Cards

Find out all about the BB Ouro Credit Card

Find out now all the advantages and characteristics of the BB Ouro card in a detailed and explained way.

Advertisement

Features of the BB Gold card

The BB Ouro card has the Visa flag, so you will have access to many stores and establishments in Brazil and even the world.

This is because almost all companies currently accept the Visa flag.

So if you were thinking that the card would not be accepted in some places, don't worry!

Many cards these days still charge an annual fee for your customer to use the card.

However, BB Ouro, depending on the person, does not charge any type of annual fee for the card.

So, if you spend at least an amount of R$100.00 reais per month using the BB Ouro card, you are exempt from paying this fee.

Therefore, making purchases greater than R$100.00 reais using the BB Ouro card, you will not need to pay an annual amount for using the card.

Finally, the card has international coverage, that is, you will be able to buy products and services that are only found in countries abroad.

| Annuity | Exempt if you spend at least R$100.00 reais in the month with the card |

| Roof | International |

| Flag | Visa |

| Benefits | Ourocard-E on time; contactless payment, etc. |

about the card BB Gold card

Currently, many traditional banks are investing in the fintech market and, consequently, in the credit card market.

Therefore, Banco do Brasil created, seeing that it had not yet entered the competitive market, the BB Ouro credit card, aiming, above all, to compete with other banks and with other cards.

The card was created in 2018 and seeks, every day, to create more benefits and advantages for all its customers.

Who is the card for?

Nowadays, there are many cards that always offer the same benefits and advantages.

So, the BB Ouro card is specifically for a certain group of people, as it seeks to bring unique benefits and advantages to its customers.

Therefore, if you want a card that will make your personal life and, above all, your financial life easier, this is the ideal card for you.

Also, all users of the card say that it offers, in addition to what was said above, a lot of comfort and convenience.

Finally, keep reading the other features and advantages of the card and see if it is the ideal product for you.

Advantages of the BB Gold card

As has been said, the card offers several advantages and benefits, always aiming to provide more convenience and ease to its customers.

Discover, below, the main fundamentals of the card and the best advantages that make it one of the best products on the current market.

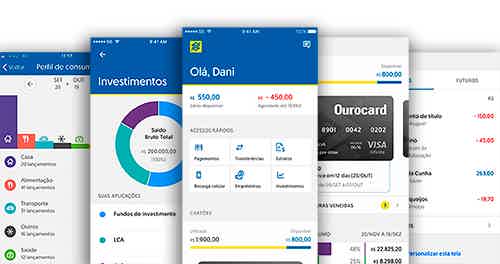

Application of BB Gold card

With the advancement of the internet, large companies needed to expand their borders and expand all their resources to meet demand.

For this reason, Banco do Brasil created, seeing that it needed to improve its service on the internet, its own application, which facilitates — and much — the lives of all its users.

With the app, you can manage all your accounts and also control all your finances in real time.

In addition, you will be notified in advance of the due date of your invoice.

In addition, you have the possibility to monitor all your expenses in real time in an easy and simplified way.

The Banco do Brasil application is available for both Android and iOS users.

Therefore, go to Google Play or the App Store and then download the card application to access all these benefits and advantages.

international coverage

Another differentiating factor of the card is that it provides, unlike other companies, the possibility of making purchases of international products.

So, if you want, you can purchase products and services that are only available outside Brazil.

You can make your purchases both online and by physical card. This depends on the situation and also on your interest at the moment.

It is worth mentioning that you also have the possibility of shopping in the national territory. So rest assured! One thing does not exclude the other.

Annuity of BB Gold card

Currently, many companies still charge their customers an annual fee for using their own card.

However, the BB Ouro card is different!

If you make at least one purchase of R$100.00 per month using the card, you won't have to pay any fees.

So, if you spend that amount monthly using the card, regardless of the store or establishment, you will be exempt from paying that annual fee.

However, if you do not spend this amount of R$100.00 reais per month with the card, you will need to pay an annual fee of approximately R$5.00 reais per month.

