loans

Agibank loan or BMG loan: which is better?

The Agibank loan or BMG loan accept negatives. In addition, credit release is quick and analysis is simplified. Check out more advantages here and choose the best one for you.

Advertisement

Agibank x BMG: find out which one to choose

When it comes to borrowing, the indications can change from person to person. After all, each case is different, isn't it? With that in mind, we decided to make the following comparison: Agibank loan or BMG loan? Which one to choose?

So, although financial institutions offer different types of credit, the personal loan is still the most sought after. Even with the highest values of total effective cost, the greatest demand from Brazilians is still for this type of credit.

Due to the highest interest rates on personal loans, we have separated here two financial institutions that offer good payroll loan options to their customers. Since this type offers more affordable credit conditions.

Furthermore, both Agibank and BMG can meet your requirements, in addition to having the benefits of a digital platform. So you can take out your loan safely, without leaving your home.

Well, here you will find the main characteristics, advantages and disadvantages of these two credit options. This way, you save your time and we help you choose the best option for your profile. Let's go!

How to apply for the Agibank loan

If you already understood what the Agibank loan for negatives is and you were delighted with its advantages, the time has come to find out how to apply for it. Read and find out!

How to apply for the BMG emergency loan

Applying for your BMG emergency loan is much easier than you might think! Read our text and understand more about this request process.

| Agibank loan | BMG loan | |

| minimum income | Uninformed | Uninformed |

| Interest rate | From 1.2% per month | From 1.8% per month |

| Deadline to pay | Up to 84 months | Up to 84 months |

| release period | 2 to 5 business days | 24 hours |

| loan amount | Up to 10 thousand reais | On request |

| Do you accept negatives? | Yes | Yes |

| Benefits | Reduced interest, no consultation with the SPC or Serasa | Accessible, no consultation with the SPC or Serasa, Online |

Agibank loan

First of all, it is very common to find ourselves in a position of financial difficulty. For example, when we want to go on a trip or even buy something of greater value. These are common situations where we need extra money in the account.

In this sense, Agibank offers a loan facilitated online. That is, you can apply for this credit without having to leave your home. In addition, they do not consult the SPC and Serasa.

However, the Agibank payroll loan is reserved for retirees, INSS pensioners, military personnel or civil servants.

Therefore, if you are interested in applying for an Agibank loan and fit into these categories, visit the website and do a credit simulation.

BMG loan

Banco BMG offers payroll loans in a simple and fast way. In fact, he serves you online, so you don't even have to leave the house. So, if you are retired, INSS pensioner, private company worker or public servant, you can apply for a personal loan with them.

In addition, he is also a great option for negatives, as he does not consult the SPC or Serasa.

So, if you think this loan is right for you, go to the BMG website and do a credit simulation.

What are the advantages of the Agibank loan?

First of all, we can say that the Agibank loan is quite affordable, as this type of loan has lower interest rates.

In addition, Agibank does not consult with the SPC and Serasa, which makes it easier for negatives who need a loan. The bank also offers a good payment term, which can be made in up to 84 months.

Furthermore, Agibank is digital and you can apply online, without leaving your home.

However, it is important to inform you that you must do a simulation before hiring. As well as do a lot of research to make sure this loan is right for you.

What are the advantages of the BMG loan?

At first, we can already say that the main advantage of the BMG loan is its interest rate. It promises one of the lowest rates on the market, if not the lowest.

In addition, he also does not consult the SPC or Serasa, which makes it easier if you are negative or have a low score for personal credit.

In addition, its payment term is also very long, totaling 84 months. And all of this you can request online, without having to leave your home.

Finally, it is important to say that you must research well before taking out this type of loan. This way, you can be sure that you have chosen the best option, with the best rates, before signing the contract.

What are the disadvantages of the Agibank loan?

Well, unfortunately Agibank offers the credit option only to retirees, pensioners, military personnel and civil servants. That is, if you are self-employed, for example, this loan option is not for you.

Although the bank does not consult the SPC and Serasa, it is important to know that the total effective cost (CET) of the loan must be taken into account. So, be careful not to end up getting into even more debt.

What are the disadvantages of the BMG loan?

So, it is important to say that the BMG loan has some limiting factors. In order to apply for this credit, you must be a pensioner or INSS pensioner, a private company worker or a public employee.

Therefore, the accessibility to this type of loan is limited. This happens because the BMG personal loan installments are debited directly from the customer's payroll or benefit.

Agibank loan or BMG loan: which one to choose?

Well, if you've come this far, you can already say that both loans are safe and easy to get. After all, both offer the opportunity of credit also for negative ones. This means that credit analysis is done quickly and simply.

Unfortunately, however, both the Agibank loan and the BMG loan are only available to a select group of people. To apply you need to be retired, pensioner, military, private company worker or public servant. So, if you fit these conditions, look for which of the two banks best suits you in terms of the loan amount and the interest charged.

Although Banco BMG does not inform the maximum loan amount, it promises to have the best interest rate on the market. This can make your life easier when paying the installments.

Therefore, before signing up, make a simulation and be sure that the installments will fit in your pocket. This way you will avoid delays and end up getting even more indebted!

Furthermore, if you still have doubts about which loan to apply for, read our recommended content and learn about other credits available on the market.

