loans

Discover the Agibank Personal Loan

Get to know the Agibank personal loan and understand how this ideal loan for negatives and pensioners can help you get out of the red!

Advertisement

Agibank personal loan

Initially, the Agibank personal loan is a quick and smart way to get money, being targeted at retirees, pensioners, military personnel and civil servants. So, get to know the Agibank loan and other information about this way to get money!

In this, in this loan you have from 3 to 72 months to settle your debt. So, continue reading to learn a little more about this loan, which despite having a high cost, is considered affordable!

How to apply for Agibank personal loan

Learn how to apply for an Agibank personal loan and other useful information about this loan, so that you can pay off all your debts!

How does the Agibank personal loan work?

Well, the Agibank loan is a line of credit aimed at pensioners, retirees, civil servants and the military, including those who have already used the payroll deduction margin!

In this regard, the loan is offered by Banco Agibank, where there is no consultation with credit bureaus such as Serasa and SPC.

In addition, customers pay the loan in fixed installments of up to 72 installments, with a payroll deduction or INSS benefit.

On the other hand, the Agibank personal loan does not yet accept freelancers, that is, it is necessary to have a registered work card.

Therefore, Agibank works to bring more security, practicality and comfort when paying off debts or looking for money to open a business! So, don't miss out on this great opportunity!

What are the advantages of the Agibank loan?

At the outset, the first advantage is that Agibank does not consult credit protection agencies, that is, for people with a dirty name, it is an excellent opportunity to get money.

And besides, with it you have from 3 to 72 installments to pay your credit, being one of the biggest on the market!

What are the disadvantages of the loan?

Well, the fact that it does not accept freelancers is a negative point of the institution, because only workers with a formal contract and public servants can have access.

As well as the effective cost of the loan is also considered high, because interest rates are variable, that is, it is not possible to know precisely how much the percentage will be.

Therefore, only apply for this Agibank personal loan if you really have the financial conditions to pay all the installments with the respective interest, otherwise, instead of becoming an option to resolve financial issues, you will create new debts!

Is Agibank loan worth it?

So, it is worth taking out the Agibank personal loan, as it is a great solution to resolve financial issues such as opening a business or paying off debts.

Therefore, it has a high number of installments and is still ideal for people with a dirty name.

And besides, it is a process that brings practicality and safety, as it can be done through the official website of the institution, just fill out the form and wait for the agency to return!

So, when it comes to choosing an agency that brings convenience and confidence to customers, Agibak has proven to be one of the best options on the market, as it offers different payment methods and is also a good option for people with a dirty name!

How to get an Agibank loan?

So, to apply for an Agibank personal loan, you must have your personal documents in hand and fill out the forms on the official website! Ready!

Therefore, when choosing to apply for an Agibank loan, make an analysis of your financial situation, to find out if this is a good solution for you and see if you meet all the criteria! So, now that you know how everything works, let's show you how you can access it!

How to apply for Agibank personal loan

Learn how to apply for an Agibank personal loan and other useful information about this loan, so that you can pay off all your debts!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Good loan for credit online: several options for reliable offers

Check out in this post how the Bom Pra Crédito online loan works and learn how you can apply for this personal credit option.

Keep Reading

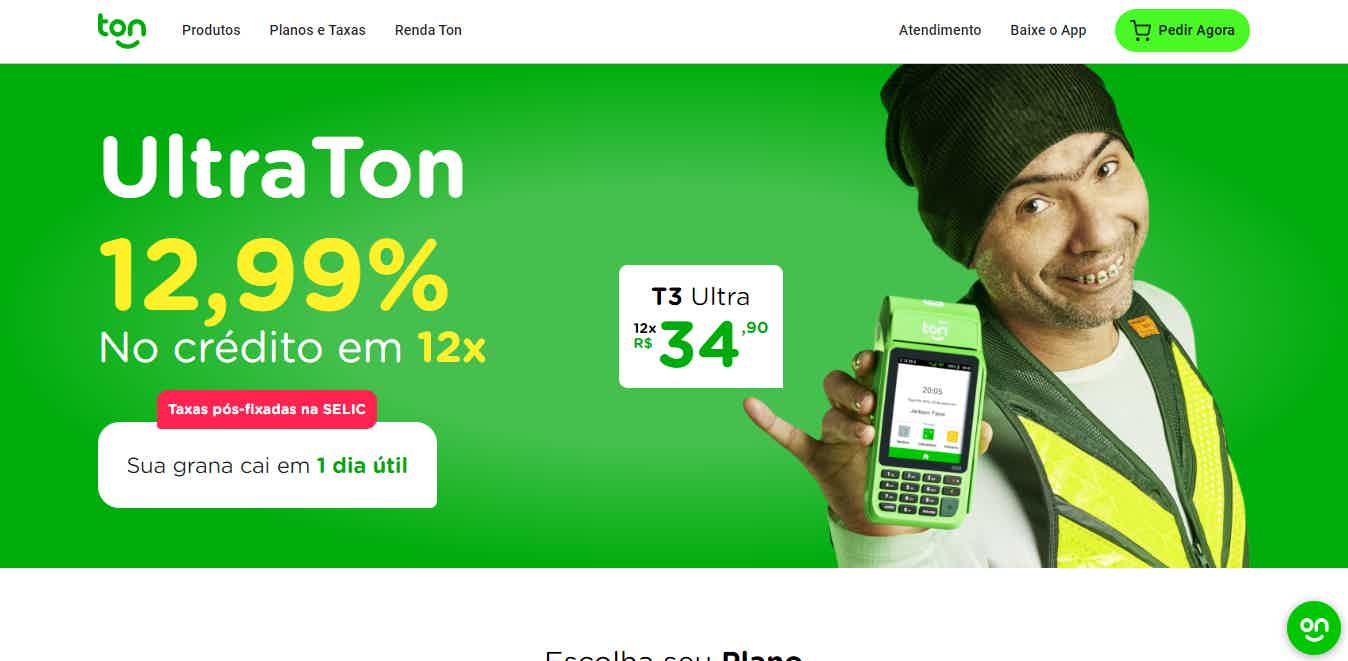

Discover the Ton card machine

Discover in this post more about the Ton card machine and all the benefits it can offer for different businesses!

Keep Reading

Find out about the Family Allowance Benefit

Today we are going to show you how the Family Allowance works and also help you understand who can receive this benefit. Check out!

Keep ReadingYou may also like

Discover how to make money with Itimania

Through Itaú's digital wallet, you can pay bills, make transfers and even pay at physical establishments using QR Code. In addition, Iti Itaú also offers a rewards program, Itimania. So you can earn money through the app!

Keep Reading

Pão de Açúcar Platinum credit card: coverage, annuity, benefits and much more!

How about knowing everything about the Pão de Açúcar Platinum credit card to decide if applying for this card is a good choice for you? We have gathered here in the article all the information on the subject. So keep reading ahead to find out more!

Keep Reading

Santander shares operate lower after bank reports results below market expectations

Santander bank securities fell by around 3.36% on the afternoon of last Wednesday and operated in a fall on the Stock Exchange. However, experts point to favorable results for the future. Check more here!

Keep Reading