loans

Discover the Egoncred online loan

Get to know the Egoncred online loan and see if this loan is what you need right now! Ah, he is ideal for negatives! Check out!

Advertisement

Egoncred online loan

So, the Egoncred online loan is an ideal loan modality for people who have a dirty name and need credit in the market! And in addition, he has a term of up to 60 months to pay and low interest rates!

So read on to find out what this loan has to offer! Check out!

How to apply for the Egoncred loan

Do you want to learn how to apply for the ideal Egoncred loan for negatives and with quick release? Then continue reading to learn the step by step!

How does the Egoncred online loan work?

So, the Egoncred online loan is a type of credit that can be applied for by civil servants, retirees and INSS pensioners.

And in addition, it has a secure credit analysis and does not consult credit agencies such as SPC and SERASA, that is, negatives can have access to the loan!

It also has low interest rates and the installments are deducted directly from the applicant's payroll without charging guarantee fees for loan approval!

What is the Egoncred online loan limit?

So, the loan limit will depend on the credit analysis carried out by the institution!

Is Egoncred online loan worth it?

Well let's know the advantages and disadvantages of this loan! So check it out!

Benefits

So, Egoncred has several advantages, for example, direct payroll deduction and up to 60 months to settle! In this, municipal, state and federal public servants, members of the armed forces and private companies with agreements can access the loan.

Another advantage is the direct debit: In it, there is no consultation with the SPC and SERASA, and the discount happens on the current account every month, being ideal for negatives!

And Egoncred also has a check loan in which the sheets are used to pay the installments in the chosen amounts and dates!

And yet, approval is immediate with up to 24 months to pay, with the first installment after 60 days!

Disadvantages

So, one of the biggest disadvantages of the loan is the restriction of people who can access the loan!

How to make an Egoncred loan online?

So, you can apply for the Egoncred loan online at one of the financial branches, as well as through the internet! And so, you will have access to a quick analysis process, without bureaucracy and, totally safe to settle your debts!

How to apply for the Egoncred loan

Do you want to learn how to apply for the ideal Egoncred loan for negatives and with quick release? Then continue reading to learn the step by step!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to become an iFood delivery person?

Discover the main requirements to be an iFood delivery person and how much you can earn by working with the app!

Keep Reading

Discover the C&C credit card

The C&C credit card is one of the products of the Casa e Construção C&C store, which allows its customers to benefit from purchases on the network.

Keep Reading

Discover the Social Water Tariff benefit

With the Social Water Tariff benefit, you get incredible discounts and better quality of life for your family! Learn more right now.

Keep ReadingYou may also like

Credit or debit: what is the best way to pay for purchases?

If you want to use your cards correctly, it is important to understand the main differences between credit and debit. To learn more about each modality, just continue reading the article!

Keep Reading

How to apply for City Furniture card

Do you want to buy your furniture and decorations with discounts, safely and without worrying? So, check here how to apply for the City Furniture card and take advantage of the discounts and special conditions for store customers.

Keep Reading

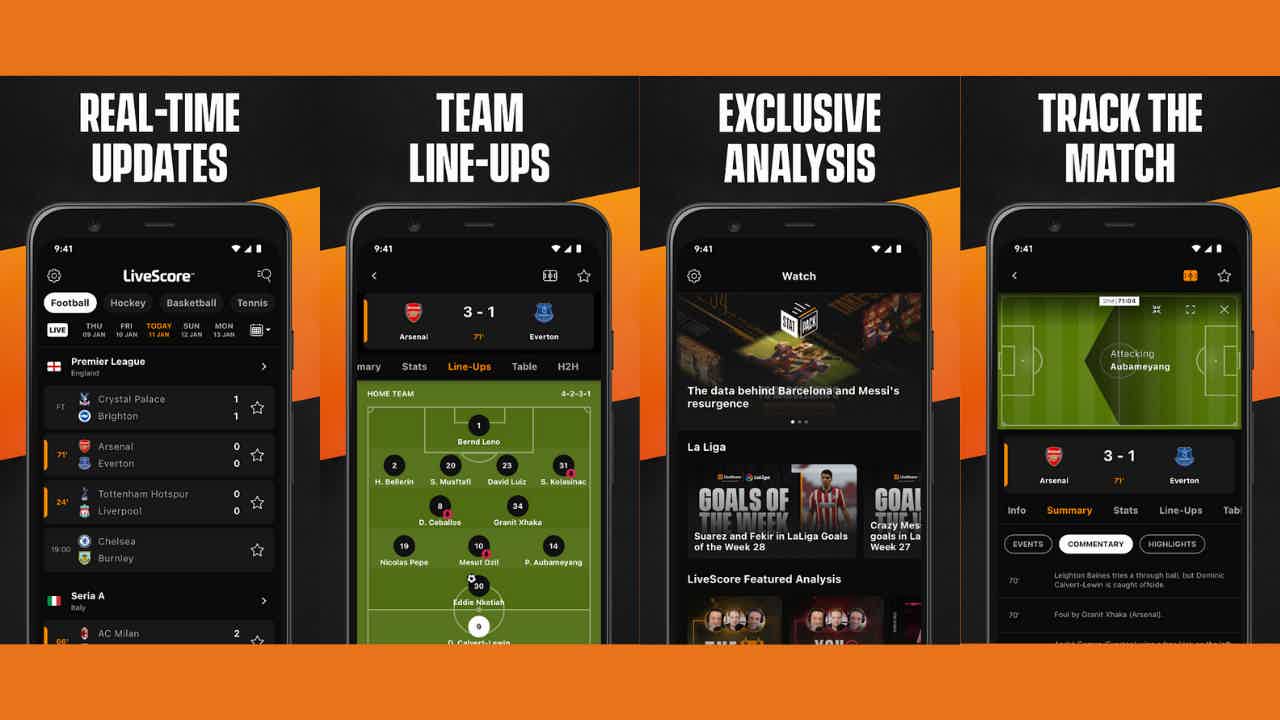

Discover the LiveScore app

Anyone who is a football fan will love discovering the LiveScore app. After all, it brings current information on more than 1000 matches per week! Find out more now and read the article until the end to find the link and download this amazing application.

Keep Reading