loans

Get to know the Decolar personal loan

The Decolar personal loan can help you finance your trip or get out of the red. Additionally, you can use a credit of up to R$ 25 thousand and pay in installments via bank slip in up to 24 installments. Check out more here!

Advertisement

Take off: the ideal loan for your trip with installments in up to 24 installments

Firstly, the Decolar personal loan is the ideal solution for you who want to finance a trip or need a line of credit to pay off your debts.

So, how about finding out a little more about this financing and evaluating whether it meets your financial needs? So, let's go!

How to apply for the Decolar loan

The Takeoff personal loan is the solution for you to finance your next trip! Want to know how to apply? So check it out here!

How does the Decolar personal loan work?

Initially, the loan is made through Koin, the official fintech payment method of the Decolar group. In fact, fintech uses a credit analysis method known as “machine learning”. In other words, approval of your profile is faster and does not require any guarantee.

Furthermore, you can pay the installments via bank slip in installments. Therefore, you do not need to use your card limit.

However, a credit analysis is carried out to check whether you fit the profile that the company requires.

What is the Decolar personal loan limit?

As of now, the maximum amount that the company offers in the loan is R$25,000.00. However, it all depends on the credit assessment carried out by the fintech at the time of the request.

So, after approval of your proposal, you already know how much limit you have. Furthermore, at this point it is also possible to find out what the interest rates and payment deadline are.

Is Decolar personal loan worth it?

First of all, it is important to remember that when applying for a personal loan, you need to have a financial plan to make sure you can afford the monthly installments.

Furthermore, Decolar does not offer this financing to those who are negative. Therefore, if you have any restrictions on your name, you will not be able to apply for the loan.

Certainly, the Decolar personal loan is a great credit line option. In this sense, the limit value can reach up to R$ 25 thousand and interest rates start at 1.29% per month, which is an additional attraction. Furthermore, the payment term is flexible and the first installment is only charged 45 days after contracting. In other words, more time for you to organize your budget.

Furthermore, the entire process is carried out by Koin in partnership with SIM, Grupo Santander's lending platform. This way, you don't have to worry about the company's credibility and can make your request with peace of mind and security.

How to get a Decolar personal loan?

So, applying for your Decolar personal loan is very simple. Next, we’ll show you how to apply for this personal line of credit and turn that dream trip into reality!

First, you need to access the official Koin website. Then, you choose the amount you want and fill in some registration details. Once this is done, fintech's artificial intelligence analyzes your credit profile and you can find out if your request was accepted.

Therefore, if the request is approved, you are directed to fill in the rest of the necessary details. Finally, if all the data meets the company's requirements, the money will reach your account within 3 business days. Easy, right? And the best: no bureaucracy.

Well, if you liked the Decolar personal loan and want to know how to apply for yours, check out the recommended content below and stay up to date with all the details.

How to apply for the Decolar loan

The Takeoff personal loan is the solution for you to finance your next trip! Want to know how to apply? So check it out here!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Secure borrowed money: how to get it?

The online loan came to simplify your life and optimize your time. Want tips on how to get personal credit online? Check out!

Keep Reading

Saraiva Card or BBB Card: which is better?

Either the Saraiva Card or the BBB Card, both are international credit cards that offer several advantages to their customers. Check out!

Keep Reading

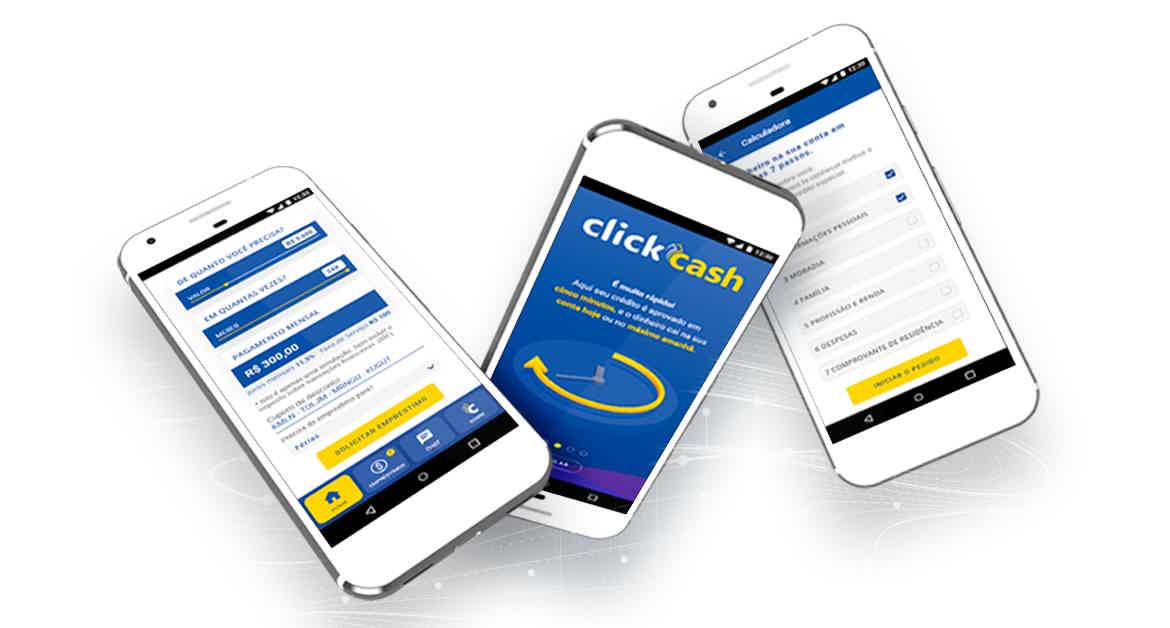

Click Cash personal loan: what it is and how it works

The Click Cash personal loan is the perfect line of credit for those who need financial assistance without bureaucracy. Want to know more? Check out!

Keep ReadingYou may also like

Discover the Ourocard Visa TravelMoney

Likes to travel? Then you need to know the Ourocard Visa TravelMoney credit card that allows you to fully control your expenses through the app.

Keep Reading

Find out about Cofidis personal consolidated credit

In short, Cofidis personal consolidated credit is the perfect way to organize your pending financial matters! Do you want to see it? So, check out the content we've prepared below!

Keep Reading

Ordering food has never been so easy! Get to know the delivery apps and kill hunger in one click

Delivery apps are platforms that connect users to a variety of restaurants allowing them to order food and have meals delivered directly to their homes or desired locations. Learn about app options here.

Keep Reading