loans

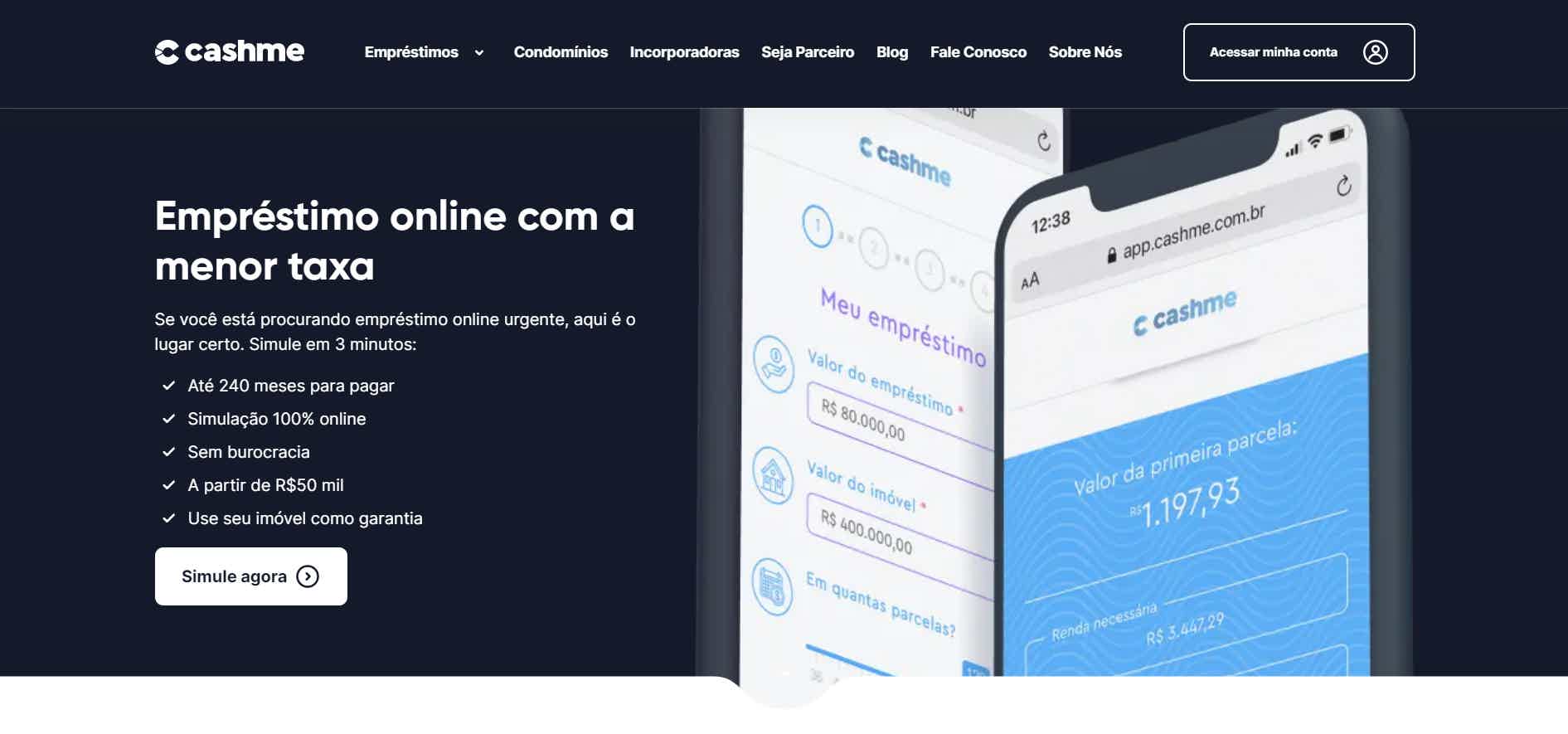

Discover the Cashme personal loan

Get to know the Cashme personal loan and see everything about this credit offered by fintech for over 50 years in the market with all the security, convenience and credibility you need. In addition, you have terms of up to 240 months to pay.

Advertisement

Cashme: learn all about this loan with the most competitive interest rates on the market

The Cashme personal loan can be a great ally when it comes to paying off debts, investing in studies or making a down payment on a property. In the face of this, continue reading, and we will tell you everything about this credit, below.

How to apply for Cashme loan

Do you want a loan with a term of up to 240 months to pay and unique conditions for you? Then click here.

How does the Cashme personal loan work?

So, the Cashme personal loan is among the best on the market, because it is offered by a fintech with more than 50 years of existence.

Thus, it has all security, transparency and no bureaucracy, all you have to do is go through a quick and easy credit analysis.

And, in addition, through Cashme, you will find interest rates up to 12 times lower than other loans on the market.

It is worth mentioning that this is a loan with a property guarantee, that is, you need to inform the data of a paid off house or apartment in order to obtain the credit.

In addition, all your information is protected without you having to worry when passing on your data for the credit analysis.

Thus, it is enough to present your personal data and a bank account in your name to carry out the simulation and contract the credit. In addition, Cashme accepts negatives.

What is the Cashme personal loan limit?

Well, the Cashme personal loan limit is from R$50 thousand.

Thus, according to the analysis carried out through the information you pass on during the simulation, the values will be established.

Is Cashme personal loan worth it?

Check out the advantages and disadvantages of this loan below.

Benefits

In the quest to find a loan with credibility and security, we are faced with several alternatives without knowing which one is really a good option. Thus, we have brought you the Cashme personal loan so that you can evaluate all the advantages it has.

Initially, this loan has the lowest interest rates on the market, starting at 0.85% + IPCA, that is, it helps you get out of trouble without putting you in another debt.

And, in addition, the values are high, starting at R$50 thousand.

So, it's an ideal loan for you to renovate your house, pay for college or buy that car to help you work with an app, how about that?

In addition, this loan also has terms of up to 240 months to be paid off and you can apply for it completely online, without having to leave the comfort of your home.

Disadvantages

Despite having so many advantages, Cashme also has some disadvantages, such as the fact that it has a credit analysis that may compromise, for example, the access of people with low credit scores to Cashme's personal credit.

And, in addition, although the interest rates are low, the loan still has interest, which is one of the disadvantages.

How to get a Cashme personal loan?

Thus, to apply for a personal loan, just enter the official website of the institution, answer the questionnaire and wait for the analysis. To better understand the step by step, click on the recommended content below.

How to apply for Cashme loan

Do you want a loan with a term of up to 240 months to pay and unique conditions for you? Then click here.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to open a bank account

Learn how to open a Banco Pan account. It is free, digital and also has unlimited transfers and an emergency limit.

Keep Reading

How to request the Mercado Pago machine

Requesting the Mercado Pago machine is simple! Find out in this post how to do it through the company's official website in an easy and practical way!

Keep Reading

Superdigital personal loan: what it is and how it works

Check out the Superdigital loan that has extended terms to avoid default and assistance to make your life easier.

Keep ReadingYou may also like

IR 2022 extract for retirees and other INSS beneficiaries is now available for consultation

The rules for filing this year's Income Tax should be released later this week, and INSS policyholders can now access the benefit income information for 2021. See more here!

Keep Reading

IPVA 2021: everything you need to know

IPVA 2021 can be a headache if you forget or have many doubts and do something wrong. Reading our article can prevent all of that. Check out!

Keep Reading

What is and how to apply for a Permanent Land Certificate?

With the Permanent Property Certificate, you can certify the fiscal condition of a property: owner, taxes paid and due, pledge, mortgage, etc. See below how to request the document for your property or make an appointment online.

Keep Reading