Cards

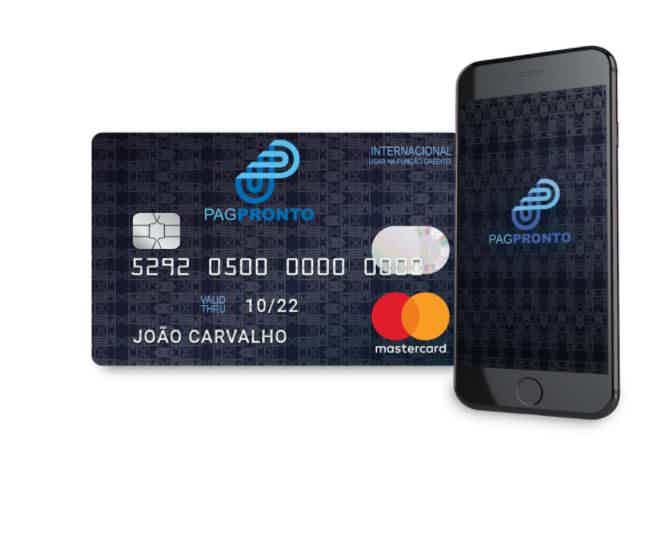

Discover the PagPronto credit card

The PagPronto credit card is a prepaid card that offers several advantages to its customers, such as immediate approval and does not require proof of income. Check out more details!

Advertisement

PagPronto credit card, immediate approval and international Mastercard brand

O PayPal credit card eliminates any bureaucracy and has immediate approval, because it is prepaid. It belongs to the Acesso Soluções de Pagamento S/A group and has a Mastercard Internacional brand. Want to know more? For that, keep reading and check out everything about this card.

How to apply for a PagPronto credit card

The pagpronto card is an excellent option for anyone looking for an affordable credit card without proof of income. Look!

How does the PagPronto credit card work?

The PagPronto card is a prepaid card. This means that, in order to use it, you need to make a deposit in advance. That way, you guarantee payment for purchases and expenses even before making them. It is this, incidentally, that allows the waiver of credit analysis, so the approval is immediate.

Also, the limit amount depends on the amount you are going to deposit. It is also worth remembering that it does not allow installment purchases.

Is the PagPronto credit card worth it?

So, being this a prepaid card, is it worth it? See the main advantages:

- International Mastercard Brandl – allows purchases in Brazil and abroad at millions of establishments and participation in the Mastercard Surpreenda program;

- expense control – as it is prepaid, it helps you control your finances;

- No minimum income requirement – it is possible to request it even for those who do not have a fixed income or cannot prove it;

- No SPC and Serasa analysis – does not consult credit records such as SPC and Serasa. Therefore, it can be requested even by those who have a negative name.

Disadvantages

On the other hand, the PagPronto credit card charges an annual fee of R$ 71.40 which corresponds to R$ 5.95 per month. Still, it is only possible to use it after depositing the account. Also, to top up you have to pay a fee of R$2.50. It is

Another disadvantage is that it is not possible to make purchases in installments or even participate in programs to accumulate points and advantages.

How to make a PagPronto credit card?

If you are interested in the card, you can request it through the app for Android or IOS or by calling 4003-3635.

Additional recommendation: AME prepaid card

If you want to know other prepaid cards, but with lower fees, see below a comparison with the AME prepaid card:

| PagPronto | AME prepaid card | |

| Minimum Income | not required | not required |

| Annuity | R$ 71.40 or 12x R$ 5.95 | Free |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Mastercard Surprise | Cashback Ame Digital, Mastercard Surprise |

Did you like the content? Then learn how to apply for the AME card below!

How to apply for AME card

The AME card offers exclusive benefits, in addition to cashback and international coverage with the Mastercard brand. See here how to apply!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Fies or Prouni: which is the best option?

Fies or Prouni? If you want to understand which option is best for you, click here and see this complete comparison!

Keep Reading

Discover the Egoncred online loan

Get to know the Egoncred online loan and see if this loan is what you need right now! Ah, he is ideal for negatives! Check out!

Keep Reading

How to apply for the Santander 1|2|3 Gold card

The Santander 1|2|3 Gold card offers advantages for international and national purchases, points system and much more! See how to apply.

Keep ReadingYou may also like

Linked to the Selic rate, Ton machine offers different plans

If you are a small business owner or self-employed professional and are looking for a secure card machine with affordable rates, you need to know the Ton machine. Belonging to Brazilian fintech Stone, the machine is pegged to the Selic rate. Check out more about her!

Keep Reading

How to increase Bahamas card limit?

Discover everything about how to increase your Bahamas card limit and enjoy it with comfort and practicality. It's a simple, easy process and can be 100% online, hassle free.

Keep Reading

Have you ever thought about knowing everything that was spent on your credit card? With the Nubank app you can!

Knowing the amount of money you've already spent on your credit card can help you have greater control over your financial life. And with Nubank, this query is done quickly through the app. Check out.

Keep Reading