digital account

C6 MEI digital account: how it works

Starting a business is not easy, so it is necessary to find alternatives that generate less costs. So, get to know the C6 MEI account and don’t pay high fees to boost your business. Also, have a credit card with no annual fee. Find out more here!

Advertisement

C6 MEI: account with free withdrawals and PIX

C6 Bank is a Brazilian digital bank, created in 2018. Since then, it has had digital accounts for individuals and legal entities. The free C6 MEI digital account can be opened without leaving home. Furthermore, if you happen to need a card machine to make sales, do not pay a monthly fee under conditions.

Furthermore, this is a specific account for small entrepreneurs. In other words, it guarantees benefits to those who have a regular CNPJ, are an active company and are looking to expand their business.

So, without further ado, check out the advantages of this account. This information will certainly help you know how the C6 MEI account works. Follow along!

| open rate | Exempt |

| minimum income | not informed |

| rates | Exempt |

| credit/debit card | Yes |

| Benefits | Credit card with no annual fee; Free withdrawals and PIX; Opening process 100% online. |

How to open C6 MEI account

Open your C6 MEI account and enjoy exclusive benefits, such as exemption from the maintenance fee, as well as a credit card with no annual fee and much more!

C6 MEI Advantages

Since it is a free account, it has numerous transactions without charges. In other words, do not pay for transfers via PIX, payments, withdrawals and even for issuing deposit slips every month, for example.

While most digital banks charge, with the C6 MEI account, you can make withdrawals from ATMs on the Banco24Horas network without spending money.

Finally, there is no bureaucracy to open the account and you can request a credit card with no annual fee subject to credit analysis. In addition, it can also guarantee installment loans and a high limit. All of this subject to bank evaluation.

Main features of the C6 MEI

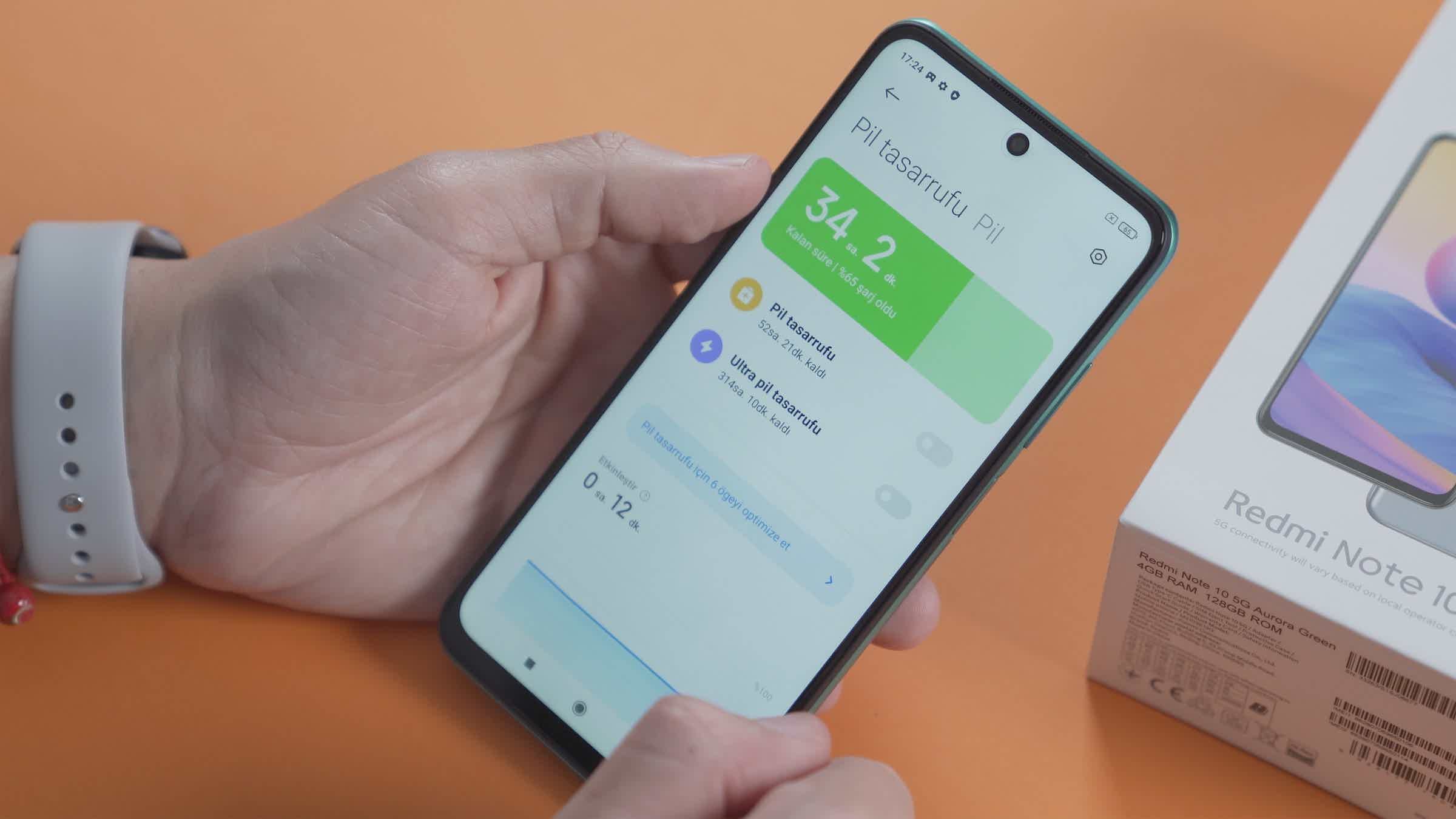

The main feature is that it is a traditional checking account that can be controlled by the application. Therefore, you can do all your banking transactions without leaving home.

Furthermore, it is possible to order a credit card immediately after activating the C6 MEI account. This way, you can make purchases and expand the business. Furthermore, the account also offers a card machine.

Still talking about the machine, you can get a monthly fee exemption if you sell at least R$ 3.5 thousand per month, which is very advantageous.

Who the account is for

Therefore, micro-entrepreneurs with a regular MEI status can open their C6 MEI digital account. After that, you can take advantage of the credit lines offered by the bank to expand your business.

By the way, did you like this option? So, take the opportunity to click below and find out more details about this digital account.

Discover the C6 MEI digital account

The C6 MEI digital account is for entrepreneurs who want to grow, as it offers different types of credits at low costs for you to take advantage of.

Trending Topics

How to enroll in Rock University courses

Check out how you can enroll in Rock University courses and thus access free training in digital marketing!

Keep Reading

How to be an affiliate of American stores?

Do you know how to become an affiliate of Lojas Americanas? So, read this post and find out how to earn commissions of up to 11% on sales.

Keep Reading

How to request the C6Pay machine?

Find out how to request the C6Pay machine and have a tool that accepts payments and allows you to manage your sales!

Keep ReadingYou may also like

How to Apply for a Gold Mastercard

Mastercard's Gold card offers more benefits to those who usually buy with this payment method. So, when you apply for yours, you make the most of an international card that makes your life easier. Check out how to get yours today!

Keep Reading

Black Mastercard Card: How it works

Enjoy everything a Mastercard card can offer in its Black version. As well as more experiences with Priceless Cities and full insurance coverage. So, read this post and learn more!

Keep Reading