is analyzed in seconds. Therefore, the loan is a great option for those who need quick cash.

Even more, if after the credit analysis your loan is approved, the money falls into your account within one business day.

Key Features of Click Cash

So, the main characteristic of the loan is that it is a completely digital process. That is, everything is done through the application. What's more, the response to your request is immediate, so you don't have to worry about a long review period.

Along with speed, payment flexibility is an added attraction, as you can pay your personal credit in up to 24 installments with the first payment in 45 days.

Furthermore, interest rates vary from 4.0% to 14.9% per month, and this amount is defined after the initial analysis of your profile.

Who the loan is for

Therefore, Click Cash is the ideal loan for anyone looking for quick and simple financial assistance.

In addition, you must be over 21 years old and have no restrictions with the SPC/SERASA to apply for your line of credit.

So, do you want to know a little more about the loan? Continue reading through the recommended content.

Discover the Click Cash personal loan

The Click Cash loan is the ideal solution to your financial problems or to make an investment. Find out more here!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How is bank credit analysis done?

Credit analysis is done to assess your consumer profile, that is, if you usually keep your payments up to date. Understand more!

Keep Reading

How to apply for the PagSeguro Prepaid Card

Learn all about how to apply for your PagSeguro prepaid card. Read this article and find out all the ways to apply right now.

Keep Reading

8 Main questions about Havan card

Do you want to answer the main questions about the Havan card? So, read this post and check out everything about the card without annuity and that you can pay your purchases in 10 installments.

Keep ReadingYou may also like

QR Code scam: what is it and how does it work?

Protect yourself from the QR Code Scam! Discover how fraudsters exploit your trust and learn effective strategies to avoid falling into digital traps. Read now and stay safe online.

Keep Reading

How to apply for the Platinum BV card

With discounts with partners, a points program, two brands and assistance services, the BV Platinum card stands out from the rest. See how you too can have yours.

Keep Reading

Get to know the current account Minimum Services Banco Invest

If you are looking for an account to organize your finances, the Banco Invest Minimum Services current account is a great alternative. To find out more about her, just keep reading and check it out!

Keep Reading