Cards

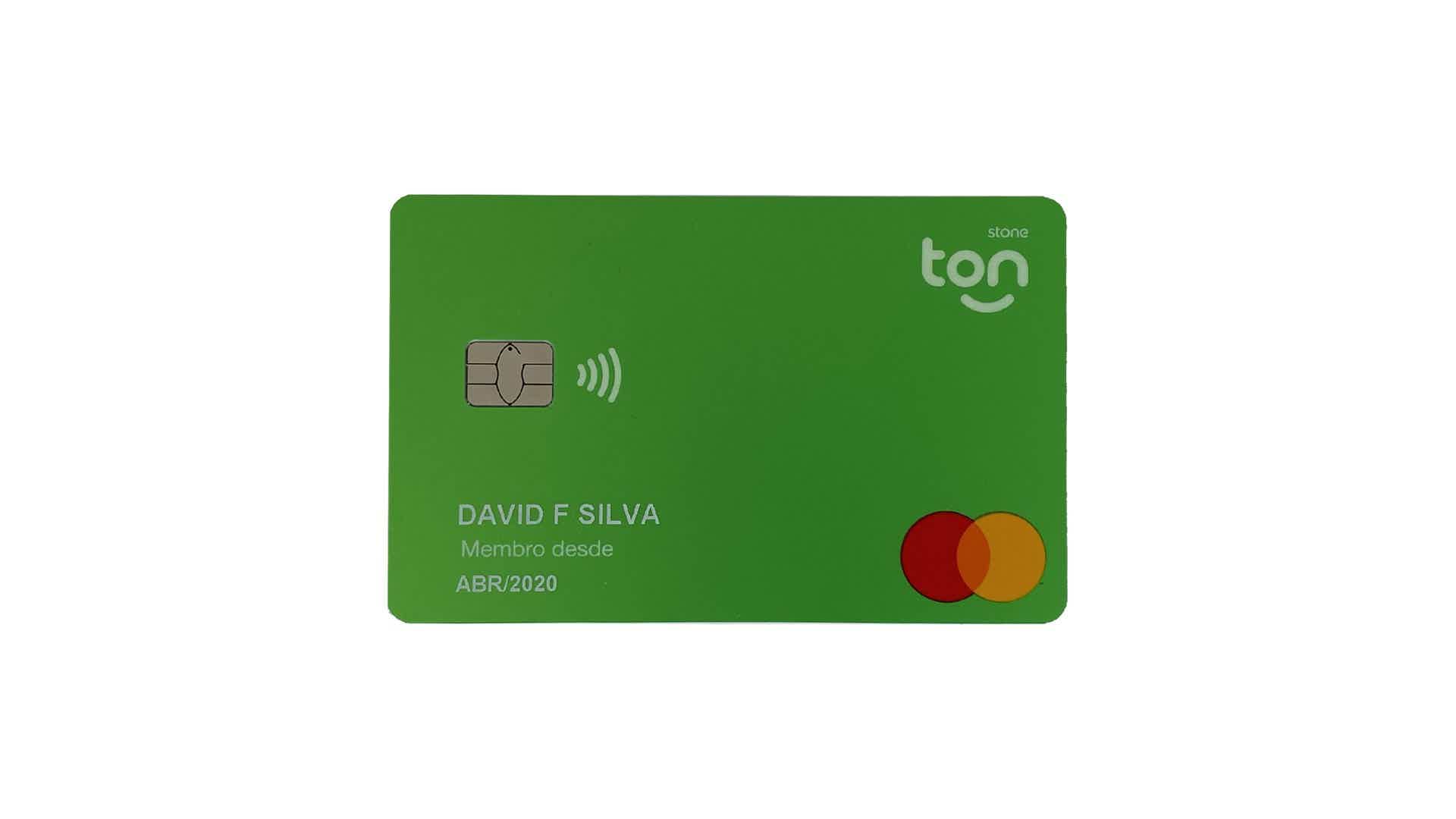

Discover the Ton credit card

Get to know the Ton machine card, ideal for individuals and companies that do not have a bank account, and want more practicality when taking care of their personal and business finances! Check out!

Advertisement

How does Ton credit card work?

