Cards

Discover the Pan Mastercard Gold credit card

Get to know the Pan Mastercard Gold credit card and guarantee access to the Mastercard Surpreenda program, Use+ and Pague Menos program, cashback program and the Offers Club.

Advertisement

Pan Mastercard Gold: access the Club of Offers and guarantee discounts at dozens of Pan bank partners

Learn all about the Pan Mastercard Gold credit card and see how it can be a great ally in your purchases through the Offers Club, cashback program and Mastercard Surpreenda. So read on, we'll tell you all about this card.

How to apply for the Pan Mastercard Gold card

Learn how to apply for the Pan Mastercard Gold card and have access to cashback, Club Deals and the possibility of waiving the annuity.

How does the Pan Mastercard Gold credit card work?

In the search for a credit card with good conditions, we found several options on the market, so the Pan Mastercard Gold card was launched by Banco Pan to be a differential in the lives of customers.

This is because, despite charging annuity, you have the possibility of zeroing the annuity, that is, according to your expenses, the annuity can be zeroed.

And, in addition, the card also has an Offers Club, that is, you guarantee access to several offers from Pan bank partner companies.

As well as owning the Mastercard brand, you have access to all the benefits of the brand, such as the Mastercard Surprise program, Purchase Protection Insurance, Extended Warranty and Mastercard Global Service.

In addition, to apply for the Pan Mastercard Gold card, you need to enter the Pan bank website, fill in the form with all the data and proof of income of R$2500. Then, just wait for the credit analysis to proceed with receiving the card.

What is the Pan Mastercard Gold credit card limit?

So, the limit of the Pan Mastercard Gold card was not informed by the institution.

Is the Pan Mastercard Gold credit card worth it?

Check out the advantages and disadvantages of this card below.

Benefits

Among the advantages of the Pan Mastercard Gold card is the Club of Offers program, so you will have access to discounts at several partner establishments.

And, in addition, you have the possibility to zero the annuity with the Use + Pay Menos program, that is, the more you use the card, the less you will pay in annuity.

In addition, you have the PAN Mais program, in which you can convert your purchases into points that can be exchanged for products, services, airline tickets and other rewards.

Therefore, the Pan Mastercard Gold card is a great alternative if you want a card that offers multiple rewards, making your purchases easier.

Disadvantages

So, despite several positive points, the card also has negative points, such as the minimum income requirement and the annuity charge.

This is because, to exempt yourself from the annuity, you must spend at least R$ 3 thousand, otherwise the annuity will be charged.

How to make a Pan Mastercard Gold credit card?

So, you can apply for Pan Mastercard Gold card through Pan bank website. So, to see the step-by-step process on how to apply for this card, click on the recommended content below.

How to apply for the Pan Mastercard Gold card

Learn how to apply for the Pan Mastercard Gold card and have access to the unique conditions of the partnership between Pan bank and the Mastercard brand.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Know the loan with vehicle guarantee Yes

See how the loan with car guarantee Sim works and find out what special conditions it can offer!

Keep Reading

Vale Gas was not paid: what to do?

18.1 million Brazilians received Auxílio Brasil in May, but Vale Gás was not paid. Check here what to do in this case.

Keep Reading

Porto Seguro Card or Bradesco Card: which one is better?

Find out which is the best option between Porto Seguro card or Bradesco card! For this, in this post we will show you all the details of the two.

Keep ReadingYou may also like

Discover the Itaú Personnalité Black credit card

Do you know the Itaú Personnalité Black credit card? It offers many benefits to its customers. Continue reading and check it out!

Keep Reading

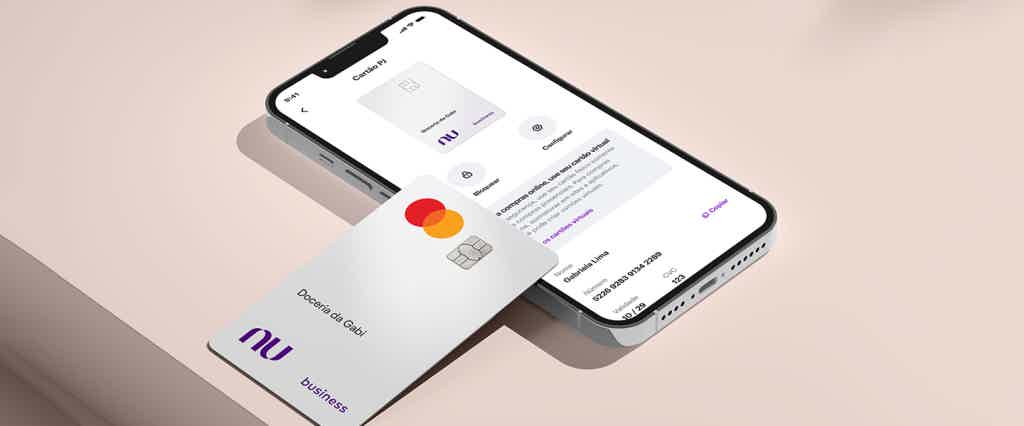

How to apply for the Nubank PJ Silver card

The Nubank PJ Prateado card is the solution you need to organize your company's finances and have a unique business card. To learn more about how to apply for yours, just read on!

Keep Reading

See how to make money with commercial photography!

If you are already a photographer or even want to earn some extra money, you can migrate to commercial photography. Through it, you will be able to photograph products and services to feed the websites of companies and micro entrepreneurs, a fertile ground nowadays.

Keep Reading