Cards

Discover all the features of the Hipercard Card.

Find out now everything you need to know about the Hipercard Credit Card. Read until the end to learn about the advantages of this card and also know the step-by-step process to apply for one.

Advertisement

Hipercard Card

If you are looking for a card that is well known throughout Brazil and that provides its consumers with various benefits, the Hipercard card is ideal for you.

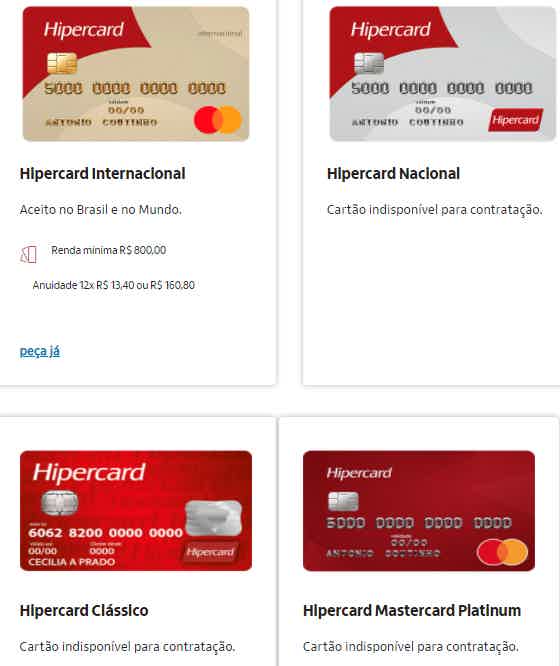

Currently, the card belongs to Banco Itaú, the largest private financial institution in the country, offering great security to its customers. Hipercard has some versions, but, at the moment, only Internacional is available.

The card provides consumers with several benefits, which will be listed below. At the moment, only the Hipercard Internacional Card is available, which has the following characteristics:

| ANNUITY | 12X 13.40 |

| FLAG | MASTERCARD |

| MINIMUM INCOME | 800,00 |

| INTERNATIONAL | YES |

| EXCLUSIVE BONUS | YES |

What makes the Hipercard card different?

Currently, many credit cards carry the Visa or Mastercard brand.

However, some Hipercard cards have their own brand, which makes them unique.

At the moment, only the card below is available on the Hipercard website:

card features hypercard

The Hipercard credit card has several features, which are listed below:

own flag

Because the Hipercard brand has fewer customers, many stores and establishments do not accept the flag, as it is difficult to find machines that accept the card.

However, there are many companies that still accept it, such as, for example, Cielo, PagSeguro, MercadoPago, SumUp, SafraPay, iZettle and also Rede.

Therefore, before requesting the card, check which ones are available and remember to check the flag, if it is from Hipercard itself, be aware that some establishments do not accept it.

No annual fee

It is worth noting that some Hipercard cards do not have this fee.

Although you need to check this availability, on the day of publication of this article, the international card was only available on the Hipercard website, which already had its characteristics listed in the table above (and does have an annual fee)

additional cards

If you are interested in ordering more credit cards, it will be possible to order up to 4 cards per individual.

40 days interest free

If, by the time you buy something, you can't pay it off, you'll have up to 40 interest-free days to pay off everything you owe.

Therefore, if you are unable to pay, for example, your electricity, water and telephone bills, you will have 40 days without interest on the value of your purchases.

exclusive discounts

Whoever has the Hipercard card has, in several stores in Brazil, several discounts that are exclusive to Hipercard customers.

Therefore, you will find several discounts at the following stores, which provide Hipercard users with many benefits: at Walmart Brasil stores, such as Walmart, Bompreço, Hiper Bompreço, BIG, Mercadorama, etc.

Invoice amount of the Hipercard card

With the Hipercard card, you have the possibility to pay at least 17% on the invoice.

That is, you will not be required to pay the entire invoice amount at once and you will still be able to choose any amount between the maximum and minimum statement.

Versatility

You can, using the Hipercard card, pay your invoice directly at Walmart stores and also at any bank.

This makes it easier for consumers to choose where to pay.