Initially, the Ton credit card is a completely free card, with no annual fee and also features Contactless approximation technology (NFC). And in addition, the card brand is Mastercard, and has national and international coverage.

And so, you can shop on websites in Brazil and around the world, bringing more comfort when shopping. Another feature of this card is that it is linked to an application where you can access all your card information.

So, Ton is a great option for anyone looking for a more practical, safer life full of advantages to bring more comfort in their purchases and bill payment.

Therefore, see below some features that only the Ton card brings to you:

| Minimum Income | EXEMPT |

| Annuity | EXEMPT |

| Flag | MASTERCARD |

| Roof | International |

| Benefits | Annuity Exemption Minimum income exemption international coverage Application full of exclusive advantages approximation payment |

How to apply for the Ton card

Ton Card is a credit card option, free of annuity and minimum income, ideal for people who do not have bank accounts and want a versatile and secure card,

What are the advantages of the Ton card?

Well, let's get to know the advantages of the Ton credit card:

- Initially, the first advantage is the absence of annual fees, as well as the absence of maintenance fees for this card. This is because, the absence of annuity and fee-free acquisition, allows users to enjoy more benefits;

- Another advantage is the national and international coverage that the Mastercard brand offers. That is, it allows users to make purchases in Brazil and in other countries;

- And in addition, it has the Contactless approach payment method (NFC), that is, technology working in your favor;

- Another advantage is that the card only has fees of R$ 7.50 per withdrawal charged by Banco24H, and IOF in the case of withdrawals or international purchases;

- And you can also make a withdrawal at Banco24Horas and the Cirrus network, as well as password protection and, in case of loss, it can be blocked by the application itself.

Therefore, the Ton card is a great investment, since in addition to so many advantages, it allows you to stay safe and protected through a personalized password to protect yourself from loss, theft and theft, as well as situations that may cause the card loss.

What are the downsides?

Well, the biggest disadvantage we found with this card are the fees charged for withdrawals of R$7.50 per withdrawal charged by Banco24H, and IOF in the case of withdrawals or international purchases. However, it is still a good alternative since it does not have other fees.

Ton is it worth it?

Well then, according to our analyses, it is worth applying for the Ton card. This is because it does not have acquisition and maintenance fees, as well as low withdrawal rates at 24h Banks.

Another super advantage of this card is that in purchases up to R$50, it is not necessary to enter the password, just bring the card to the machine. And, in purchases above this amount, just enter the password, and make the same approach in the machine to make your purchase normally.

Therefore, it is a card that has the technology to bring even more convenience to its users. Too much isn't it?

How to make the Ton credit card?

So, the Ton machine card is ideal for individuals and companies that do not have a bank account, as well as, who do not want to mix personal money with the money in the legal account. That is, it still helps to take care of all financial investments.

Therefore, in order to apply for the card, it is not necessary to prove income and there is no credit analysis, so we will show you the steps you need to follow below.

How to apply for the Ton card

Ton Card is a credit card option, free of annuity and minimum income, ideal for people who do not have bank accounts and want a versatile and secure card,

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Balaroti Financing or Leroy Financing: which is better?

In this article, we are going to compare balaroti financing and leroy financing, to help you make the best decision. Check out!

Keep Reading

Mercado Pago Card or Magalu Card: which one to choose?

Whether it's the Mercado Pago card or the Magalu card, both have international coverage and you also participate in the Vai de Visa program. Compare here!

Keep Reading

3 best cards with cashback for negatives 2022

Get to know the three best cards with cashback for negatives and see which one best suits you: Méliuz, PagBank or Superdigital card.

Keep ReadingYou may also like

FinanZero loan online: personalized credit offers

FinanZero loan online is one of the best options for those who need fast cash. It works online, which makes it very practical and accessible. To learn more about this option, just continue reading the article.

Keep Reading

How to apply for the BTG Basic Option card

The BTG Basic Option card has everything you need to take care of your finances. Because there is no annual fee, it is international and has the Mastercard Surprise program. To find out how to apply and enjoy its benefits, just continue reading the article!

Keep Reading

Learn all about the Itaú Salary Account

Maybe you don't know, but the Itaú salary account brings several advantages to your financial life. So, to start 2021 off right with your personal finances, keep reading the post!

Keep Reading