loans

Discover the Bcredi online loan

Get to know the Bcredi loan and see if this loan is what you need right now! Ah, he has property guarantee! Check out!

Advertisement

Bcredi online loan

So, the Bcredi online loan is a type of credit that works with the guarantee of residential and commercial property, as well as reduced interest rates and a safe and bureaucratic process. And so, it brings security, comfort and accessibility when applying for a personal loan!

So read on to find out what this loan has to offer! Check out!

How to apply for the Bcredi loan

Do you want to learn how to apply for the Bcredi loan with extended terms, quick release and property guarantee? Then continue reading to learn the step by step!

How does the Bcredi online loan work?

Well, the Bcredi online loan works with property given as collateral, so the customer presents a property that will be given as collateral for payment of the loan, which can be residential or commercial and the loan limit is from R$30 thousand to R$2 million, depending on the property value.

And so, with the guarantee, interest rates will reduce, because Bcredi becomes more confident that the installments will be paid within the stipulated period through the signing of the fiduciary alienation term that proves that the property will be given as guarantee and thus reduces the interest rate, which reaches 0.8% per month!

What is the Bcredi online loan limit?

So, the Bcredi online loan has a high limit of R$ 30 thousand to R$ 2 million, because it will depend on the property given as collateral!

Bcredi online loan worth it?

So let's know the advantages and disadvantages of this loan! Check out!

Benefits

So, the first big advantage of the Bcredi online loan is that the process is completely online and you receive property given as collateral, which can be commercial or residential.

Furthermore, installment payments range from 36 to 120 installments on the Price Table, and from 36 to 180 installments on the SAC Table.

As well as payment of the first installment only after 180 days! And you still have credit that can reach R$2 million reais, depending on the property!

Another advantage is that the property does not need to be paid off, as well as, it can be in its own name, third parties or with a tenant.

Also, it accepts proof of up to 4 combined incomes from Individuals or Legal Entities! Therefore, the loan has several attractive advantages!

Disadvantages

Well, one of the biggest disadvantages of the loan is the property given as collateral, because if you don't have any property, unfortunately you won't be able to apply for the loan!

How to make a Bcredi loan online?

So, to make the loan is very simple! That's because, just access the Bcredi website and do the simulation and contracting of the loan that occurs 100% online and with all the necessary security! In this, you will have access to a fast, safe and full of exclusive advantages for customers!

How to apply for a Bcredi loan

Do you want to learn how to apply for the Bcredi loan with extended terms, quick release and property guarantee? Then continue reading to learn the step by step!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Tips for saving when paying off debt

Are you in the red and want to get out of this situation? Learn now the best tips for saving when paying off debt and adjusting finances

Keep Reading

How does the Casas Bahia digital booklet work?

Learn all about the Casas Bahia digital booklet and find out how you can make purchases in installments at the virtual store without having a credit card.

Keep Reading

99Food Delivery Driver: What you need to know

Find out what it's like to be a 99Food delivery person by getting to know this professional's routine better and checking out the advantages of this profession!

Keep ReadingYou may also like

How to apply for the More Card

Want a card that offers you more benefits? The name already suggests, the Mais! allows you to participate in the Surpreenda Mastercard and the Vou Pode Mais! Check out!

Keep Reading

WiZink Flex card online: zero annuity and limit of up to 6000 euros

The WiZink Flex online credit card is a good ally for your finances. For more information on the subject in order to decide whether to ask or not, just continue reading the article below. Check out!

Keep Reading

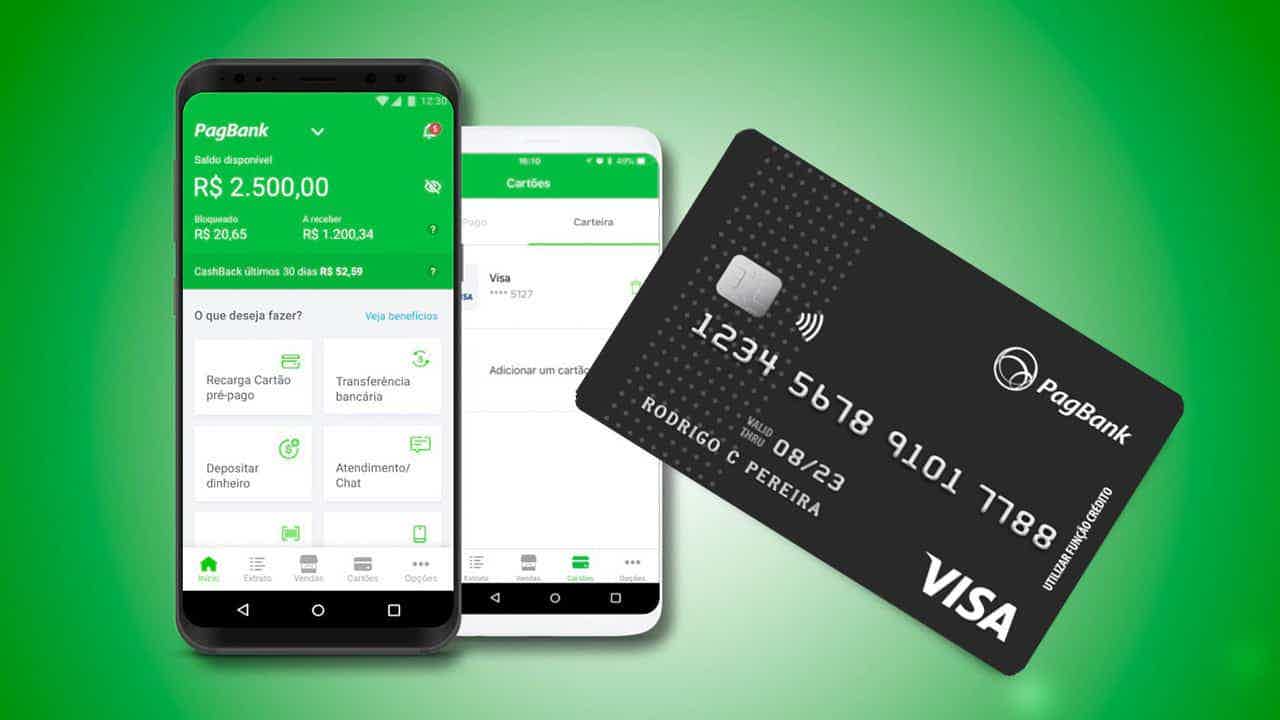

How to apply for PagBank card

Are you looking for a card with no annual fee, international coverage and that facilitates the payment of ride and streaming services? So, request your PagBank card now and enjoy all its advantages.

Keep Reading