loans

Discover the Click Cash personal loan

The Click Cash personal loan is ideal to get your plans off the ground. With it you can get up to R$ 10 thousand to pay in up to 24 months with an interest rate of up to 14.9% per month. Learn more here!

Advertisement

Click Cash: immediate approval and money in the account within one business day

First, the Click Cash personal loan is a great opportunity for anyone who needs quick cash without bureaucracy.

So how about getting to know a little more about this line of credit and assessing whether it meets your financial needs? So come with us!

How to apply for the Click Cash loan

The Click Cash loan can be the ideal solution to help you invest in your dreams! Want to know how to apply? Check it out here!

How does the Click Cash personal loan work?

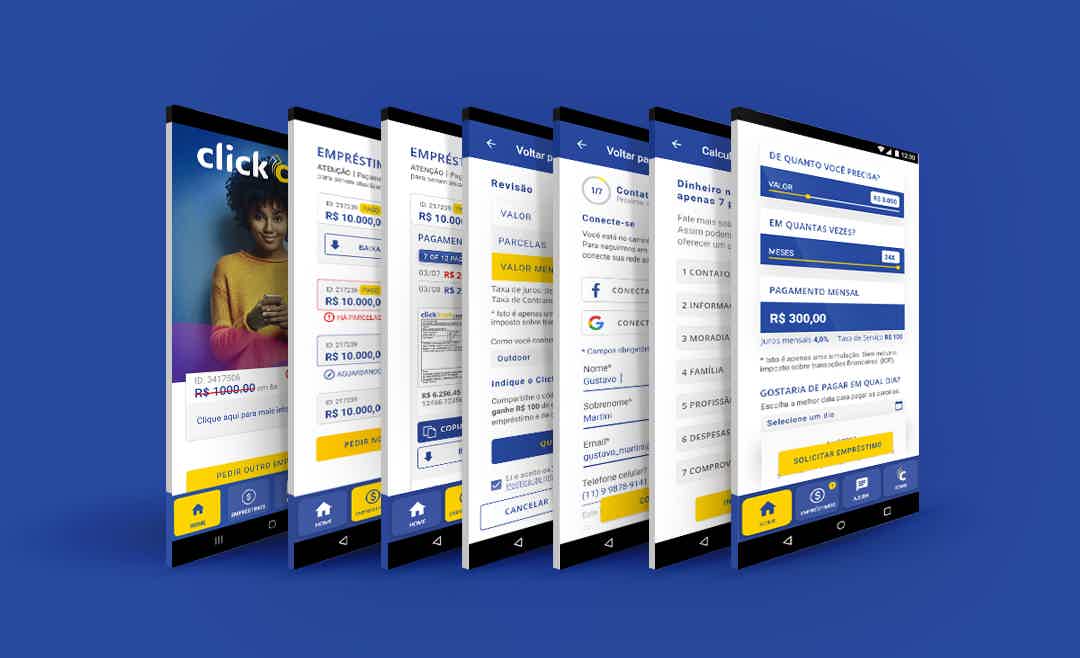

At first, the loan works digitally. I mean, everything is done through the application, from the request to the payment of installments.

In addition, payment can be made via bank slip, which is generated by the application itself and made available 5 days before the due date. Or, if you prefer, you can pay via bank transfer.

However, to apply for your credit line you must be over 21 years old and must not be in default.

What is the Click Cash personal loan limit?

Well, your loan limit can vary between R$1,000 and R$10,000, but it all depends on the credit analysis that is carried out in your profile after requesting the desired amount.

That is, after your proposal is approved, you already know how much limit you have and what the interest rates will be, in addition to the term for payment of the installments.

Is the Click Cash personal loan worth it?

Therefore, it is important to remember that when applying for a personal loan, you need to make sure that you have adequate financial planning to fit the amount of the installments into your budget.

First of all, Click Cash does not offer this line of credit to those with a negative name, so you need to make sure you don't have any outstanding debt.

Without a doubt, the Click Cash personal loan offers a very attractive proposition. The limit amount can reach up to R$10,000 and the interest rates vary between 4.0% and 14.9% per month, which is adequate compared to other companies of its kind.

Furthermore, the payment term is flexible and the first installment is only charged after 45 days. That way you have more time to organize your finances with peace of mind.

