Cards

Discover the Samsung Itaucard credit card

Did you know that Samsung, an electronics company, has a card to call yours? If not, then it's time to learn more about the Samsung Itaucard credit card. Read our text and understand!

Advertisement

Samsung Itaucard credit card: the newest card on the market

New in the credit card market, Samsung launched, in February 2021, a credit card in partnership with Itaucard and Visa with a free annual fee. In the platinum version and compatible with Samsung Pay, in addition to contactless payment, the Samsung Itaucard credit card came to revolutionize. Know more!

About the Samsung Itaucard card

When someone searches for a credit card, the first thing they try to escape is the annuity. After all, nothing is more unpleasant than paying a fee to the bank just for carrying and using the card, right? But, what if we told you that there is an excellent option on the market that doesn't charge anything to have it, would you believe it? If not, know that this is precisely the case with the Samsung Itaucard credit card.

With a free and lifetime annual fee, the Samsung Itaucard credit card is undeniably a pioneering launch by a technology company in the Brazilian market. After all, it is the first product launched in partnership with a financial institution, card brand and a technology company. Is it or is it not innovative?

According to Tiago Moherdaui, Vice President of Business Development at Visa do Brasil, the company co-created this solution with the aim of making it complete throughout the consumer's payment journey. “In addition to having technology and security, we have gathered advantages and benefits so that this is people's preferred card both for purchasing Samsung products and for day-to-day purchases”, he says.

From the Visa flag and issued by Itaucard, the Samsung credit card has numerous benefits. The first is that it is a platinum product, which means that it has all the advantages of the range, such as international medical emergency insurance, travel insurance, rental car insurance, purchase protection, extended original warranty and price. In the latter, Visa refunds the difference in the amount paid for a product if you find it cheaper within thirty days after certain conditions. Too good, isn't it?

Advantages of Samsung Credit Card

As we said, the Samsung Itaucard credit card has numerous benefits. In addition to having a free annual fee forever and those already mentioned for belonging to the Visa flag and the Platinum category, there are other advantages of the product itself. Check out what they are!

1. Immediate availability

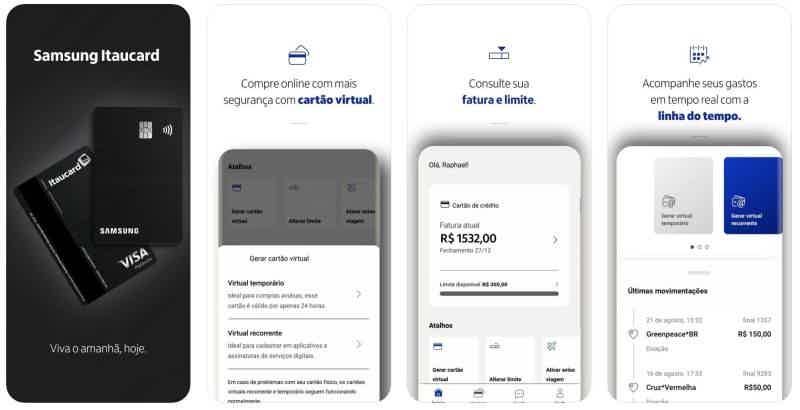

One of the first advantages of the Samsung credit card is that it is not necessary to wait for the physical card to arrive to use it. After approval, it will be immediately available on the Samsung Itaucard application, enabling registration with Samsung Pay for payments by approach at any establishment.

2. Virtual cards

In addition to the possibility of approximation payment, the application also provides virtual cards that can be used for online payments. In this case, there will be two types: one for recurring purchases such as subscriptions to streaming services (Netflix, Spotify, etc.) and the other for one-time purchases. This, in turn, ensures more security in online transactions for customers, greatly minimizing the risk of the card being cloned.

3. Complete application

Another huge benefit of the Samsung credit card also refers to its application, since it is quite complete and offers all the features that a customer is looking for. For example, the app allows you to follow releases in real time, request a limit change, make a trip abroad notice and be answered via chat. That is, everything you need in the palm of your hand.

4. Double points in the Samsung Rewards program

Did you know that Samsung offers its customers a loyalty program? So it is! Called Samsung Rewards, whoever owns the company's card will have double points. There will be 30 extra points for payment made with Samsung Pay, limited to 30 transactions per month, and a promotion with a bonus of 1,000 points on the first transaction. The points, in turn, can be exchanged for various benefits, such as credits for use in products and services from partner companies. Unfortunately, it is not possible to transfer them to airline programs.

5. Different payment terms

Finally, Samsung credit card customers will have different payment terms on the company's official website. For example, they will be able to pay their purchase in up to 21 interest-free installments, which is excellent, and participate in exclusive promotions when using the card to purchase products from the brand. Quite an advantage, don't you agree?

And there's even more!

Think it's over? Well, know that there's more! Whoever uses the Samsung Itaucard card to buy one of the new smartphones in the Galaxy S21 5G line during the pre-sale period, which is between February 10 and March 4, 2021, will earn an additional amount of R$ 1,000. Yes, that's exactly what you read!

This value is a bonus that will be added to the pre-sale promotion voucher, which ranges from R$ 1,000 to R$ 2,000 for those who purchase products from the Galaxy S21 5G line. If you don't understand, it will work something like this:

- Galaxy S21: R$ 1,000 voucher on pre-order + R$ 1,000 on purchase with Samsung Itaucard

- Galaxy S21+: R$ 1,500 voucher on pre-order + R$ 1,000 on purchase with Samsung Itaucard

- Galaxy S21 Ultra: R$ 2,000 voucher on pre-order + R$ 1,000 on purchase with Samsung Itaucard

Not bad, huh?

How to apply for your Samsung Itaucard credit card?

In this text, it is impossible not to realize that the Samsung Itaucard credit card is, in fact, an excellent product, especially for those who are fans of the Samsung brand. If you are part of this clan, then don't leave for tomorrow what can be done today and apply for your card soon! To find out how the process works, just click the button below.

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Nubank recurring PIX: what is it and what are its benefits?

Discover how the Nubank recurring PIX helps you automatically pay your monthly bills in a very simple and easy way to set up!

Keep Reading

How to open a Nubank account for minors

Find out here all the steps that parents and teenagers need to take to open a Nubank account for minors.

Keep Reading

How to apply for the Family Allowance

Do you want to find out how to apply for the Family Allowance? In this article, we will explain how it works and the step by step to register!

Keep ReadingYou may also like

Elo Diners Club: discover the new card on the market

Want to know more about the new Elo Diners Club? Then you've come to the right place! Read on and find out more about this card, which is one of the best on the market.

Keep Reading

How to apply for the RecargaPay card

You are negative and can't get a card to call yours. So, how about having the RecargaPay prepaid credit card? Read on to find out all about it!

Keep Reading

Here's Everything We Know About Season 4 of Netflix's Stranger Things

The Stranger Things series is an absolute success on the Netflix streaming platform. Its fans are anxious to know the premiere date of the fourth season, and the social network is increasingly in an uproar trying to unravel the tips posted by the official accounts of the series. The new episodes should arrive on Netflix in 2022!

Keep Reading