This is one of the reasons why the card provides greater savings to its customers.

Go from Visa

The Vai de Visa program is provided, especially, by the card brand, and not by Banco do Brasil itself.

This program is one of the main advantages of the card, so try to understand how this great benefit works.

With this benefit, you earn, after making a purchase with the card, a certain amount of points, which can, as they accumulate, be exchanged for available products and services.

So, the more purchases you make with the card, regardless of their value, the more points will be sent to you, and consequently, the more products and services of your interest can be exchanged.

approximation payment

Another advantage of the card is the proximity payment.

Just bring the card to the place where you are going to make the payment and then your purchase will have been made.

This is a benefit that makes life easier for the customer, as everyone knows that it is much more practical to just bring the card closer.

checking account

Another very good thing about the card is that, if you want to acquire one, you don't need to have a bank account beforehand.

So, if you don't have a bank account at Banco do Brasil and, even so, you want to ask for the card from the same bank, don't worry, it won't be necessary!

To order the card, simply download the bank's app and then order your card.

This is a very simple and practical way to acquire the card, isn't it?

Ourocard-E on time

After ordering your BB Ouro credit card, you can instantly receive your digital card and then use it to make purchases.

With this, the process of receiving the card becomes completely bureaucratic and also simplified for the customer.

What is the limit of the BB Ouro card?

As with all other credit cards, the limit will vary according to the cardholder.

So, before setting your card limit, Banco do Brasil, which makes the cards, will study your credit history.

Also, they will see if your name is, at the time you order, dirty or not.

After studying your entire profile, the Bank will define your card limit.

In addition, your monthly income will be considered when defining your card limit.

Therefore, the more money you earn per month, the higher your credit card limit will be.

Therefore, remember to have your name and bank history clean before making your profile, because otherwise your card request may be blocked and your limit may be low.

After ordering, how long will it take for the card to BB Gold card are you at my house?

Before all that, you must, of course, order your card.

After accepting your order, your card will be created and, in a few days, it will already be in your hands.

But you must be wondering how long, specifically, the card will arrive at your house, right?

First of all, the time for sending the card varies according to different circumstances.

However, the average arrival time for the card is approximately 10 working days.

Your card will arrive at the same address you provided when placing the order.

So rest assured about it!

How to unlock the BB Gold card?

If you are thinking that you will have to face giant queues, along with slow and inefficient service, you are wrong!

Nowadays, you can unlock your card over the internet.

The best thing about it is that the card unlocking process is simple and completely unbureaucratic.

To do so, you must download the Banco do Brasil/Ourocard application and then unlock the card.

You will easily find the unlocking location, as the application is very simple and intuitive.

As mentioned, the application is available for both iOS and Android users.

Then, go to Google Play or the App Store and, after that, download the card application, as this is the best way to unlock it.

Ask for the BB Gold card now!

If you liked the card and its main features, click the button below and then find out how to request yours.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to be approved in Neon?

Did you know Neon and now want to have your account and card? In today's article we will show you how to be approved in Neon. Check out!

Keep Reading

Extra income ideas for 2022

See a list of ideas to guarantee extra income with solutions that can help many people in 2022. So, read this post and check it out!

Keep Reading

Is Neon account good?

Looking to know if the Neon account is good? We can say that it offers a free account and credit card with no annual fee. Come check!

Keep ReadingYou may also like

How to open a Nubank account for minors

The sooner young people know how to handle money and make good financial choices, the more prosperous their lives will be in the future. Find out how to apply for a Nubank account for minors and contribute to this important learning process!

Keep Reading

How to open account Easy

After all, what should I do to open my Easy account? It's simple, the whole process is digital and takes just a few minutes. Check it out in the post below.

Keep Reading

How to apply for Itaú Samsung card

The Itaú Samsung credit card has no annual fee, is safe and can be used however you want and wherever you want. Still not have yours? So, see now how to apply for it.

Keep Reading