Cards

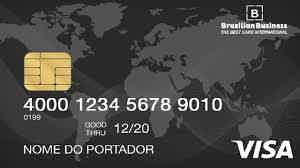

Discover all the features of the BBB card

If you want a card for those who are negative, it doesn't require proof of income or analysis of the CPF, the Brazilian Business Bank card can be your choice.

Advertisement

BBB card features

Discover the main characteristics and advantages of the BBB (Brazilian Business Bank) card, which is growing more and more in the Brazilian market.

This card is advantageous for almost everyone who wants to do it. However, if you have a dirty name, know that this is the ideal product for you.

While most companies do not let people with a dirty name make their card, Brazilian Business Bank allows the person to make the card, even with a dirty name.

In addition, you do not need to provide proof of income and the company also does not carry out any credit analysis to approve your application for the card. So how about knowing more about him? Check out!

How to apply for the BBB card

Check out the Brazilian Business Bank credit card and how this option can be ideal for your case.

| Monthly payment | R$7.00 reais |

| minimum income | is not required |

| Roof | International |

| Flag | Visa or Mastercard |

| Benefits | Several discounts from Visa or Mastercard partner stores, etc. |

How does the BBB card work?

If you open a digital account with the BBB, you will soon become a bank customer.

As mentioned, in order to use the card and enjoy all its benefits, you need to recharge it monthly.

For this, you have to pay a bill whose value is around R$7.00 reais.

Payment of the bill must be made at an ATM, through the card application and even through Internet Banking.

The card has international coverage. So, you can access products and services that are only found in countries abroad, that is, in countries outside Brazil.

In addition, you have either the Visa flag or the Mastercard flag. However, you cannot, unfortunately, have both at the same time. It is therefore up to your taste to choose which flag to use on your card.

Regardless of your choice, you will have access to one of the best flags on the current market, since, currently, almost all stores and establishments in Brazil and the world have these two flags.

After all, it's hard to see a company that doesn't accept one of these flags, isn't it?

Finally, before proceeding, know that you can also apply for a personal loan, being able to receive an amount from R$500.00 reais to even R$3,500.00 reais.

Advantages of the BBB Card

As mentioned, you have the option to choose either Mastercard or Visa.

With them, you will be able to access most of the stores in the Brazilian territory, because, currently, almost all of them accept these two flags.

Furthermore, since the card has international coverage, you can purchase services and products in countries other than Brazil, doing all of this with the Mastercard or Visa flag.

So, it's up to you to choose which flag your card will be.

However, regardless of your choice, you will be able to access all these benefits mentioned above.

What are the disadvantages of the BBB card

Unfortunately, in order to use the Brazilian Business Bank card, you have to pay some fees and charges.

See below the main rates and fees that the card charges.

- Monthly fee: R$7.00 reais;

The Brazilian Business Bank card has several features, which we have previously discussed.

See below the main advantages and benefits offered by the card.

- Recharge fee: R$3.25 reais;

- Maintenance fee: not required;

- Fee for TED/DOC transfer: R$9.80 reais;

- Membership fee: R$39.00 reais;

- Statement issue fee: R$1.25 reais;

- ATM withdrawal: R$9.80 reais.

Is it worth getting the BBB card?

If you have a dirty and negative name, this card is one of the best options on the market.

Even having to pay several fees and fees, this card is very good, especially if you are in the condition mentioned above.

How to apply for the BBB card?

Did you like the card and its main features? Then click the button below and learn how to order yours.

How to apply for the BBB card

Check out the Brazilian Business Bank credit card and how this option can be ideal for your case.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Ourocard Universitário Card or CEA Card: which one to choose?

In order for you to decide between the Ourocard Universitário card or the CEA card. Get discounts, don't pay annuities and much more!

Keep Reading

Atacadão Card or Vooz Card: which is better?

What is the best option between the Atacadão card and the Vooz card? Both have international coverage and exclusive benefits! Check it out here!

Keep Reading

Atacadão card or Marisa card: which is better?

How about deciding between cards with an international flag, discounts and low annual fees? So, learn more about the Atacadão card or Marisa card.

Keep ReadingYou may also like

Discover the Sicoob Classic credit card

Meet the Sicoob Classic credit card. With it, you will be able to participate in two benefit programs at the same time, in addition to other unmissable advantages. Check out all about it here!

Keep Reading

Get to know Neon digital account

If you are looking for a free and practical digital account to use, then meet the Neon digital account. No annual fee or opening fee. Learn more here!

Keep Reading

Discover the Samsung Platinum Credit Card

Samsung Platinum credit card is a novelty in the Brazilian financial market of cards with no annual fee. Click and learn more!

Keep Reading