digital account

Digital account: how it works

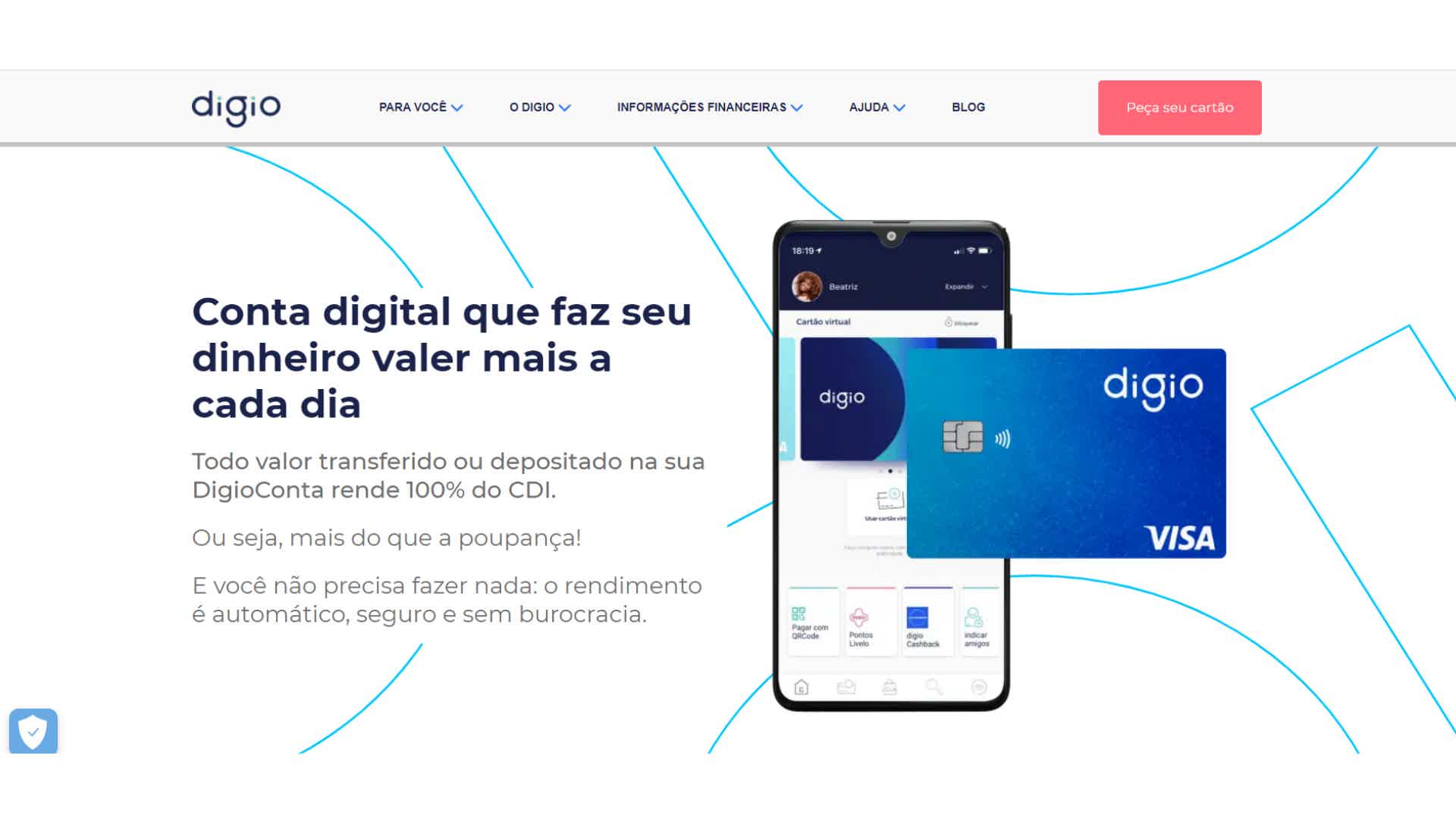

Do you already know the Digio account? It is a digital account that yields up to 100% of the CDI, as well as allowing free and unlimited transfers and payments through the application. So, continue reading to find out more.

Advertisement

Digio Account: enjoy the benefits of a free account

First, Digio is a digital financial institution that operates by offering various financial products, including the Digio account, which is aimed at individuals and can be managed through the institution's application.

So, continue reading to understand a little more about how the Digio account works.

| Minimum Income | not informed |

| Monthly cost | Exempt |

| credit/debit card | Yes |

| Account Type | Digital |

| Benefits | Free and unlimited transfers; Control 100% digital by app. |

How to open Digi account

Learn how to open a Digio account and have access to all the advantages, such as free and unlimited transfers and payments. Learn more here!

Digio Advantages

So, the Digio account has several advantages, the first of which is the fact that it is a completely free account. To request it, first of all, you just need to have the institution's credit card in hand, enter the application and activate the account opening.

Among other advantages, with it you can also make free transfers between Digio accounts or different institutions and you can even use the QR Code to make payments.

And, in addition, you can also make payments by PIX, just as you can carry out salary portability. Remember that any amount transferred or deposited in the account yields 100% of the CDI, that is, more than the Savings.

In addition, with it you can also make withdrawals on the Banco24Horas network paying a reduced fee. And yet, through your account you can control your cards, both physical and virtual. So, read on to find out more information about the Digio account.

Main features of Digio

Initially, the Digio account has income of up to 100% of the CDI, that is, it yields more than savings and, with the portability of your salary, you can make this money yield even more, being able to use it however you want.

So, to open the account, first of all, you need to be a credit card customer. From there, access the application's home screen and click on "activate account". After that, just follow the rest of the instructions and your free Digio account will be opened.

So, through this account you can control your cards and also make transfers and payments for free.

Who the account is for

The Digio account is indicated for credit card customers who want to control all their bank and card transactions in a single application. As well as those who want to make money yield more than savings. So, if you fit this profile, then this account is for you.

Also, if you still have doubts, read our recommended content below and learn more about this account.

Discover the Digio digital account

Get to know the Digio digital account and learn everything about this account that allows transfers and payments with free and unlimited QR Codes.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the PicPay card

The PicPay card has benefits for its customers, the main one being the practicality and ease of ordering yours online. See how!

Keep Reading

How to earn money on PicPay for free 2021

Have you ever thought about making money on PicPay for free? Because know that this is possible and it's much simpler than you realize! See more here!

Keep Reading

Get to know the loan with Itaú property guarantee

Discover in this post the main characteristics of the loan with Itaú property guarantee, which has low rates and up to 20 years to pay.

Keep ReadingYou may also like

Visa Platinum Card or Visa Signature Card: Which is Better?

If you are looking for a credit card to call your own and have access to the main resources to take care of your finances, the Visa Platinum card or Visa Signature card is a great alternative. To learn more about them and their main differences, just continue reading the article and check it out!

Keep Reading

Discover the PJ Nubank card

Get to know the PJ Nubank card and request yours right now. Manage your business accounts without a headache.

Keep Reading

Méliuz or PicPay: which is the best card with cashback?

Méliuz or PicPay? We know that both digital platforms offer good cashback programs. Learn more about it in our article.

Keep Reading