loans

Bradesco Corporate Loan: how it works

The Bradesco Empresarial loan can be applied for completely online and has immediate credit release! In addition, it has an interest rate starting at 0.99% per month and 72 months to pay. Want to know more? Check it out here!

Advertisement

Bradesco Corporate Loan: special installment conditions

Firstly, the Bradesco Empresarial loan works in the working capital modality and was created with the aim of boosting the cash flow of companies that need financial assistance to honor their commitments or that wish to invest in business opportunities.

Therefore, if your company has an account opened at Bradesco and you want to know more about the characteristics of this line of credit, check the table below and continue reading to learn more!

| Minimum Income | not informed |

| Interest rate | From 0.99% per month |

| Deadline to pay | Up to 72 months |

| release period | When hiring through digital channels |

| loan amount | Depends on credit analysis |

| Do you accept negatives? | No |

| Benefits | Grace period of 120 days to start paying Fast release time |

How to apply for a Bradesco Business Loan

With payment flexibility and immediate credit, the Bradesco Corporate loan may be ideal for your company! Want to know how to apply? Check it out here!

Bradesco Empresarial Advantages

So, the positive point that draws the most attention in the Bradesco Empresarial loan is agility in contracting. Thus, you can order yours through the website or the application and the amount is credited to your company's checking account immediately after being approved.

In addition, as it is a credit with no specific destination, you do not need to justify its use to the bank and you can use the money freely to strengthen your cash flow.

Main features of Bradesco Empresarial

Well, one of the characteristics that draws the most attention to the loan is its flexibility for repayment. Thus, you can divide your debt in up to 72 installments and Bradesco also offers a grace period of up to 120 days to settle the first installment.

In addition, hiring can be done completely online and without bureaucracy through Internet Banking or the Bradesco Empresa app. Amazing, isn't it?

Furthermore, interest rates start at 0.99% per month, but the total effective cost is only defined after simulating the loan.

Who the loan is for

Therefore, the Bradesco Empresarial loan is indicated for companies that hold Bradesco accounts and wish to boost their cash flow or need help to honor their financial commitments.

So, if your company falls into these categories, how about learning more about this business line of credit? Well then, read on through our recommended content below!

Get to know the Bradesco Empresarial loan

With the Bradesco Empresarial loan, you organize your expenses and still have up to 72 months to pay! Find out more here!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the C6 Carbon card

Do you already know the C6 Carbon? An exclusive card, with Mastercard Black benefits and international coverage. Find out everything in this article!

Keep Reading

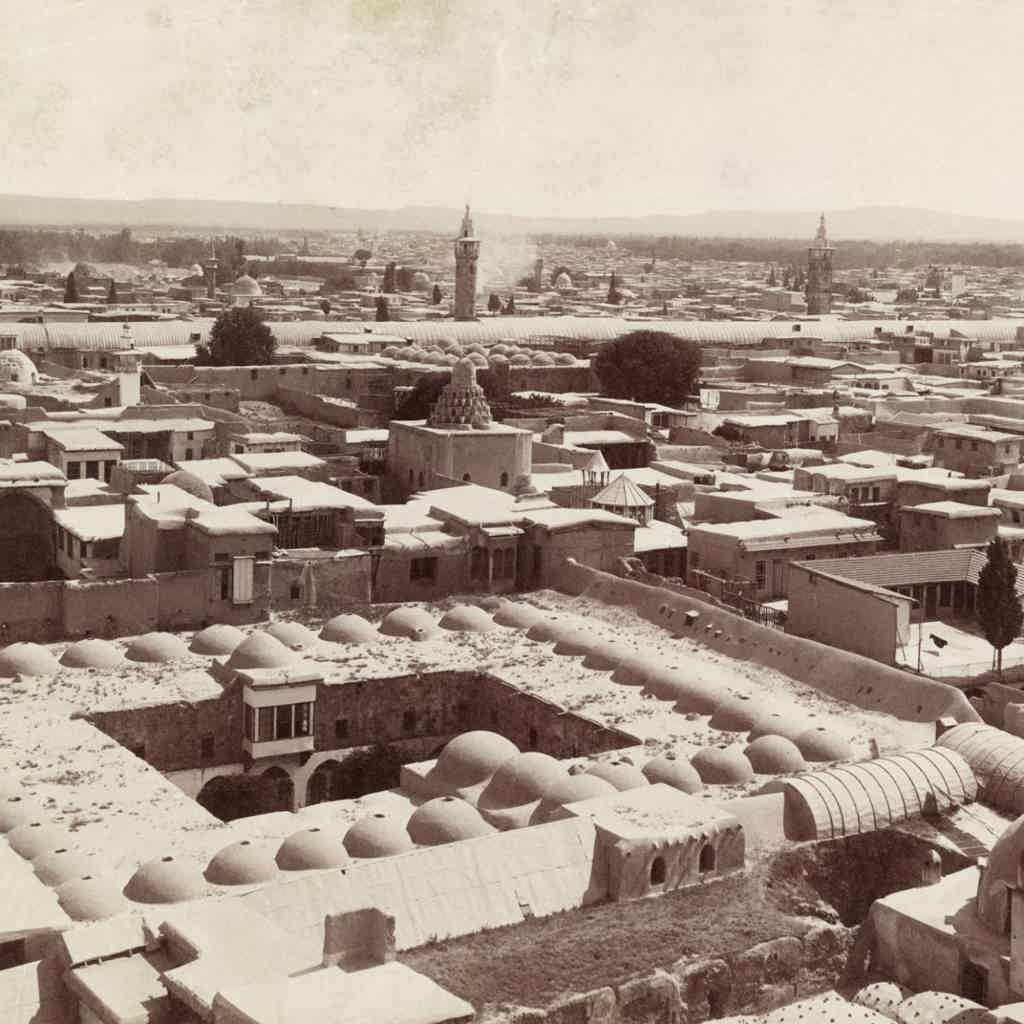

The 15 Oldest Places in the World Everyone Should Visit Someday

Like to travel and love historic destinations? Then read our text and get to know the 30 oldest places in the world right now!

Keep Reading

How to apply for the Reclusion Aid 2022 benefit?

See here how it is possible to request the Reclusion Aid benefit from the INSS application, website and telephone number 135.

Keep ReadingYou may also like

16 best digital accounts of 2021

In this list, we have listed the 16 best digital accounts so that you know everything they offer and have all the information before choosing the best option for your financial life! Want to know more? Check it out here!

Keep Reading

How to be approved for the Bradesco credit card?

If you want a card to call your own, how about getting to know our tips for being approved for a Bradesco credit card? Continue reading and check it out!

Keep Reading

How to apply for the Will Bank Basic card

With the basic Will Bank card, you can enjoy numerous benefits, such as access to Mastercard Surpreenda, exemption from annual fees and administrative fees, and much more! See here what to do to apply for this card.

Keep Reading