loans

Learn about Leroy Financing

Find out about Leroy financing and how it can help you buy those materials and pay for services you need so much! Check out!

Advertisement

Leroy Financing

At first, having a type of credit that allows you to make your purchases is a great proposal. With that in mind, Leroy financing brings a personal credit modality to be contracted with the Célebre card.

Therefore, this card that is part of Leroy Merlin stores has several advantages, as we will show you later. So keep reading until the end to find out how this financing can help you! Check out!

How to apply for Leroy financing

Learn how to apply for Leroy construction financing and other useful information about this financing so you can buy everything you need and finish

How does Leroy financing work?

So, the Célebre credit card was created to bring exclusive conditions to consumers who shop at leroy merlin stores, as well as at establishments that accept cards with the Mastercard brand.

In this regard, it is a card that has no minimum income, low annuity, international coverage, and simple application!

So, on the first purchase made at any of the Leroy Melin stores, the consumer has a 5% discount.

As well as advantages beyond the initial limit for purchases in installments at Leroy, purchase installments of up to 30 installments, and various discounts at partner stores.

In this regard, one of the exclusive conditions is the personal credit that can be contracted with the Célebre card.

That's because, with the card, you can access Leroy financing when shopping for construction material at Leroy Merlin stores!

So, it is nothing more than a granting of credit to acquire goods at Cetelem's partner establishments, and the installments are paid to Cetelem!

Financing worth it?

A loan is worthwhile for you to acquire a property or good of high value, being able to start living now. Learn more in our article below!

What are the advantages of Leroy Financing?

Well, customers have access to Leroy financing, which is a line of credit to help when buying materials for the complete renovation of the house!

In addition, the customer can request withdrawals through the Cetelem application, by telephone or at Banco 24 Horas.

