loans

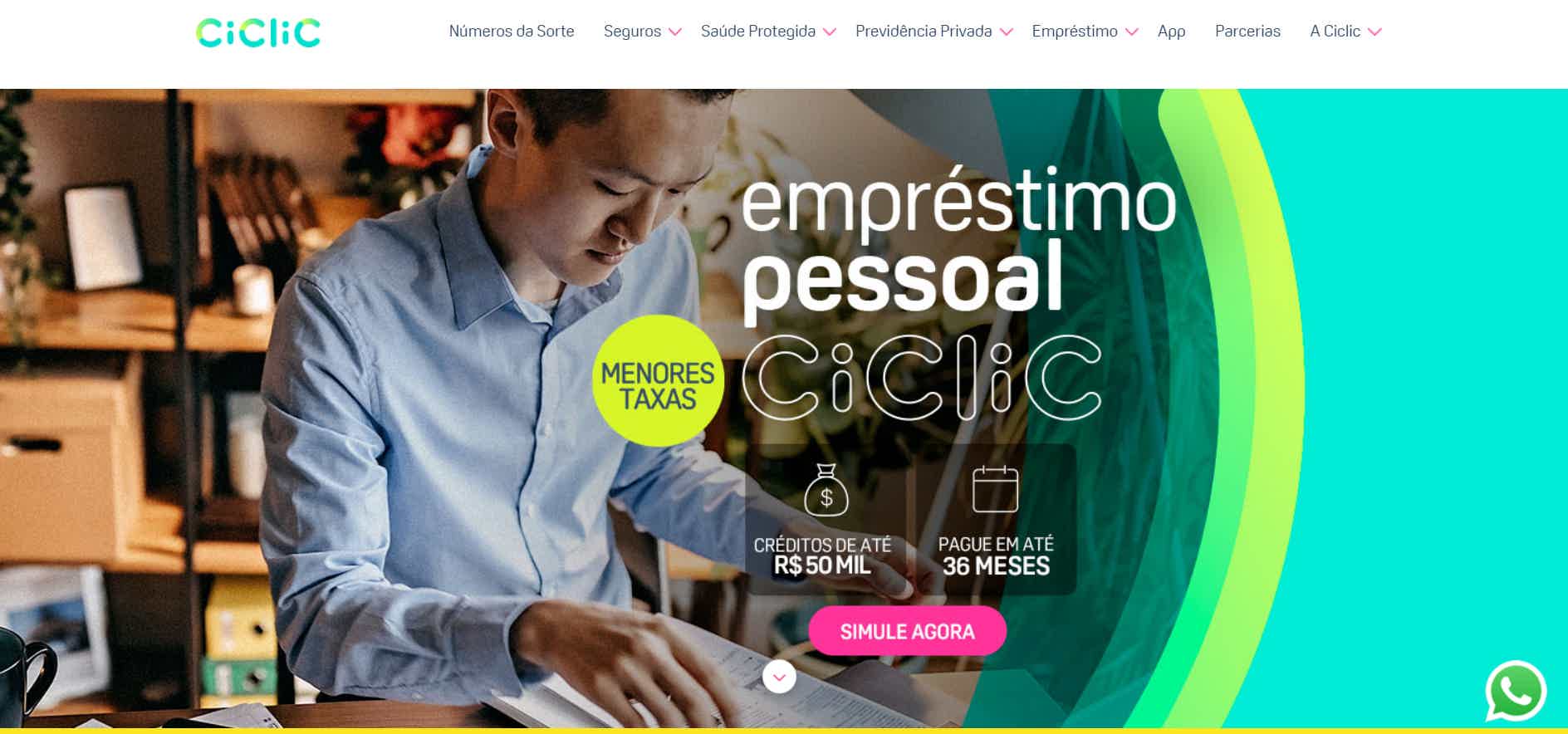

Ciclic personal loan: what is it and how does it work

Discover the Ciclic personal loan and see how this credit can help you pay off your debts with competitive interest rates, a payment period of up to 36 months and you can even borrow up to R$ 50 thousand.

Advertisement

Ciclic Loan: solve your financial problems once and for all

If you are having financial problems and no longer know how to solve them, the Ciclic personal loan could be the solution you need. This is because you can pay it in up to 36 months, you can request up to R$ 50 thousand and the credit can be released on the same day.

So, to learn more about this loan, continue reading.

| Cycle | |

| Minimum Income | not informed |

| Interest rate | From 1,49% per month |

| Deadline to pay | Up to 36 months |

| release period | On the same day, if approved by 1pm |

| loan amount | Up to R$50 thousand |

| Do you accept negatives? | Depends on credit analysis |

| Benefits | 100% digital contracting Security Credibility Up to 45 days to pay the first installment |

How to apply for the Ciclic loan

Do you want a loan with a term of up to 36 months to pay and unique conditions for you? Then click here.

Ciclic Advantages

Initially, the Ciclic loan has several advantages, the first of which is the fact that you can request up to R$50 thousand in credit, depending on your credit analysis with affordable installments.

Furthermore, if approval and release of loan amounts are carried out by 1pm, your credit will be released on the same day.

Furthermore, Ciclic's interest rates are low, that is, from 1.49% per month, being among the most competitive on the market.

Furthermore, you can choose the best way to pay your loan, which can be up to 36 installments, whichever way works best for you.

Ciclic main features

So, Ciclic is a BB Seguros company and offers exclusive advantages for customers who choose to request fast personal credit, without bureaucracy, with transparency and security.

And, in addition, if you want to buy your own home or renovate, Ciclic helps you by optimizing your way of obtaining credit, just go to the company's official website, fill out the form with all your personal data and wait for the proposal to be analyzed.

In the case of a personal loan, Ciclic does not charge to make the credit proposal, nor does it charge to release the amounts.

Furthermore, you can pay the loan installments through a bank slip that is sent in advance to the customers' homes, just as you have up to 45 days from the date of signing the contract to pay the first installment of the loan.

Who the loan is for

If you are looking for personal credit with security, transparency and fully optimized, you are among the best people to apply for a Ciclic loan. However, it carries out credit analysis, so if you have a bad name or a low credit score, we recommend that you evaluate your situation and regularize your CPF.

So, to know more about this loan, click on the recommended content below.

Discover the Ciclic personal loan

Do you want a loan with a term of up to 36 months to pay and 45 days to pay the first installment? Find out more here.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the underage Mercado Pago digital account

In this post, find out more about the underage Mercado Pago digital account that offers everything young people need!

Keep Reading

Discover the New Bolsa Familia

Get to know the Novo Bolsa Família program, and see the new guidelines and values of the Federal Government program for the year 2022! Check out!

Keep Reading

Discover the Saraiva credit card

Find out in this article exactly all the advantages of the Saraiva credit card, an international product, with no annual fee and unique benefits.

Keep ReadingYou may also like

Carrefour scholarships available until January 30th

In partnership with Digital Innovation One, the Carrefour hypermarket chain launches a program to train professionals for the technology market. In addition, it offers 300 scholarships for blacks between 18 and 30 years old. Applications must be submitted by January 30th.

Keep Reading

How to Apply for the Juno Card

The Juno prepaid card is a great way to control your spending because your limit will always be equal to your account balance. Want to know how to order the product? Continue reading and check it out!

Keep Reading