Just Loan or Paraná Bank Loan

Just loan or Banco Paraná loan are credits for those looking for a secure online 100% contract, with low interest rates and exclusive conditions. Check out!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

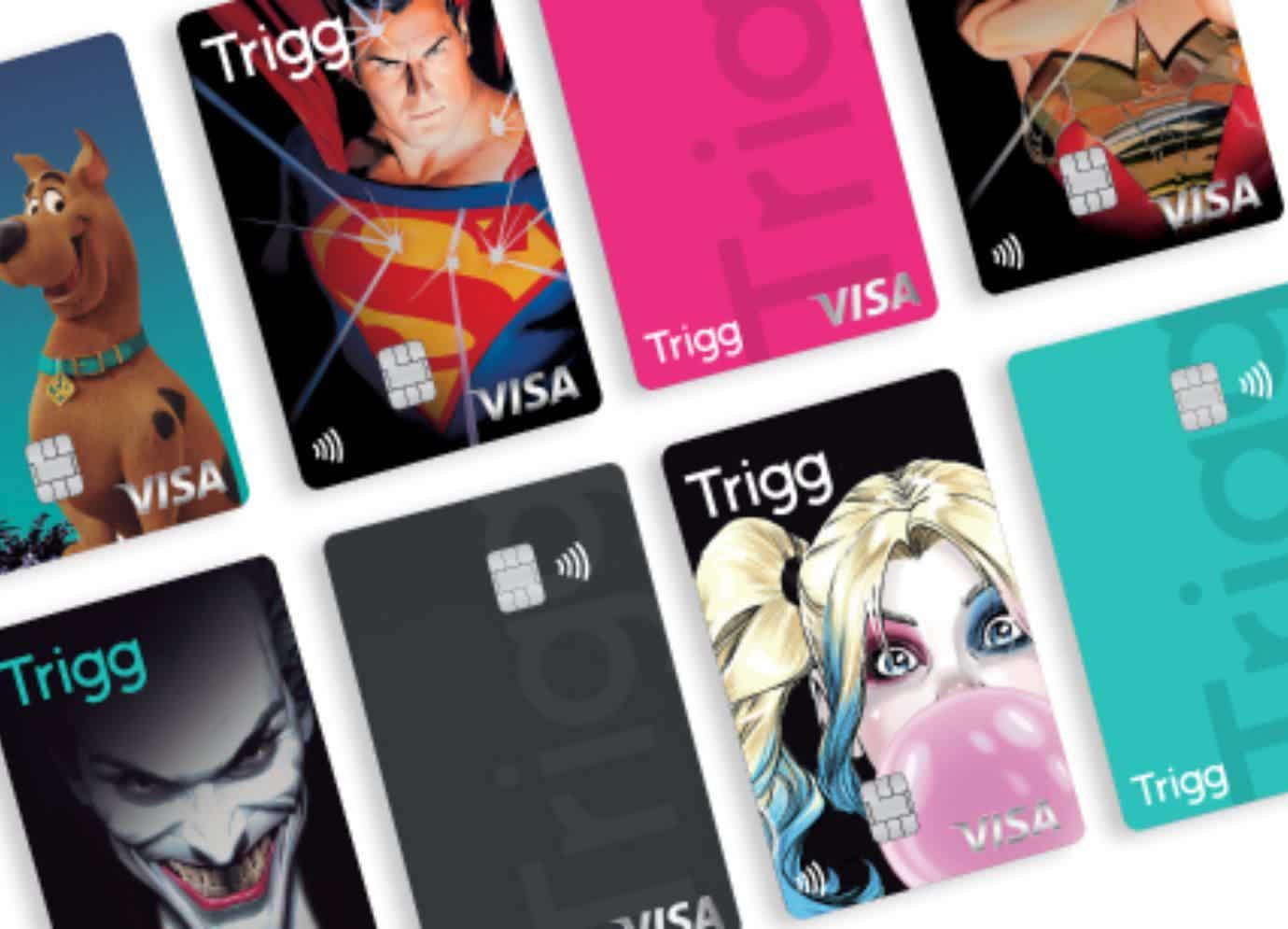

Online Trigg Card: with international coverage and cashback

Find out what the online Trigg card can offer you and how you can have a collection of fun cards with it!

Keep Reading

What to do to get a job fast?

Need to find a job fast but don't know where to start? So keep reading and check out our tips!

Keep Reading

Havan Card or Carrefour Card: which one to choose?

Find out about options that offer facilities for in-store purchases. Then, follow our comparison between the Havan card and the Carrefour card!

Keep ReadingYou may also like

How is a refinance done?

Refinancing can be a great way to avoid payment delays and renegotiate credit terms. Continue reading this text and see how this practice works!

Keep Reading

Discover It Cashback Credit Card: How It Works

A simple credit card with great advantages is what everyone is looking for. Even more so if it costs nothing to maintain. If you are looking for such a card, check out the Discover It Cashback card.

Keep Reading

Is it possible to order a credit card online?

One thing is for sure: if you have the famous "dirty name", it becomes more difficult to get a credit card, but... It's not impossible! Do you want to see how it is possible to apply for a negative credit card online? We tell you here, see.

Keep Reading