In fact, everything is done digitally and securely, as Click Cash works as a banking correspondent authorized by the Central Bank. It's much easier and safer in the palm of your hand, isn't it?

How to make a Click Cash personal loan?

So applying for your loan is very simple. Next, we'll show you step-by-step how to apply for this personal credit line and start turning your dreams into reality!

First of all, you need to download the app on your phone. Then you choose the amount and amount of installments you want to pay. Once this is done, it is necessary to fill in the registration form with your personal data and in a few minutes Click Cash will analyze your profile.

So, do you want to know more details on how to apply for your Click Cash personal loan? Check out the recommended content below.

How to apply for the Click Cash loan

The Click Cash loan can be the ideal solution to help you invest in your dreams! Want to know how to apply? Check it out here!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to enroll in the CadÚnico Program

Signing up for CadÚnico can be very simple. In today's article we will show you the step by step to sign up. Check out!

Keep Reading

How to apply for the PicPay card

The PicPay card has benefits for its customers, the main one being the practicality and ease of ordering yours online. See how!

Keep Reading

Get to know Serasa Limpa Nome

Tired of being in the red for being negative? Get to know Serasa Limpa Nome and find out how the site can help you improve your finances.

Keep ReadingYou may also like

Nubank application experiences instability in its services on Friday morning

Although technology is a great ally in the routine of millions of people around the world, operational failures are still constant in this environment. Last Friday, Nubank presented instability in several services and left its customers in a state of alert. See more here!

Keep Reading

Check out Paris Hilton's favorite investments in the cryptocurrency segment!

After achieving fame by participating in a reality show in the early 2000s, Paris Hilton seems to have found her calling in the world of cryptocurrencies and NFTs. Check out the socialite's favorite projects and investments right now.

Keep Reading

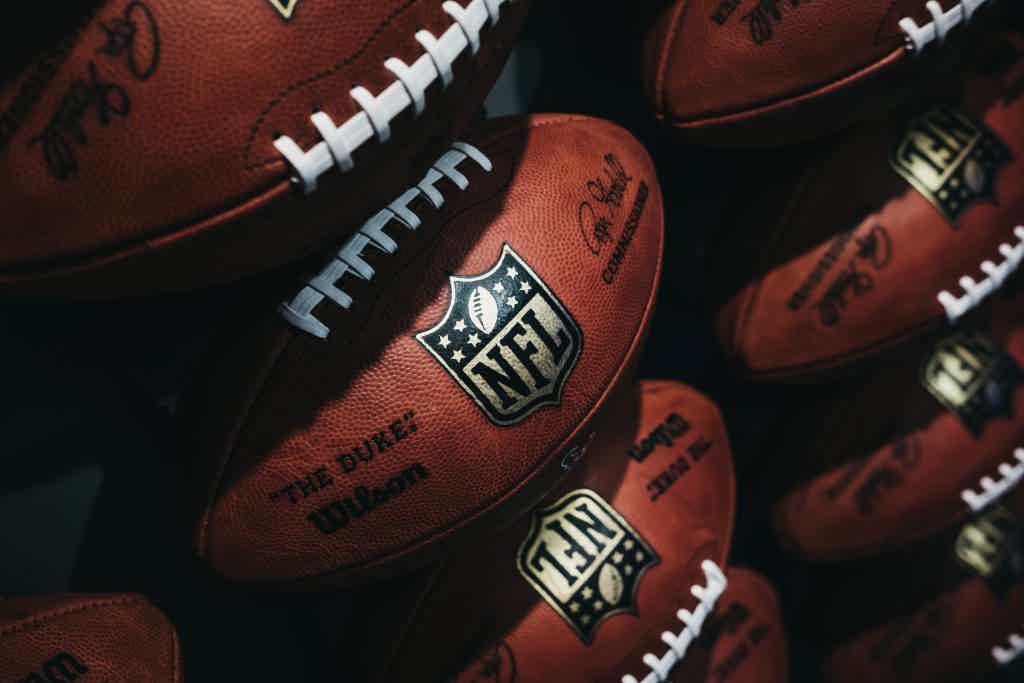

Don't miss any bids! Discover the best app to watch the NFL live here

Here's how to follow all the games and enjoy live streams, replays and in-depth analysis. Don't miss out on the football excitement, stay connected to the action with these apps.

Keep Reading