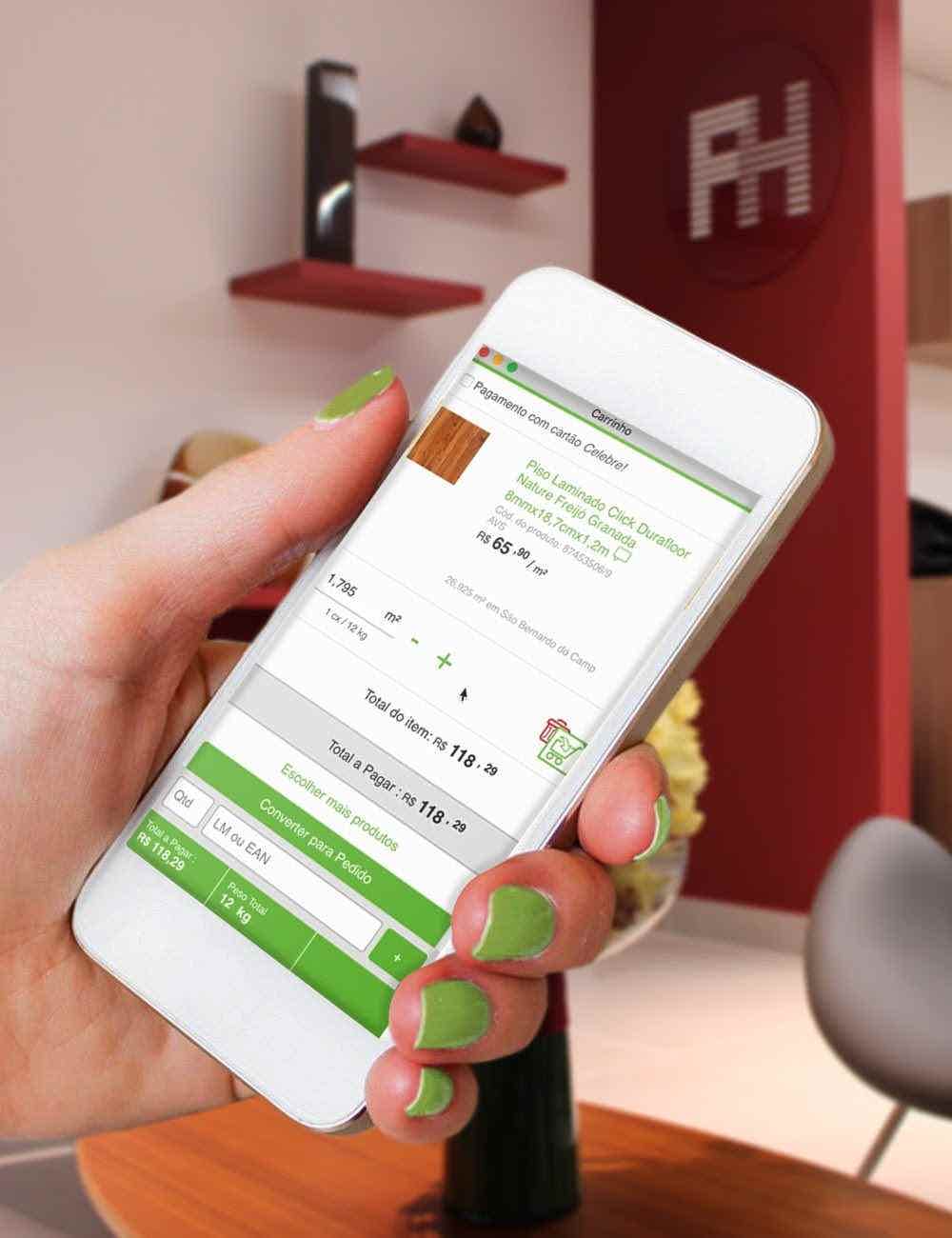

Another advantage is that you can control and organize all movements on the Cételem card, as well as consult limits and the best day of purchase on digital channels such as the Cetelem app, whatsapp and the Cetelem Online website.

What are the downsides?

Among the disadvantages of Leroy financing, we have the credit approval analysis that is usually very careful, as well as, it has interest rates and fees at the time of hiring!

Therefore, it is necessary to consult the conditions, interest rates, and the Total Effective Cost of the operation before contracting Leroy financing!

How to contract financing?

Well, the hiring will be done at partner establishments and the conditions vary according to each establishment and the purchase price.

In this, payment can be made in up to 36 installments and there may be a hiring fee and interest rates that will be informed at the time of hiring.

It is important to mention that, in order to contract the credit, you must have access to the Célebre card. To request the Célebre card, just go to one of the Leroy stores.

So, just go to the store with ID with photo, CPF, proof of residence and income, and if you have any questions, you can contact Cetelem bank.

Is Leroy financing worth it?

So, based on our research, this financing is worthwhile as it works as a proposal to simplify the purchasing process for Leroy customers.

But, like any other type of credit, it also has its negative points.

Therefore, before hiring, make an analysis of all the pros and cons of Leroy financing, to then make your decision! Good luck!

How to apply for Leroy financing

Learn how to apply for Leroy construction financing and other useful information about this financing so you can buy everything you need and finish

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Which bank has the lowest interest rate for a 2021 loan?

Do you know which bank has the lowest interest rate for a loan? So let's tell you so you can compare! Check out!

Keep Reading

BrasilCard balance: how to check?

If you have a BrasilCard card, you certainly want to know the balance available for purchase. So, read this post and check out how to do this query.

Keep Reading

Mister Panda Recommender – Clerk

Check out all the information about the clerk's job, here you can find out about the functions and how to find vacancies

Keep ReadingYou may also like

How to open an OpenBank Savings Account Welcome

Check out how to open your OpenBank account Welcome and start your savings without having to pay maintenance commission and with remuneration of up to 2% (TANB) in the first semester of the contract. Learn more in the post below.

Keep Reading

Discover the Easy Credit Card

Want to start 2021 with more financial autonomy? Meet the Easy credit card, a good option for those with a low credit score.

Keep Reading

Platinum credit card: which is the best option?

Platinum credit cards offer many benefits to their users. In summary, they can be quite interesting for those looking for a plastic with travel advantages. Interested? Continue reading and learn more about the models available on the market.

Keep Reading