Get to know Hipercard

First of all, the company was created in 1969, showing that, due to its duration and stability, the company has a great tradition and, above all, a professionalized work system.

One of the company's main factors is its partnership with Redecard (an Itaú company), which makes Hipercard reach even more establishments.

Card fees and charges

If you pay all fees on time, Hipercard may not charge you a fee. However, if the company buys it, it will be a very low rate.

For sending the duplicate with the credit function, Hipercard charges around R$9.90 reais.

Also, the company allows cash withdrawals. For this, it charges around R$12.00 reais in Brazil and, abroad, around R$22.00. Remembering: these values are for each operation.

Customers can get a general credit assessment, free of charge.

However, for sending automatic messages, the company charges its users a fee of R$5.50 per month.

Is it worth having the Hipercard card?

As said, the Hipercard card has its own flag. This, despite the fact that some places do not accept it, means that fees and tariffs are not charged.

In addition, the card provides its users with the possibility, if a product cannot be paid in cash, to be paid by card.

The International Card, on the other hand, is Mastercard and has a small annual fee, this is also a good option if you like all the benefits of the network.

What is the card limit?

The Hipercard card provides two types of limits to its consumers.

For cash purchases, the first limit is the same as most common cards.

The second limit, however, is exclusive to those who make purchases in installments. With the second option, the card will be able to make purchases with amounts greater than the first option.

There is no fixed limit, it depends from person to person. However, the average value is usually R$800.00 reais.

If the customer wants to increase the limit or even adapt it, he will need to call the Customer Service Center.

How does the card bill work?

The invoice will, until the due date, be sent to the customer's address.

Therefore, it is very important that the user has informed the company of all his residential data.

Also, if the customer has changed address, he must immediately inform the company so that his data is updated.

If the customer has not yet received the invoice by the due date, a duplicate may be requested via the Hipercard website, the NAC (Walmart customer service center) or by calling the Hipercard call center.

The customer, if he so wishes, may pay the credit card bill at any other bank and also at any of the cashiers of the Walmart Brasil Network.

Finally, Banco Itaú account holders can also request that the invoice be deducted from automatic debit.

How do card fees and fees work?

As informed, the minimum invoice payment is approximately around 17% of the total amount.

As much as this is a positive factor, you must be careful not to fall into revolving interest, resulting in the accumulation of debt for the following month.

So, the customer, in the next month, will pay 10.23% of revolving interest.

How is the service provided by the Hipercard card?

For the customer to contact Hipercard, he must speak with the company's Call Center. It is also possible to do this through the Mastercard APP.

In addition, it is possible to contact the company through other affiliated stores, such as, for example, Walmart, BIG, Bompreço, Hiper Bompreço, etc.

Finally, another way to talk to the company is through Reclame Aqui, which, according to what many customers say, is a good platform to solve their problems.

Find out more about the advantages of the Hipercard Card

In addition, if you want to learn more about all the advantages of the Hipercard Card, click on the button below and we have all the detailed advantages of the Card, which can help you understand whether or not it is a good option for you.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to increase the score with Serasa Score Turbo

Learn how to quickly increase your credit score with Serasa Score Turbo and take care of your financial health again. See here how!

Keep Reading

PagBank card with digital account

Meet the PagBank card with digital account. With it, you can do your day-to-day shopping and you can also control everything through the app. Check out!

Keep Reading

All in Roxinho: how does the Nubank promotion work?

Now your purchases at roxinho can be worth money to you! Find out here how this is possible with the Tudo no Roxinho promotion.

Keep ReadingYou may also like

Discover the Discover It Cashback credit card

A simple credit card with good conditions and no annual costs. This is Discover It Cashback. Want to know more about it and the advantages it offers? Follow here.

Keep Reading

How to open a BIG 100% current account

For those looking for a complete current account, with no bureaucracy and no maintenance fee, the BIG 100% current account could be perfect. Check out, in the following post, how you can make yours.

Keep Reading

Real Estate Auction Offers Amazing Discounts In March!

For those who want to fulfill the dream of owning their own home, the real estate auction can be an excellent alternative. In this sense, several online platforms are offering properties with discounts of up to 80%! Check more here.

Keep Reading